Question: Please help me solve for Capital, Value Added, leverage and coverage and dupont equation. YETI Holdings, Inc. (Dollars in Millions) Actual 2018 2019 2020 Sales

Please help me solve for Capital, Value Added, leverage and coverage and dupont equation.

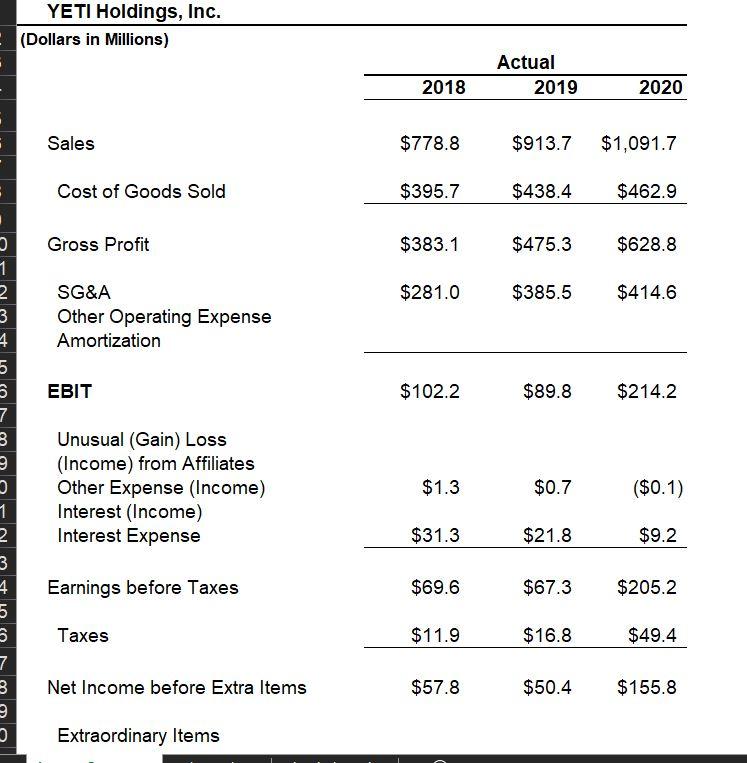

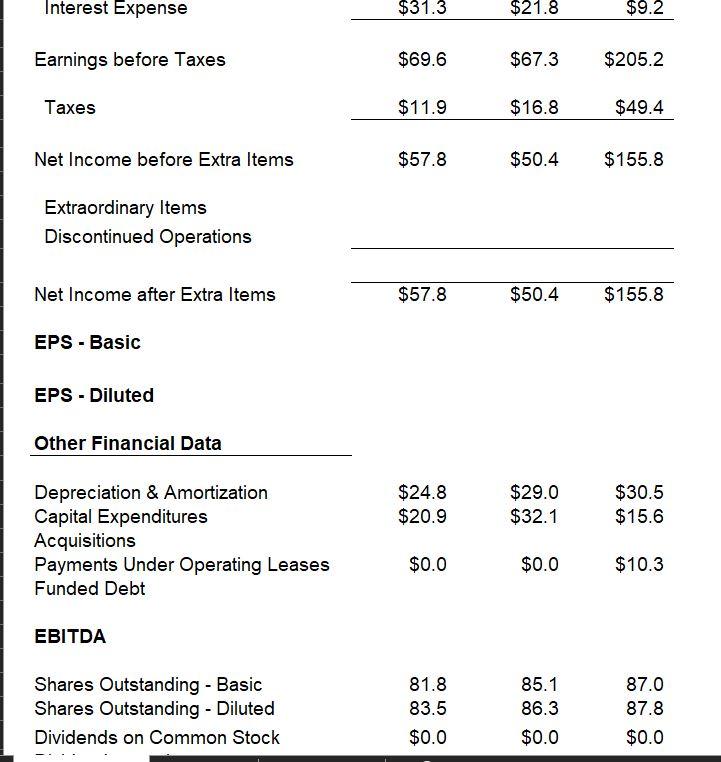

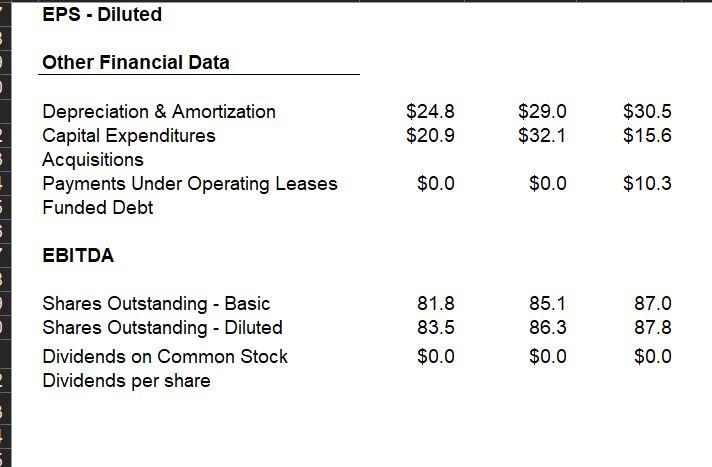

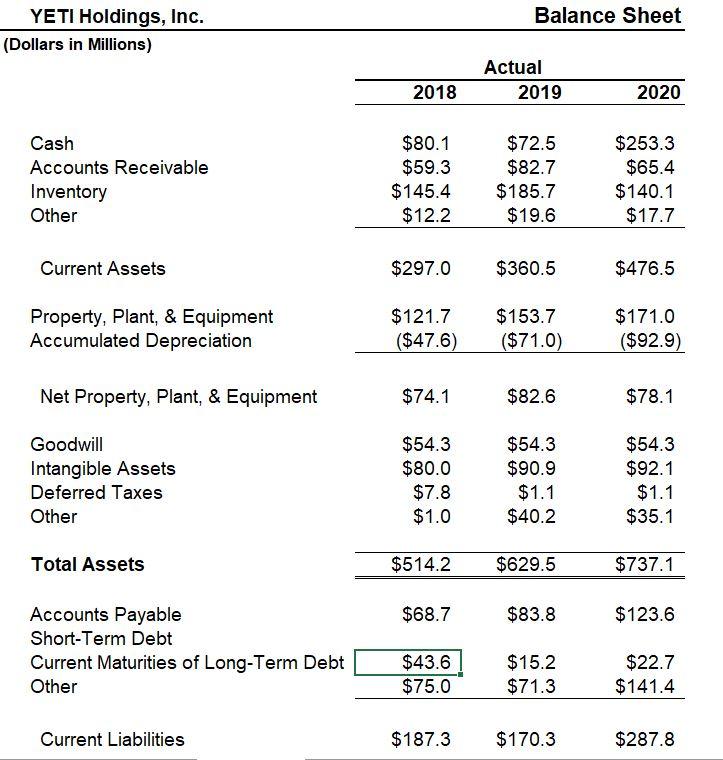

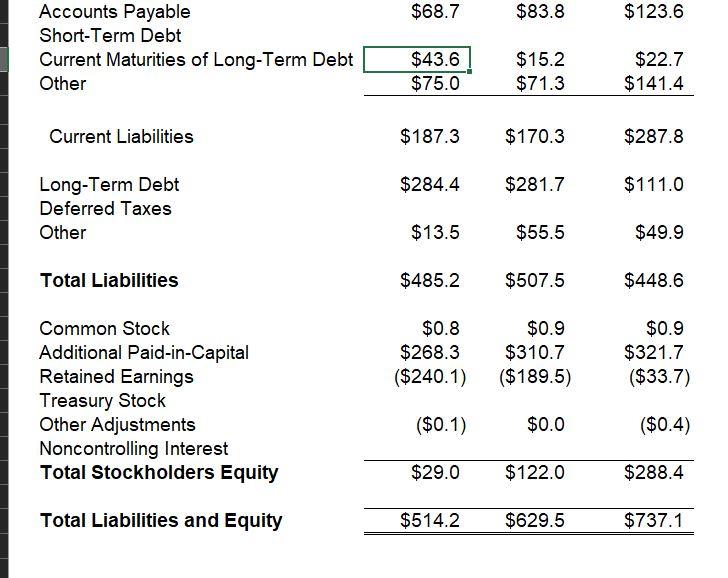

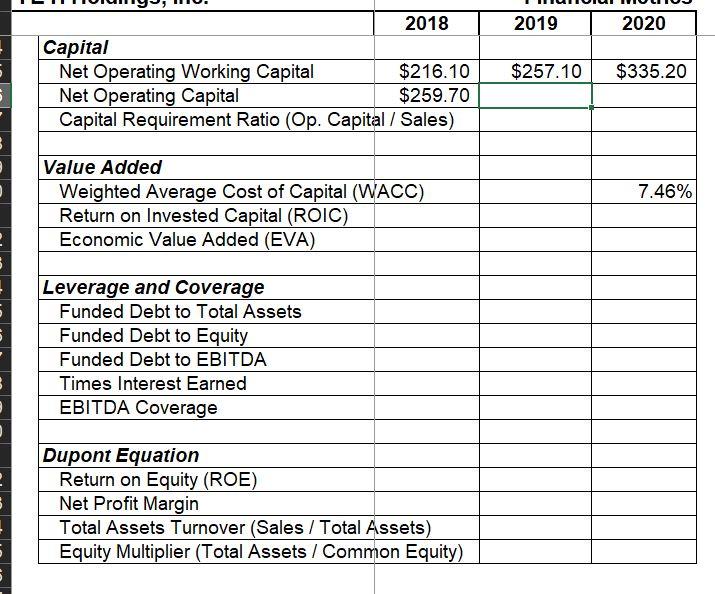

YETI Holdings, Inc. (Dollars in Millions) Actual 2018 2019 2020 Sales $778.8 $913.7 $1,091.7 Cost of Goods Sold $395.7 $438.4 $462.9 Gross Profit $383.1 $475.3 $628.8 1 2 $281.0 $385.5 $414.6 3 SG&A Other Operating Expense Amortization 4 5 EBIT $102.2 $89.8 $214.2 7 Unusual (Gain) Loss (Income) from Affiliates Other Expense (Income) Interest (Income) Interest Expense $1.3 $0.7 ($0.1) 1 2 $31.3 $21.8 $9.2 3 4 Earnings before Taxes $69.6 $67.3 $205.2 5 6 Taxes $11.9 $16.8 $49.4 7 3 Net Income before Extra Items $57.8 $50.4 $155.8 9 3 Extraordinary Items Interest Expense $31.3 $21.8 $9.2 Earnings before Taxes $69.6 $67.3 $205.2 Taxes $11.9 $16.8 $49.4 Net Income before Extra Items $57.8 $50.4 $155.8 Extraordinary Items Discontinued Operations Net Income after Extra Items $57.8 $50.4 $155.8 EPS - Basic EPS - Diluted Other Financial Data $24.8 $20.9 $29.0 $32.1 $30.5 $15.6 Depreciation & Amortization Capital Expenditures Acquisitions Payments Under Operating Leases Funded Debt $0.0 $0.0 $10.3 EBITDA 85.1 87.0 Shares Outstanding - Basic Shares Outstanding - Diluted 81.8 83.5 86.3 87.8 Dividends on Common Stock $0.0 $0.0 $0.0 EPS - Diluted Other Financial Data $24.8 $20.9 $29.0 $32.1 $30.5 $15.6 Depreciation & Amortization Capital Expenditures Acquisitions Payments Under Operating Leases Funded Debt $0.0 $0.0 $10.3 5 EBITDA 81.8 85.1 87.0 Shares Outstanding - Basic Shares Outstanding - Diluted 83.5 86.3 87.8 Dividends on Common Stock $0.0 $0.0 $0.0 Dividends per share Balance Sheet YETI Holdings, Inc. (Dollars in Millions) Actual 2019 2018 2020 Cash Accounts Receivable Inventory Other $80.1 $59.3 $145.4 $12.2 $72.5 $82.7 $185.7 $19.6 $253.3 $65.4 $140.1 $17.7 Current Assets $297.0 $360.5 $476.5 Property, Plant, & Equipment Accumulated Depreciation $121.7 ($47.6) $153.7 ($71.0) $171.0 ($92.9) Net Property, Plant, & Equipment $74.1 $82.6 $78.1 Goodwill Intangible Assets Deferred Taxes Other $54.3 $80.0 $7.8 $1.0 $54.3 $90.9 $1.1 $40.2 $54.3 $92.1 $1.1 $35.1 Total Assets $514.2 $629.5 $737.1 $68.7 $83.8 $123.6 Accounts Payable Short-Term Debt Current Maturities of Long-Term Debt Other $43.6 $75.0 $15.2 $71.3 $22.7 $141.4 Current Liabilities $187.3 $170.3 $287.8 $68.7 $83.8 $123.6 Accounts Payable Short-Term Debt Current Maturities of Long-Term Debt Other $43.6 $75.0 $15.2 $71.3 $22.7 $141.4 Current Liabilities $187.3 $170.3 $287.8 $284.4 $281.7 $111.0 Long-Term Debt Deferred Taxes Other $13.5 $55.5 $49.9 Total Liabilities $485.2 $507.5 $448.6 $0.8 $268.3 ($240.1) $0.9 $310.7 ($189.5) $0.9 $321.7 ($33.7) Common Stock Additional Paid-in-Capital Retained Earnings Treasury Stock Other Adjustments Noncontrolling Interest Total Stockholders Equity ($0.1) $0.0 ($0.4) $29.0 $122.0 $288.4 Total Liabilities and Equity $514.2 $629.5 $737.1 2019 2020 2018 Capital Net Operating Working Capital $216.10 Net Operating Capital $259.70 Capital Requirement Ratio (Op. Capital / Sales) $257.10 $335.20 7.46% Value Added Weighted Average Cost of Capital (WACC) Return on Invested Capital (ROIC) Economic Value Added (EVA) Leverage and Coverage Funded Debt to Total Assets Funded Debt to Equity Funded Debt to EBITDA Times Interest Earned EBITDA Coverage Dupont Equation Return on Equity (ROE) Net Profit Margin Total Assets Turnover (Sales / Total Assets) Equity Multiplier (Total Assets / Common Equity) YETI Holdings, Inc. (Dollars in Millions) Actual 2018 2019 2020 Sales $778.8 $913.7 $1,091.7 Cost of Goods Sold $395.7 $438.4 $462.9 Gross Profit $383.1 $475.3 $628.8 1 2 $281.0 $385.5 $414.6 3 SG&A Other Operating Expense Amortization 4 5 EBIT $102.2 $89.8 $214.2 7 Unusual (Gain) Loss (Income) from Affiliates Other Expense (Income) Interest (Income) Interest Expense $1.3 $0.7 ($0.1) 1 2 $31.3 $21.8 $9.2 3 4 Earnings before Taxes $69.6 $67.3 $205.2 5 6 Taxes $11.9 $16.8 $49.4 7 3 Net Income before Extra Items $57.8 $50.4 $155.8 9 3 Extraordinary Items Interest Expense $31.3 $21.8 $9.2 Earnings before Taxes $69.6 $67.3 $205.2 Taxes $11.9 $16.8 $49.4 Net Income before Extra Items $57.8 $50.4 $155.8 Extraordinary Items Discontinued Operations Net Income after Extra Items $57.8 $50.4 $155.8 EPS - Basic EPS - Diluted Other Financial Data $24.8 $20.9 $29.0 $32.1 $30.5 $15.6 Depreciation & Amortization Capital Expenditures Acquisitions Payments Under Operating Leases Funded Debt $0.0 $0.0 $10.3 EBITDA 85.1 87.0 Shares Outstanding - Basic Shares Outstanding - Diluted 81.8 83.5 86.3 87.8 Dividends on Common Stock $0.0 $0.0 $0.0 EPS - Diluted Other Financial Data $24.8 $20.9 $29.0 $32.1 $30.5 $15.6 Depreciation & Amortization Capital Expenditures Acquisitions Payments Under Operating Leases Funded Debt $0.0 $0.0 $10.3 5 EBITDA 81.8 85.1 87.0 Shares Outstanding - Basic Shares Outstanding - Diluted 83.5 86.3 87.8 Dividends on Common Stock $0.0 $0.0 $0.0 Dividends per share Balance Sheet YETI Holdings, Inc. (Dollars in Millions) Actual 2019 2018 2020 Cash Accounts Receivable Inventory Other $80.1 $59.3 $145.4 $12.2 $72.5 $82.7 $185.7 $19.6 $253.3 $65.4 $140.1 $17.7 Current Assets $297.0 $360.5 $476.5 Property, Plant, & Equipment Accumulated Depreciation $121.7 ($47.6) $153.7 ($71.0) $171.0 ($92.9) Net Property, Plant, & Equipment $74.1 $82.6 $78.1 Goodwill Intangible Assets Deferred Taxes Other $54.3 $80.0 $7.8 $1.0 $54.3 $90.9 $1.1 $40.2 $54.3 $92.1 $1.1 $35.1 Total Assets $514.2 $629.5 $737.1 $68.7 $83.8 $123.6 Accounts Payable Short-Term Debt Current Maturities of Long-Term Debt Other $43.6 $75.0 $15.2 $71.3 $22.7 $141.4 Current Liabilities $187.3 $170.3 $287.8 $68.7 $83.8 $123.6 Accounts Payable Short-Term Debt Current Maturities of Long-Term Debt Other $43.6 $75.0 $15.2 $71.3 $22.7 $141.4 Current Liabilities $187.3 $170.3 $287.8 $284.4 $281.7 $111.0 Long-Term Debt Deferred Taxes Other $13.5 $55.5 $49.9 Total Liabilities $485.2 $507.5 $448.6 $0.8 $268.3 ($240.1) $0.9 $310.7 ($189.5) $0.9 $321.7 ($33.7) Common Stock Additional Paid-in-Capital Retained Earnings Treasury Stock Other Adjustments Noncontrolling Interest Total Stockholders Equity ($0.1) $0.0 ($0.4) $29.0 $122.0 $288.4 Total Liabilities and Equity $514.2 $629.5 $737.1 2019 2020 2018 Capital Net Operating Working Capital $216.10 Net Operating Capital $259.70 Capital Requirement Ratio (Op. Capital / Sales) $257.10 $335.20 7.46% Value Added Weighted Average Cost of Capital (WACC) Return on Invested Capital (ROIC) Economic Value Added (EVA) Leverage and Coverage Funded Debt to Total Assets Funded Debt to Equity Funded Debt to EBITDA Times Interest Earned EBITDA Coverage Dupont Equation Return on Equity (ROE) Net Profit Margin Total Assets Turnover (Sales / Total Assets) Equity Multiplier (Total Assets / Common Equity)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts