Question: please help me solve , i included all data necessary Samson Dairy produces an organic butter that is sold by the pound. The production of

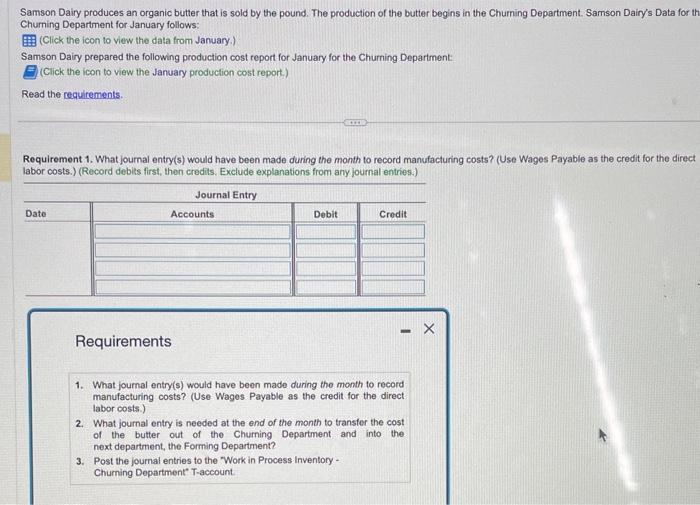

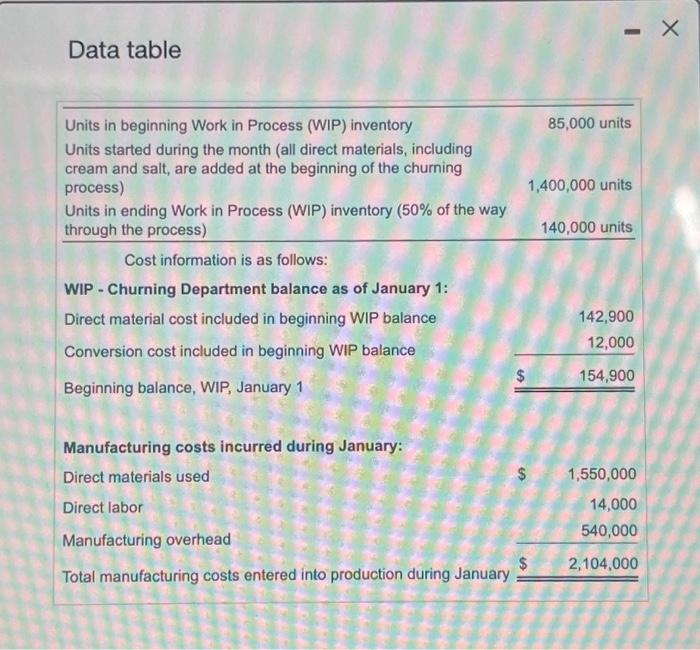

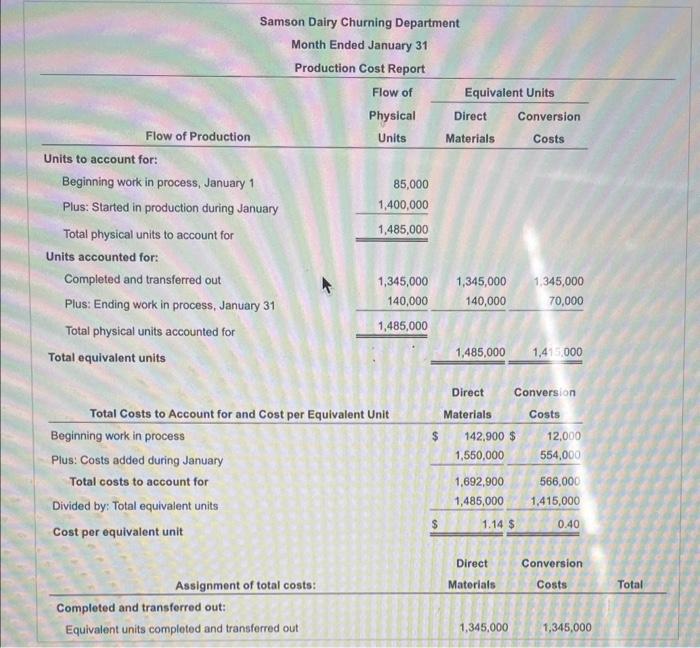

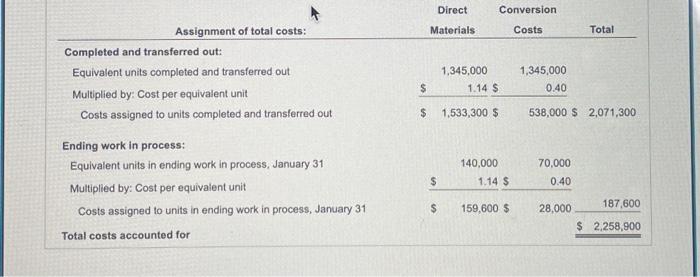

Samson Dairy produces an organic butter that is sold by the pound. The production of the butter begins in the Churning Department. Samson Dairy's Data for Chuming Department for January follows: (Click the icon to view the data from January.) Samson Dairy prepared the following production cost report for January for the Churning Department: (Click the icon to view the January production cost report.) Read the requirements. Requirement 1. What journal entry(s) would have been made during the month to record manufacturing costs? (Use Wages Payable as the credit for the direct labor costs.) (Record debits first, then credits. Exclude explanations from any journal entries.) Requirements 1. What journal entry(s) would have been made during the month to record manufacturing costs? (Use Wages Payable as the credit for the direct labor costs.) 2. What journal entry is needed at the end of the month to transter the cost of the butter out of the Churning Department and into the next department, the Forming Department? 3. Post the journal entries to the "Work in Process Inventory Churning Department" T-account. Samson Dairy Churning Department Month Ended January 31 Production Cost Report \begin{tabular}{|l|c|c|c|} & Direct & Conversion & \\ Assignment of total costs: & Materials & Costs & Total \\ \hline sferred out: & & & \\ mploted and transferred out & 1,345,000 & 1,345,000 & \\ \hline \end{tabular} Data table \begin{tabular}{|c|c|c|c|c|} \hline Assignment of total costs: & & DirectMaterials & ConversionCosts & Total \\ \hline \multicolumn{5}{|l|}{ Completed and transferred out: } \\ \hline Equivalent units completed and transferred out & & 1,345,000 & 1,345,000 & \\ \hline Multiplied by: Cost per equivalent unit & $ & 1.14$ & 0.40 & \\ \hline Costs assigned to units completed and transferred out & $ & 1,533,300$ & 538,000$ & 2,071,300 \\ \hline \end{tabular} Ending work in process: Equivalent units in ending work in process, January 31 Multiplied by: Cost per equivalent unit Costs assigned to units in ending work in process, January 31 \begin{tabular}{rrr} & 140,000 & 70,000 \\ $ & 1.14$ & 0.40 \\ \hline$159,600$ & 28,000 & 187,600 \\ \hline2,258,900 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts