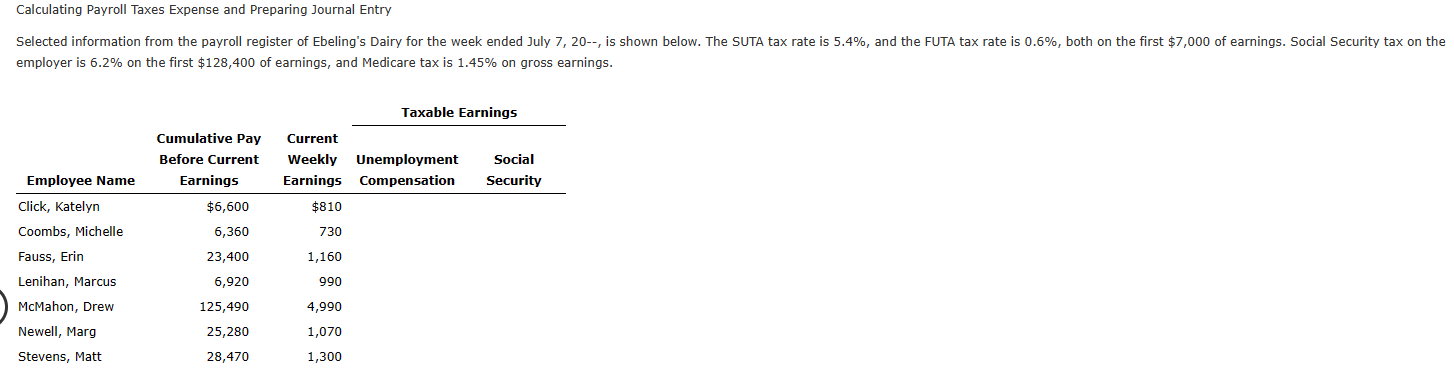

Question: Please help me solve! Calculating Payroll Taxes Expense and Preparing Journal Entry employer is 6.2% on the first $128,400 of earnings, and Medicare tax is

Please help me solve!

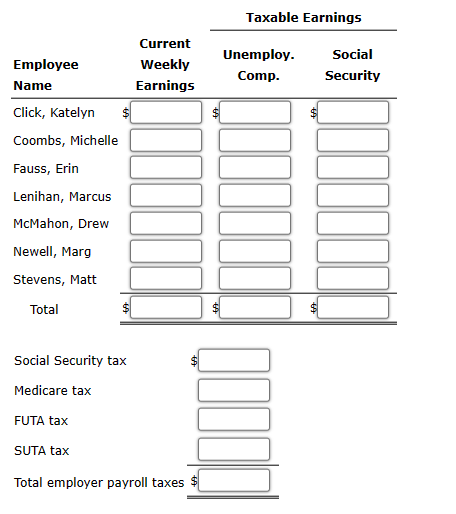

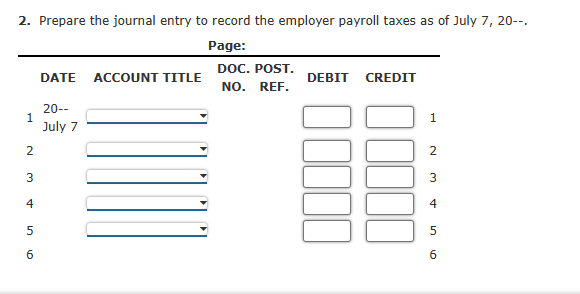

Calculating Payroll Taxes Expense and Preparing Journal Entry employer is 6.2% on the first $128,400 of earnings, and Medicare tax is 1.45% on gross earnings. \begin{tabular}{lll} Employee & CurrentWeeklyName & TaxableEarningsNarnings \\ \hline Click, Katelyn \\ Coombs, Michelle \\ Fauss, Erin \\ Lenihan, Marcus \\ McMahon, Drew \\ Newell, Marg \\ Stevens, Matt \\ Total \end{tabular} Social Security tax Medicare tax FUTA tax SUTA tax Total employer payroll taxes $ 2. Prepare the journal entry to record the employer payroll taxes as of July 7,20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts