Question: Please help me solve question 3 a-c. If all is correct I will make sure to thumbs up. Thank you! The client has $10,000 to

Please help me solve question 3 a-c. If all is correct I will make sure to thumbs up. Thank you!

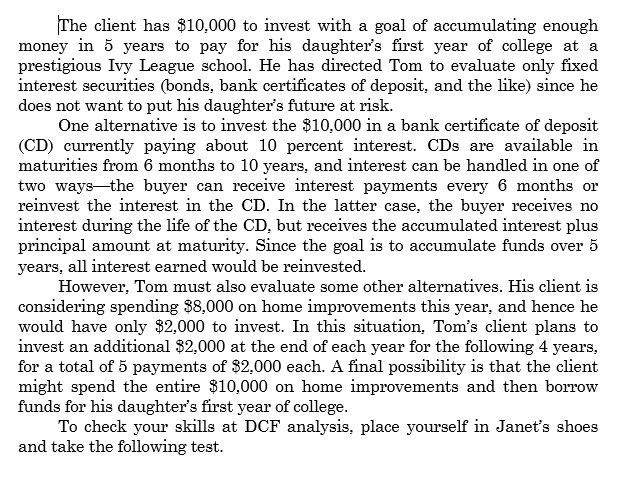

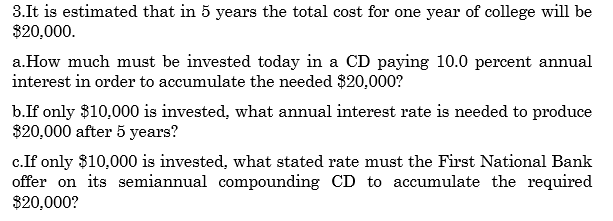

The client has $10,000 to invest with a goal of accumulating enough money in 5 years to pay for his daughter's first year of college at a prestigious Ivy League school. He has directed Tom to evaluate only fixed interest securities (bonds, bank certificates of deposit, and the like) since he does not want to put his daughter's future at risk. One alternative is to invest the $10,000 in a bank certificate of deposit (CD) currently paying about 10 percent interest. CDs are available in maturities from 6 months to 10 years, and interest can be handled in one of two waysthe buyer can receive interest payments every 6 months or reinvest the interest in the CD. In the latter case, the buyer receives no interest during the life of the CD, but receives the accumulated interest plus principal amount at maturity. Since the goal is to accumulate funds over 5 years, all interest earned would be reinvested. However, Tom must also evaluate some other alternatives. His client is considering spending $8,000 on home improvements this year, and hence he would have only $2,000 to invest. In this situation, Tom's client plans to invest an additional $2.000 at the end of each year for the following 4 years, for a total of 5 payments of $2,000 each. A final possibility is that the client might spend the entire $10,000 on home improvements and then borrow funds for his daughter's first year of college. To check your skills at DCF analysis, place yourself in Janet's shoes and take the following test. 3.It is estimated that in 5 years the total cost for one year of college will be $20,000. a. How much must be invested today in a CD paying 10.0 percent annual interest in order to accumulate the needed $20,000? b.If only $10.000 is invested, what annual interest rate is needed to produce $20,000 after 5 years? c.If only $10,000 is invested, what stated rate must the First National Bank offer on its semiannual compounding CD to accumulate the required $20.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts