Question: Please help me solve the following problem a and b, please write detailed steps, do not miss any steps, thank you! (a) We consider an

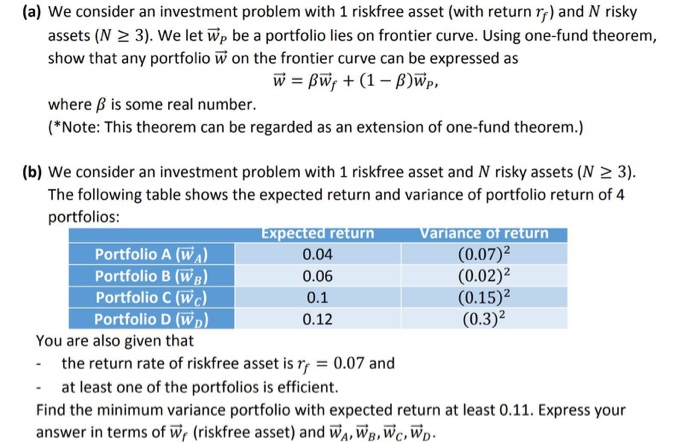

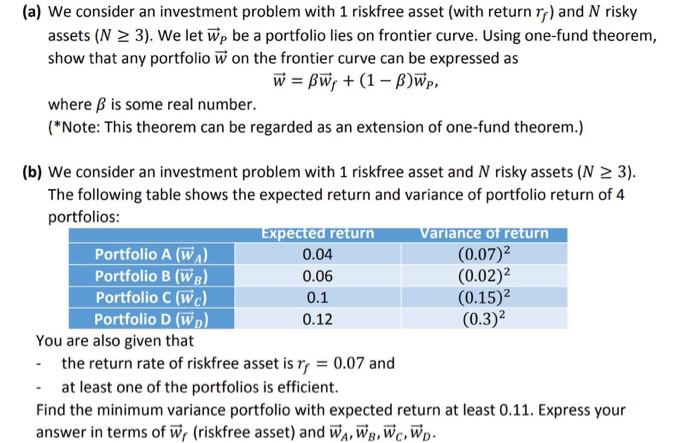

(a) We consider an investment problem with 1 riskfree asset (with return rr) and N risky assets (N 2 3). We let Wp be a portfolio lies on frontier curve. Using one-fund theorem, show that any portfolio w on the frontier curve can be expressed as where B is some real number. (*Note: This theorem can be regarded as an extension of one-fund theorem.) (b) We consider an investment problem with 1 riskfree asset and N risky assets (N 2 3) The following table shows the expected return and variance of portfolio return of 4 portfolios xpected return 0.04 0.06 0.1 0.12 ariance of return Portfolio A (WA Portfolio B (WB) Portfolio C (wc) Portfolio D (WD (0.07)2 (0.02)2 (0.15)2 (0.3)2 You are also given that - the return rate of riskfree asset is re0.07 and - at least one of the portfolios is efficient Find the minimum variance portfolio with expected return at least 0.11. Express your answer in terms of W (riskfree asset) and WA, WB, Wc, WD (a) We consider an investment problem with 1 riskfree asset (with return rr) and N risky assets (N 2 3). We let Wp be a portfolio lies on frontier curve. Using one-fund theorem, show that any portfolio w on the frontier curve can be expressed as where B is some real number. (*Note: This theorem can be regarded as an extension of one-fund theorem.) (b) We consider an investment problem with 1 riskfree asset and N risky assets (N 2 3) The following table shows the expected return and variance of portfolio return of 4 portfolios xpected return 0.04 0.06 0.1 0.12 ariance of return Portfolio A (WA Portfolio B (WB) Portfolio C (wc) Portfolio D (WD (0.07)2 (0.02)2 (0.15)2 (0.3)2 You are also given that - the return rate of riskfree asset is re0.07 and - at least one of the portfolios is efficient Find the minimum variance portfolio with expected return at least 0.11. Express your answer in terms of W (riskfree asset) and WA, WB, Wc, WD (a) We consider an investment problem with 1 riskfree asset (with return rr) and N risky assets (N 2 3). We let Wp be a portfolio lies on frontier curve. Using one-fund theorem, show that any portfolio w on the frontier curve can be expressed as where B is some real number. (*Note: This theorem can be regarded as an extension of one-fund theorem.) (b) We consider an investment problem with 1 riskfree asset and N risky assets (N 2 3) The following table shows the expected return and variance of portfolio return of 4 portfolios xpected return 0.04 0.06 0.1 0.12 ariance of return Portfolio A (WA Portfolio B (WB) Portfolio C (wc) Portfolio D (WD (0.07)2 (0.02)2 (0.15)2 (0.3)2 You are also given that - the return rate of riskfree asset is re0.07 and - at least one of the portfolios is efficient Find the minimum variance portfolio with expected return at least 0.11. Express your answer in terms of W (riskfree asset) and WA, WB, Wc, WD (a) We consider an investment problem with 1 riskfree asset (with return rr) and N risky assets (N 2 3). We let Wp be a portfolio lies on frontier curve. Using one-fund theorem, show that any portfolio w on the frontier curve can be expressed as where B is some real number. (*Note: This theorem can be regarded as an extension of one-fund theorem.) (b) We consider an investment problem with 1 riskfree asset and N risky assets (N 2 3) The following table shows the expected return and variance of portfolio return of 4 portfolios xpected return 0.04 0.06 0.1 0.12 ariance of return Portfolio A (WA Portfolio B (WB) Portfolio C (wc) Portfolio D (WD (0.07)2 (0.02)2 (0.15)2 (0.3)2 You are also given that - the return rate of riskfree asset is re0.07 and - at least one of the portfolios is efficient Find the minimum variance portfolio with expected return at least 0.11. Express your answer in terms of W (riskfree asset) and WA, WB, Wc, WD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts