Question: Please help me solve ASAP, I will leave a thumbs up if it is correct!! Please help me solve ASAP, I will leave a thumbs

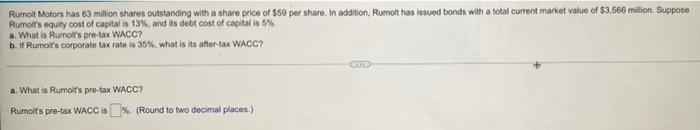

Rumolt Motors has 63 million shares outstanding with a share price of $59 per share. In addition, Rumolt has issued bonds with a total current market value of $3,566 million. Suppose Rumolt's equity cost of capital is 13%, and its debt cost of capital is 5% a. What is Rumolt's pre-tax WACC? b. If Rumoit's corporate tax rate is 35%, what is its after-tax WACC? a. What is Rumolt's pre-tax WACC? Rumolt's pre-tax WACC is%. (Round to two decimal places.) Rumolt Motors has 63 million shares outstanding with a share price of $59 per share. In addition, Rumolt has issued bonds with a total current market value of $3,566 million. Suppose Rumolt's equity cost of capital is 13%, and its debt cost of capital is 5% a. What is Rumolt's pre-tax WACC? b. If Rumolt's corporate tax rate is 35%, what is its after-tax WACC? a. What is Rumolt's pre-tax WACC? Rumolt's pre-tax WACC is%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts