Question: please help me solve the following #1 A-F #2 A-B BCS 407: Estate Planning for Families Marital Trust Assignment 1. Sidied June 7, 2009, survived

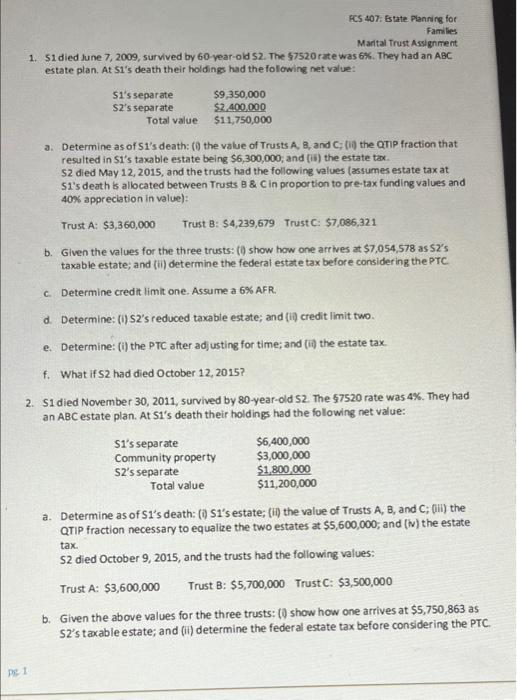

BCS 407: Estate Planning for Families Marital Trust Assignment 1. Sidied June 7, 2009, survived by 60 year-old S2. The $7520 rate was 6%. They had an ABC estate plan. At Si's death their holdings had the folowing net value: Si's separate $9,350,000 Sz's separate $2.400.000 Total value $11,750,000 a. Determine as of Si's death: (the value of Trusts A, B, and C; 09 the QTIP fraction that resulted in Si's taxable estate being $6,300,000; and (15) the estate tax S2 died May 12, 2015, and the trusts had the following values (assumes estate tax at Si's death is allocated between Trusts B & C in proportion to pre-tax funding values and 40% appreciation in value): Trust A: $3,360,000 Trust B: $4,239,679 TrustC: $7,086,321 b. Given the values for the three trusts: ( show how one arrives at $7,054,578 as 52's taxable estate; and (ii) determine the federal estate tax before considering the PTC c. Determine credit limit one. Assume a 6% AFR. d Determine: (0) S2's reduced taxable estate; and (i) credit limit two e. Determine: (i) the PTC after adjusting for time; and (in the estate tax f. What if s2 had died October 12, 2015? 2. Si died November 30, 2011, survived by 80-year-old S2. The $7520 rate was 4%. They had an ABC estate plan. At Si's death their holdings had the folowing net value: Si's separate $6,400,000 Community property $3,000,000 SZ's separate $1,800,000 Total value $11,200,000 tax a. Determine as of Si's death: ( Si's estate; (ii) the value of Trusts A, B, and Coll) the QTIP fraction necessary to equalize the two estates at $5,600,000, and (w) the estate S2 died October 9, 2015, and the trusts had the following values: Trust A: $3,600,000 Trust B: $5,700,000 TrustC: $3,500,000 b. Given the above values for the three trusts: (0 show how one arrives at $5,750,863 as S2's taxable estate; and (ii) determine the federal estate tax before considering the PTC Pet BCS 407: Estate Planning for Families Marital Trust Assignment 1. Sidied June 7, 2009, survived by 60 year-old S2. The $7520 rate was 6%. They had an ABC estate plan. At Si's death their holdings had the folowing net value: Si's separate $9,350,000 Sz's separate $2.400.000 Total value $11,750,000 a. Determine as of Si's death: (the value of Trusts A, B, and C; 09 the QTIP fraction that resulted in Si's taxable estate being $6,300,000; and (15) the estate tax S2 died May 12, 2015, and the trusts had the following values (assumes estate tax at Si's death is allocated between Trusts B & C in proportion to pre-tax funding values and 40% appreciation in value): Trust A: $3,360,000 Trust B: $4,239,679 TrustC: $7,086,321 b. Given the values for the three trusts: ( show how one arrives at $7,054,578 as 52's taxable estate; and (ii) determine the federal estate tax before considering the PTC c. Determine credit limit one. Assume a 6% AFR. d Determine: (0) S2's reduced taxable estate; and (i) credit limit two e. Determine: (i) the PTC after adjusting for time; and (in the estate tax f. What if s2 had died October 12, 2015? 2. Si died November 30, 2011, survived by 80-year-old S2. The $7520 rate was 4%. They had an ABC estate plan. At Si's death their holdings had the folowing net value: Si's separate $6,400,000 Community property $3,000,000 SZ's separate $1,800,000 Total value $11,200,000 tax a. Determine as of Si's death: ( Si's estate; (ii) the value of Trusts A, B, and Coll) the QTIP fraction necessary to equalize the two estates at $5,600,000, and (w) the estate S2 died October 9, 2015, and the trusts had the following values: Trust A: $3,600,000 Trust B: $5,700,000 TrustC: $3,500,000 b. Given the above values for the three trusts: (0 show how one arrives at $5,750,863 as S2's taxable estate; and (ii) determine the federal estate tax before considering the PTC Pet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts