Question: PLEASE HELP ME SOLVE EACH STEP BY STEP In the course, we discussed the flexibility of a Universal Life policy and the choices that a

PLEASE HELP ME SOLVE EACH STEP BY STEP

PLEASE HELP ME SOLVE EACH STEP BY STEP

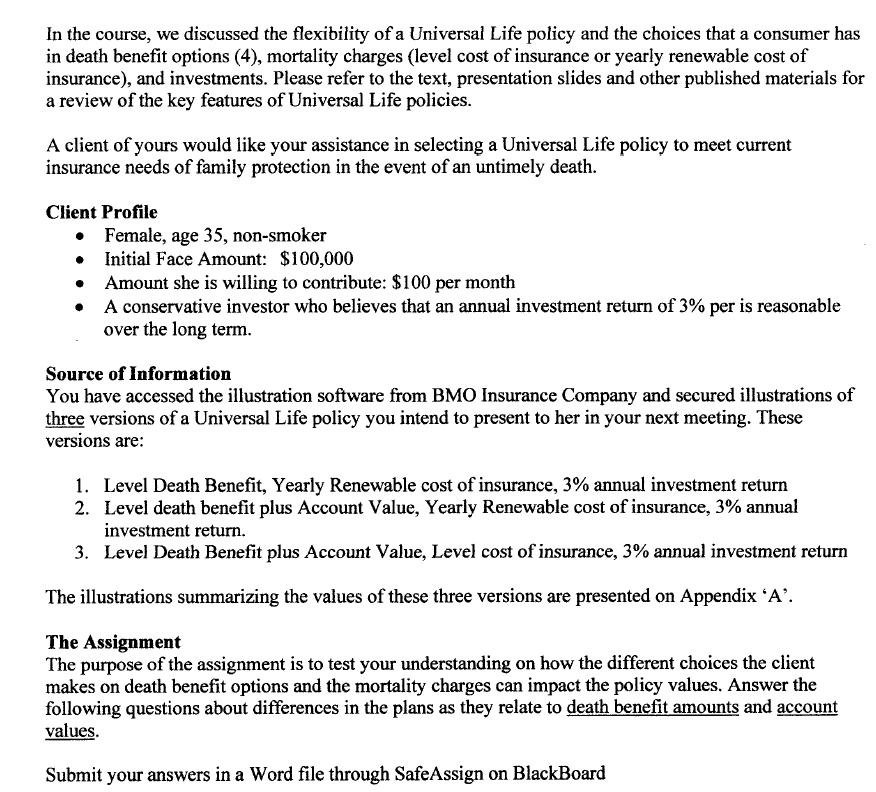

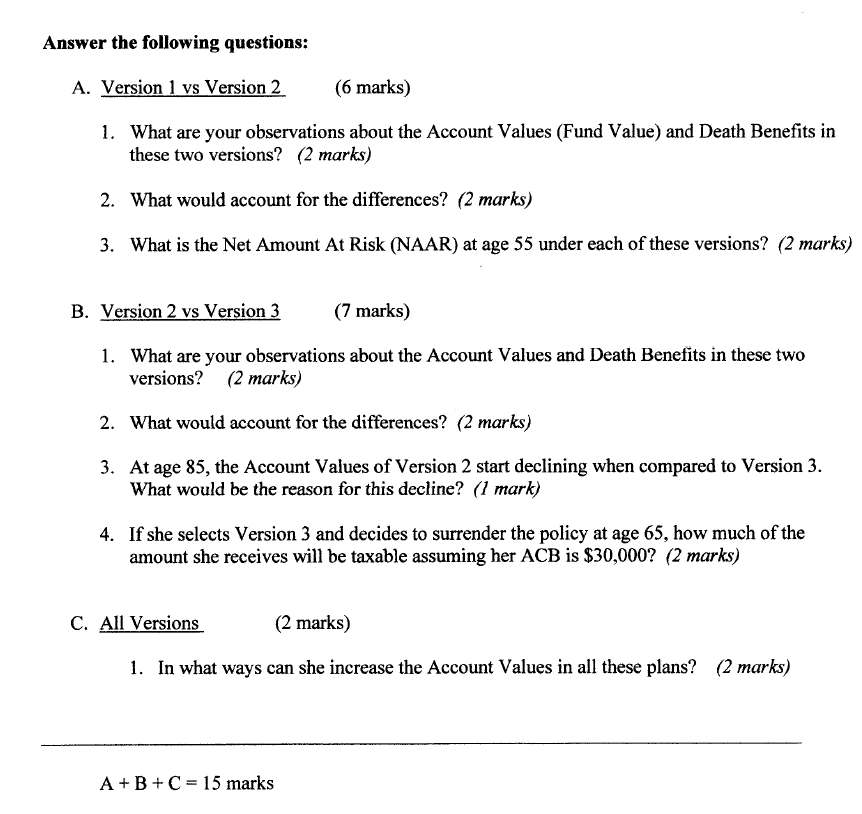

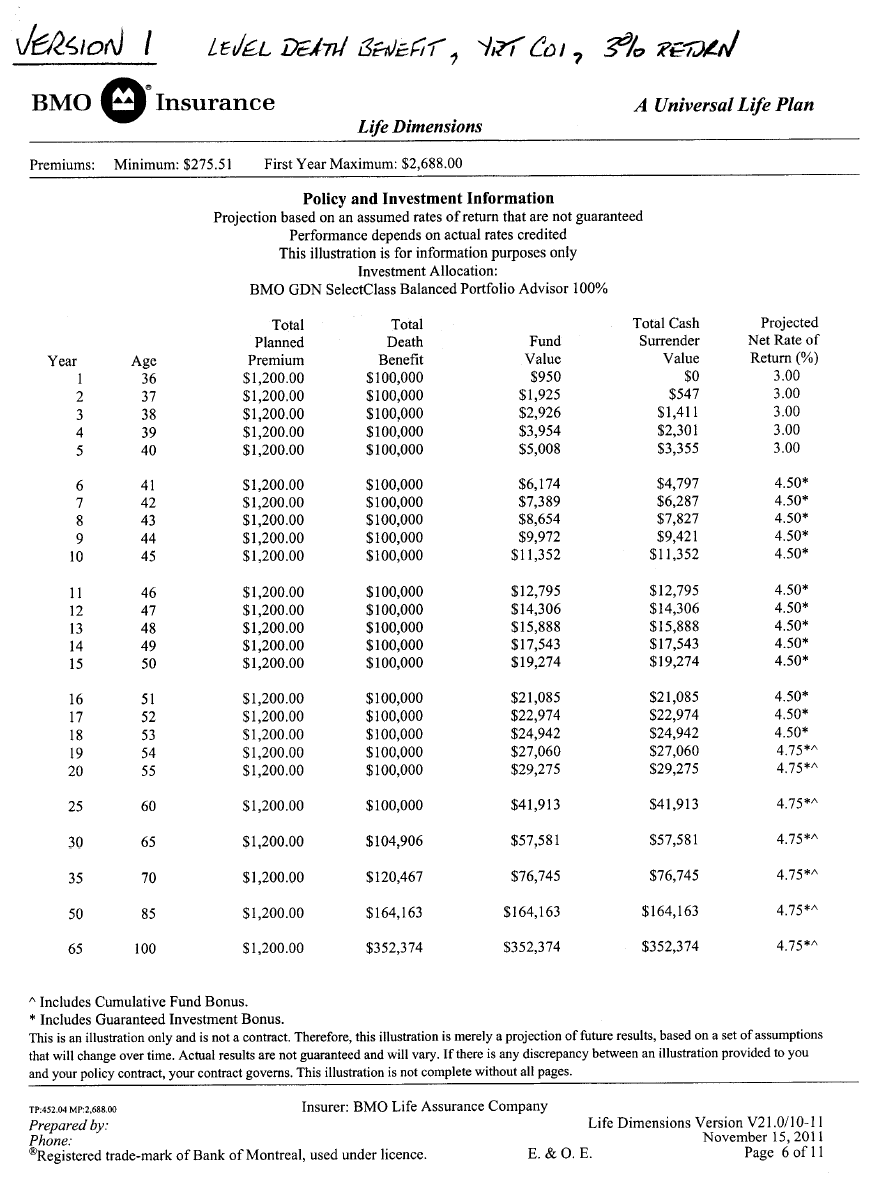

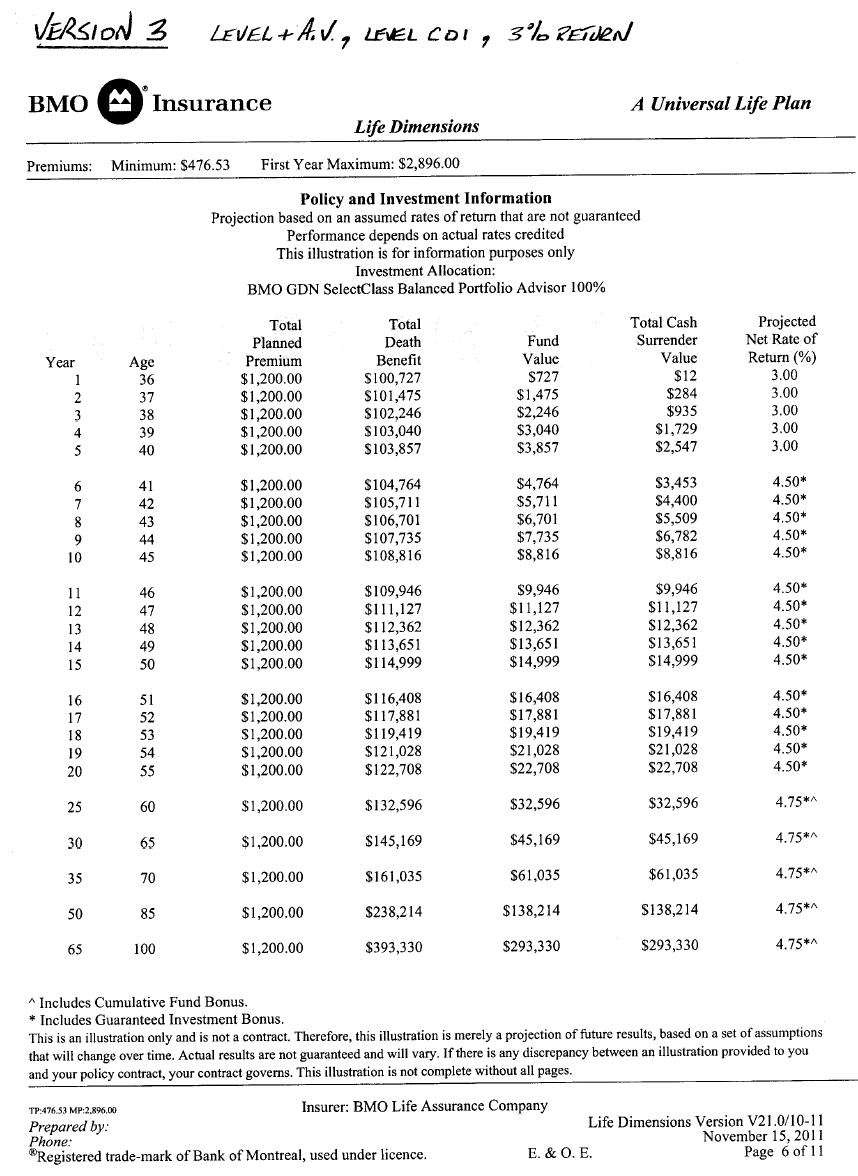

In the course, we discussed the flexibility of a Universal Life policy and the choices that a consumer has in death benefit options (4), mortality charges (level cost of insurance or yearly renewable cost of insurance), and investments. Please refer to the text, presentation slides and other published materials for a review of the key features of Universal Life policies. A client of yours would like your assistance in selecting a Universal Life policy to meet current insurance needs of family protection in the event of an untimely death. Client Profile Female, age 35, non-smoker Initial Face Amount: $100,000 Amount she is willing to contribute: $100 per month A conservative investor who believes that an annual investment return of 3% per is reasonable over the long term. Source of Information You have accessed the illustration software from BMO Insurance Company and secured illustrations of three versions of a Universal Life policy you intend to present to her in your next meeting. These versions are: 1. Level Death Benefit, Yearly Renewable cost of insurance, 3% annual investment return 2. Level death benefit plus Account Value, Yearly Renewable cost of insurance, 3% annual investment return. 3. Level Death Benefit plus Account Value, Level cost of insurance, 3% annual investment return The illustrations summarizing the values of these three versions are presented on Appendix A. The Assignment The purpose of the assignment is to test your understanding on how the different choices the client makes on death benefit options and the mortality charges can impact the policy values. Answer the following questions about differences in the plans as they relate to death benefit amounts and account values. Submit your answers in a Word file through SafeAssign on BlackBoard Answer the following questions: A. Version 1 vs Version 2 (6 marks) 1. What are your observations about the Account Values (Fund Value) and Death Benefits in these two versions? (2 marks) 2. What would account for the differences? (2 marks) 3. What is the Net Amount At Risk (NAAR) at age 55 under each of these versions? (2 marks) B. Version 2 vs Version 3 (7 marks) 1. What are your observations about the Account Values and Death Benefits in these two versions? (2 marks) 2. What would account for the differences? (2 marks) 3. At age 85, the Account Values of Version 2 start declining when compared to Version 3. What would be the reason for this decline? (1 mark) 4. If she selects Version 3 and decides to surrender the policy at age 65, how much of the amount she receives will be taxable assuming her ACB is $30,000? (2 marks) C. All Versions (2 marks) 1. In what ways can she increase the Account Values in all these plans? (2 marks) A + B + C = 15 marks VERSION 1 LEVEL DEATH BENEFIT , YRT Cola 3% RETURN BMO M Insurance A Universal Life Plan Life Dimensions Premiums: Minimum: $275.51 First Year Maximum: $2,688.00 Policy and Investment Information Projection based on an assumed rates of return that are not guaranteed Performance depends on actual rates credited This illustration is for information purposes only Investment Allocation: BMO GDN SelectClass Balanced Portfolio Advisor 100% Projected Net Rate of Return (%) 3.00 Year 1 Total Planned Premium $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 Total Death Benefit $100,000 $100,000 $100,000 $100,000 $100,000 Age 36 37 38 39 40 Total Cash Surrender Value $0 $547 $1,411 $2,301 $3,355 Fund Value $950 $1,925 $2,926 $3,954 $5,008 2 3 4 5 3.00 3.00 3.00 3.00 6 7 8 9 10 41 42 43 44 45 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $100,000 $100,000 $100,000 $100,000 $100,000 $6,174 $7,389 $8,654 $9,972 $11,352 $4,797 $6,287 $7,827 $9,421 $11,352 4.50* 4.50* 4.50* 4.50* 4.50* 11 12 13 14 15 46 47 48 49 50 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $100,000 $100,000 $100,000 $100,000 $100,000 $12,795 $14,306 $15,888 $17,543 $19,274 $12,795 $14,306 $15,888 $17,543 $19,274 4.50* 4.50* 4.50* 4.50* 4.50* 16 17 18 19 20 51 52 53 54 55 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $100,000 $100,000 $100,000 $100,000 $100,000 $21,085 $22,974 $24,942 $27,060 $29,275 $21,085 $22,974 $24,942 $27,060 S29,275 4.50* 4.50* 4.50* 4.75* 4.75* 25 60 $1,200.00 $100,000 $41,913 $41,913 4.75* 30 65 $1,200.00 $104,906 $57,581 $57,581 4.75* 35 70 $1,200.00 $120,467 $76,745 $76,745 4.75* 50 85 $1,200.00 $164,163 $164,163 $164,163 4.75** 65 100 $1,200.00 $352,374 $352,374 $352,374 4.75*1 A Includes Cumulative Fund Bonus. * Includes Guaranteed Investment Bonus. This is an illustration only and is not a contract. Therefore, this illustration is merely a projection of future results, based on a set of assumptions that will change over time. Actual results are not guaranteed and will vary. If there is any discrepancy between an illustration provided to you and your policy contract, your contract governs. This illustration is not complete without all pages. TP.452.04 MP 2.688.00 Insurer: BMO Life Assurance Company Prepared by: Life Dimensions Version V21.0/10-11 Phone: November 15, 2011 Registered trade-mark of Bank of Montreal, used under licence. E. &0. E. Page 6 of 11 VERSION 3 LEVEL+AV., LEVEL COM 3% RETURN BMO M Insurance A Universal Life Plan Life Dimensions Premiums: Minimum: $476.53 First Year Maximum: $2,896.00 Policy and Investment Information Projection based on an assumed rates of return that are not guaranteed Performance depends on actual rates credited This illustration is for information purposes only Investment Allocation: BMO GDN SelectClass Balanced Portfolio Advisor 100% Projected Net Rate of Return (%) 3.00 Year 1 2 3 4 5 Total Planned Premium $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 Age 36 37 38 39 40 Total Death Benefit $100,727 $101,475 $102,246 $103,040 $ 103,857 Fund Value $727 $1,475 $2,246 $3,040 $3,857 3.00 Total Cash Surrender Value $12 $284 $935 $1,729 $2,547 3.00 3.00 3.00 6 7 8 9 10 41 42 43 44 45 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $104,764 $105,711 $106,701 $107,735 $108,816 $4,764 $5,711 $6,701 $7,735 $8,816 $3,453 $4,400 $5,509 $6,782 $8,816 4.50* 4.50* 4.50* 4.50* 4.50* 11 12 13 14 15 46 47 48 49 50 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $109,946 $111,127 $112,362 $113,651 $114,999 $9.946 $11,127 $12,362 $13,651 $14,999 $9,946 $11,127 $12,362 $13,651 $14,999 4.50* 4.50* 4.50* 4.50* 4.50* 16 17 18 19 20 51 52 53 54 55 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $116,408 $117,881 $119,419 $121,028 $122,708 $16,408 $17,881 $19,419 $21,028 $22,708 $16,408 $17,881 $19,419 $21,028 $22,708 4.50* 4.50* 4.50* 4.50* 4.50* 25 60 $1,200.00 $132,596 $32,596 $32,596 4.75** 30 65 $1,200.00 $145,169 $45,169 $45,169 4.75** 35 70 $1,200.00 $161,035 $61,035 $61,035 4.75** 50 85 $1,200.00 $238,214 $138,214 S138,214 4.75* 65 100 $1,200.00 $393,330 $293,330 $293,330 4.75** Includes Cumulative Fund Bonus. * Includes Guaranteed Investment Bonus. This is an illustration only and is not a contract. Therefore, this illustration is merely a projection of future results, based on a set of assumptions that will change over time. Actual results are not guaranteed and will vary. If there is any discrepancy between an illustration provided to you and your policy contract, your contract governs. This illustration is not complete without all pages. TP:476.53 MP:2.896.00 Insurer: BMO Life Assurance Company Prepared by: Life Dimensions Version v21.0/10-11 Phone: November 15, 2011 Registered trade mark of Bank of Montreal, used under licence. E. & O. E. Page 6 of 11 In the course, we discussed the flexibility of a Universal Life policy and the choices that a consumer has in death benefit options (4), mortality charges (level cost of insurance or yearly renewable cost of insurance), and investments. Please refer to the text, presentation slides and other published materials for a review of the key features of Universal Life policies. A client of yours would like your assistance in selecting a Universal Life policy to meet current insurance needs of family protection in the event of an untimely death. Client Profile Female, age 35, non-smoker Initial Face Amount: $100,000 Amount she is willing to contribute: $100 per month A conservative investor who believes that an annual investment return of 3% per is reasonable over the long term. Source of Information You have accessed the illustration software from BMO Insurance Company and secured illustrations of three versions of a Universal Life policy you intend to present to her in your next meeting. These versions are: 1. Level Death Benefit, Yearly Renewable cost of insurance, 3% annual investment return 2. Level death benefit plus Account Value, Yearly Renewable cost of insurance, 3% annual investment return. 3. Level Death Benefit plus Account Value, Level cost of insurance, 3% annual investment return The illustrations summarizing the values of these three versions are presented on Appendix A. The Assignment The purpose of the assignment is to test your understanding on how the different choices the client makes on death benefit options and the mortality charges can impact the policy values. Answer the following questions about differences in the plans as they relate to death benefit amounts and account values. Submit your answers in a Word file through SafeAssign on BlackBoard Answer the following questions: A. Version 1 vs Version 2 (6 marks) 1. What are your observations about the Account Values (Fund Value) and Death Benefits in these two versions? (2 marks) 2. What would account for the differences? (2 marks) 3. What is the Net Amount At Risk (NAAR) at age 55 under each of these versions? (2 marks) B. Version 2 vs Version 3 (7 marks) 1. What are your observations about the Account Values and Death Benefits in these two versions? (2 marks) 2. What would account for the differences? (2 marks) 3. At age 85, the Account Values of Version 2 start declining when compared to Version 3. What would be the reason for this decline? (1 mark) 4. If she selects Version 3 and decides to surrender the policy at age 65, how much of the amount she receives will be taxable assuming her ACB is $30,000? (2 marks) C. All Versions (2 marks) 1. In what ways can she increase the Account Values in all these plans? (2 marks) A + B + C = 15 marks VERSION 1 LEVEL DEATH BENEFIT , YRT Cola 3% RETURN BMO M Insurance A Universal Life Plan Life Dimensions Premiums: Minimum: $275.51 First Year Maximum: $2,688.00 Policy and Investment Information Projection based on an assumed rates of return that are not guaranteed Performance depends on actual rates credited This illustration is for information purposes only Investment Allocation: BMO GDN SelectClass Balanced Portfolio Advisor 100% Projected Net Rate of Return (%) 3.00 Year 1 Total Planned Premium $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 Total Death Benefit $100,000 $100,000 $100,000 $100,000 $100,000 Age 36 37 38 39 40 Total Cash Surrender Value $0 $547 $1,411 $2,301 $3,355 Fund Value $950 $1,925 $2,926 $3,954 $5,008 2 3 4 5 3.00 3.00 3.00 3.00 6 7 8 9 10 41 42 43 44 45 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $100,000 $100,000 $100,000 $100,000 $100,000 $6,174 $7,389 $8,654 $9,972 $11,352 $4,797 $6,287 $7,827 $9,421 $11,352 4.50* 4.50* 4.50* 4.50* 4.50* 11 12 13 14 15 46 47 48 49 50 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $100,000 $100,000 $100,000 $100,000 $100,000 $12,795 $14,306 $15,888 $17,543 $19,274 $12,795 $14,306 $15,888 $17,543 $19,274 4.50* 4.50* 4.50* 4.50* 4.50* 16 17 18 19 20 51 52 53 54 55 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $100,000 $100,000 $100,000 $100,000 $100,000 $21,085 $22,974 $24,942 $27,060 $29,275 $21,085 $22,974 $24,942 $27,060 S29,275 4.50* 4.50* 4.50* 4.75* 4.75* 25 60 $1,200.00 $100,000 $41,913 $41,913 4.75* 30 65 $1,200.00 $104,906 $57,581 $57,581 4.75* 35 70 $1,200.00 $120,467 $76,745 $76,745 4.75* 50 85 $1,200.00 $164,163 $164,163 $164,163 4.75** 65 100 $1,200.00 $352,374 $352,374 $352,374 4.75*1 A Includes Cumulative Fund Bonus. * Includes Guaranteed Investment Bonus. This is an illustration only and is not a contract. Therefore, this illustration is merely a projection of future results, based on a set of assumptions that will change over time. Actual results are not guaranteed and will vary. If there is any discrepancy between an illustration provided to you and your policy contract, your contract governs. This illustration is not complete without all pages. TP.452.04 MP 2.688.00 Insurer: BMO Life Assurance Company Prepared by: Life Dimensions Version V21.0/10-11 Phone: November 15, 2011 Registered trade-mark of Bank of Montreal, used under licence. E. &0. E. Page 6 of 11 VERSION 3 LEVEL+AV., LEVEL COM 3% RETURN BMO M Insurance A Universal Life Plan Life Dimensions Premiums: Minimum: $476.53 First Year Maximum: $2,896.00 Policy and Investment Information Projection based on an assumed rates of return that are not guaranteed Performance depends on actual rates credited This illustration is for information purposes only Investment Allocation: BMO GDN SelectClass Balanced Portfolio Advisor 100% Projected Net Rate of Return (%) 3.00 Year 1 2 3 4 5 Total Planned Premium $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 Age 36 37 38 39 40 Total Death Benefit $100,727 $101,475 $102,246 $103,040 $ 103,857 Fund Value $727 $1,475 $2,246 $3,040 $3,857 3.00 Total Cash Surrender Value $12 $284 $935 $1,729 $2,547 3.00 3.00 3.00 6 7 8 9 10 41 42 43 44 45 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $104,764 $105,711 $106,701 $107,735 $108,816 $4,764 $5,711 $6,701 $7,735 $8,816 $3,453 $4,400 $5,509 $6,782 $8,816 4.50* 4.50* 4.50* 4.50* 4.50* 11 12 13 14 15 46 47 48 49 50 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $109,946 $111,127 $112,362 $113,651 $114,999 $9.946 $11,127 $12,362 $13,651 $14,999 $9,946 $11,127 $12,362 $13,651 $14,999 4.50* 4.50* 4.50* 4.50* 4.50* 16 17 18 19 20 51 52 53 54 55 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $1,200.00 $116,408 $117,881 $119,419 $121,028 $122,708 $16,408 $17,881 $19,419 $21,028 $22,708 $16,408 $17,881 $19,419 $21,028 $22,708 4.50* 4.50* 4.50* 4.50* 4.50* 25 60 $1,200.00 $132,596 $32,596 $32,596 4.75** 30 65 $1,200.00 $145,169 $45,169 $45,169 4.75** 35 70 $1,200.00 $161,035 $61,035 $61,035 4.75** 50 85 $1,200.00 $238,214 $138,214 S138,214 4.75* 65 100 $1,200.00 $393,330 $293,330 $293,330 4.75** Includes Cumulative Fund Bonus. * Includes Guaranteed Investment Bonus. This is an illustration only and is not a contract. Therefore, this illustration is merely a projection of future results, based on a set of assumptions that will change over time. Actual results are not guaranteed and will vary. If there is any discrepancy between an illustration provided to you and your policy contract, your contract governs. This illustration is not complete without all pages. TP:476.53 MP:2.896.00 Insurer: BMO Life Assurance Company Prepared by: Life Dimensions Version v21.0/10-11 Phone: November 15, 2011 Registered trade mark of Bank of Montreal, used under licence. E. & O. E. Page 6 of 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts