Question: Please, help me solve I cannot figure this out. Assume that you are a looking to obtain a commercial real estate loan for a property

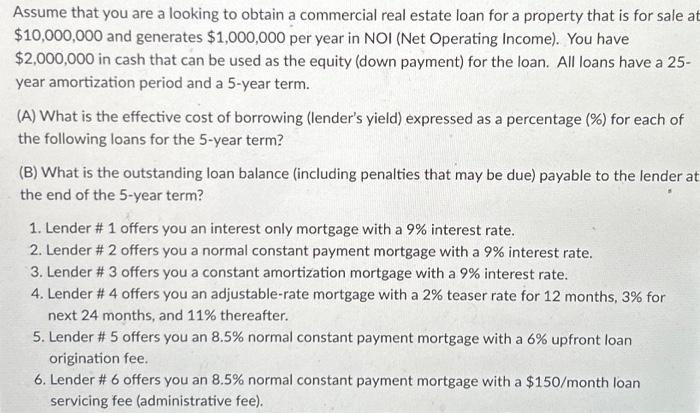

Assume that you are a looking to obtain a commercial real estate loan for a property that is for sale at $10,000,000 and generates $1,000,000 per year in NOI (Net Operating income). You have $2,000,000 in cash that can be used as the equity (down payment) for the loan. All loans have a 25 year amortization period and a 5 -year term. (A) What is the effective cost of borrowing (lender's yield) expressed as a percentage (\%) for each of the following loans for the 5 -year term? (B) What is the outstanding loan balance (including penalties that may be due) payable to the lender at the end of the 5 -year term? 1. Lender \# 1 offers you an interest only mortgage with a 9% interest rate. 2. Lender \# 2 offers you a normal constant payment mortgage with a 9% interest rate. 3. Lender \# 3 offers you a constant amortization mortgage with a 9% interest rate. 4. Lender \# 4 offers you an adjustable-rate mortgage with a 2% teaser rate for 12 months, 3% for next 24 months, and 11% thereafter. 5 . Lender \# 5 offers you an 8.5% normal constant payment mortgage with a 6% upfront loan origination fee. 6. Lender \# 6 offers you an 8.5% normal constant payment mortgage with a $150/ month loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts