Question: Please help me solve. I will leave a thumbs up!! Your firm is selling 3 million shares in an IPO. You are targeting an offer

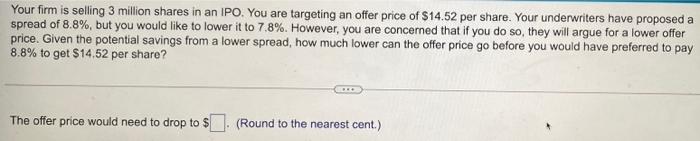

Your firm is selling 3 million shares in an IPO. You are targeting an offer price of $14.52 per share. Your underwriters have proposed a spread of 8.8%, but you would like to lower it to 7.8%. However, you are concerned that if you do so, they will argue for a lower offer price. Given the potential savings from a lower spread, how much lower can the offer price go before you would have preferred to pay 8.8% to get $14.52 per share? The offer price would need to drop to $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts