Question: please help me solve the excel spreadsheet values below based on the given information above as input values (12-21) Payback, NPV, and MIRR Your division

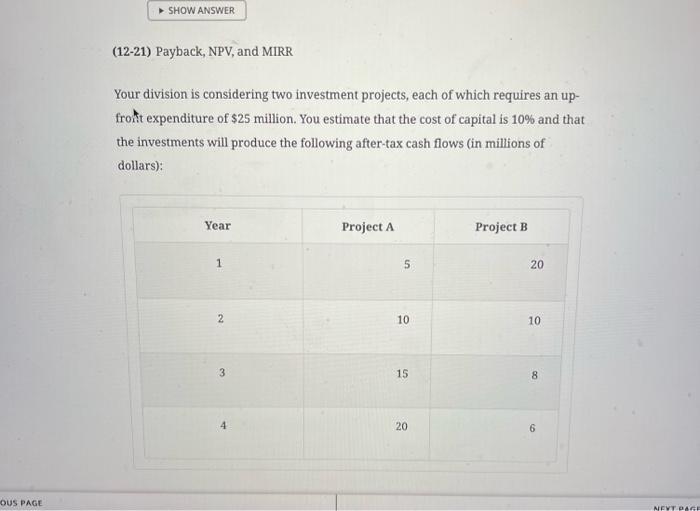

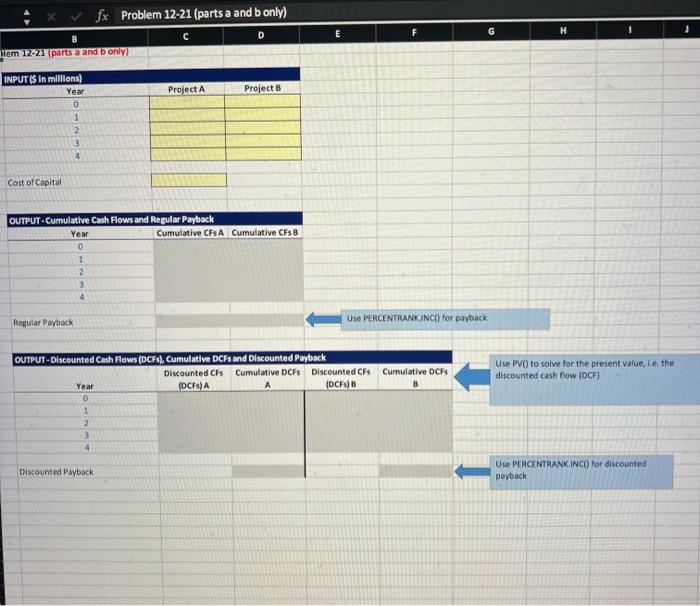

(12-21) Payback, NPV, and MIRR Your division is considering two investment projects, each of which requires an upfroht expenditure of $25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars): * Problem 12-21 (parts a and b only) blem 12-21 (parts a and b only) INPUT(S in millions) \begin{tabular}{|c|c|c|} \hline Year & Project A & ProjectB \\ \hline 0 & & \\ \hline 1 & & \\ \hline 2 & & \\ \hline 3 & & \\ \hline 4 & & \\ \hline \end{tabular} Cost of Capital OUTPUT-Cumulative Cach Flows and Regular Payback \begin{tabular}{|cc} \hline Year & Cumulative CFs A Cumulative CFs B \\ \hline 0 & \\ 1 \\ 2 & \\ 3 \\ 4 & \\ \hline \end{tabular} Reguiar Payback USE PERCENTRANKINCD for payback OUTPUT-Discounted Cash Flows (DCF), Cumulative DCFand Discounted Parback Use PV0) to solve for the present value, Le, the discounted cash flow (OCF) USE PERCE NTRANK. INC() for discounted perback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts