Question: Please help me solve the following. If correct, I will make sure to thumbs up. Thank you! 8. Replacement analysis Aa Aa Green Moose Industries

Please help me solve the following. If correct, I will make sure to thumbs up. Thank you!

Please help me solve the following. If correct, I will make sure to thumbs up. Thank you!

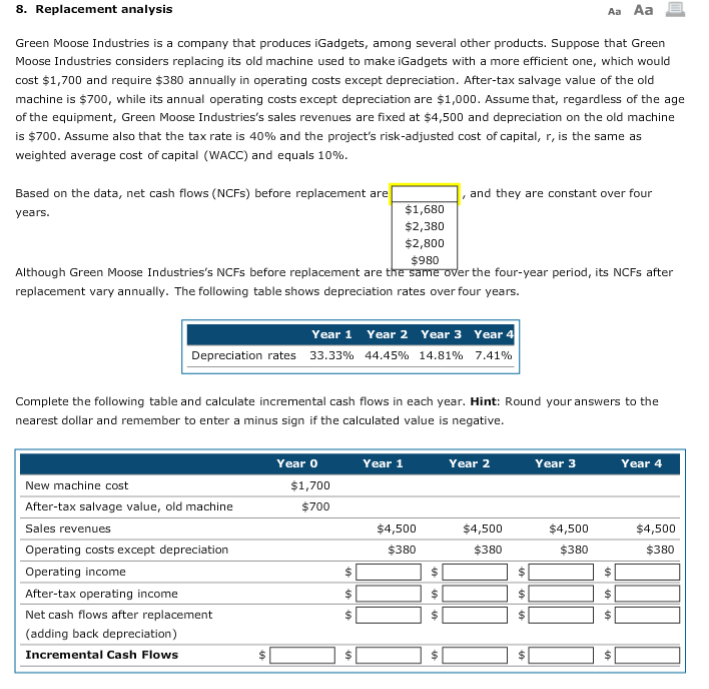

8. Replacement analysis Aa Aa Green Moose Industries is a company that produces iGadgets, among several other products. Suppose that Green Moose Industries considers replacing its old machine used to make iGadgets with a more efficient one, which would cost $1,700 and require $380 annually in operating costs except depreciation. After-tax salvage value of the old machine is $700, while its annual operating costs except depreciation are $1,000. Assume that, regardless of the age of the equipment, Green Moose Industries's sales revenues are fixed at $4,500 and depreciation on the old machine is $700. Assume also that the tax rate is 40% and the project's risk-adjusted cost of capital, r, is the same as weighted average cost of capital (WACC) and equals 10% Based on the data, net cash flows (NCFs) before replacement are and they are constant over four $1,680 $2,380 $2,800 $980 years. Although Green Moose Industries's NCFs before replacement are replacement vary annually. The following table shows depreciation rates over four years. r the four-year period, its NCFs after Year 1 Year 2 Year 3 Year 4 Depreciation rates 33.33% 44.45% 14.81% 7.41% Complete the following table and calculate incremental cash flows in each year. Hint: Round your answers to the nearest dollar and remember to enter a minus sign if the calculated value is negative Year 0 Year 1 Year 2 Year 3 Year 4 $1,700 $700 New machine cost After-tax salvage value, old machine Sales revenues Operating costs except depreciation Operating income After-tax operating income Net cash flows after replacement (adding back depreciation) Incremental Cash Flows $4,500 $380 $4,500 $380 $4,500 $380 $4,500 $380

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts