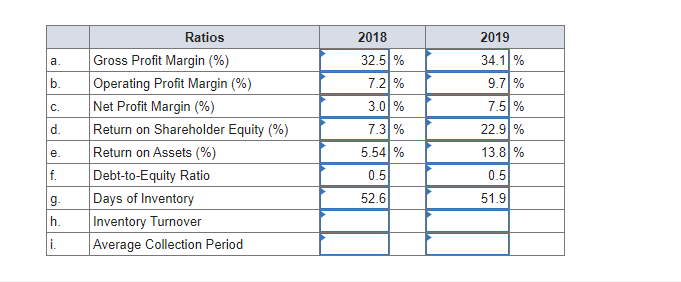

Question: Please help me solve the missing values part h & i Ratio Analysis-Urban Outfitters Read the overview below and complete the activities that follow. Assessing

Please help me solve the missing values part h & i

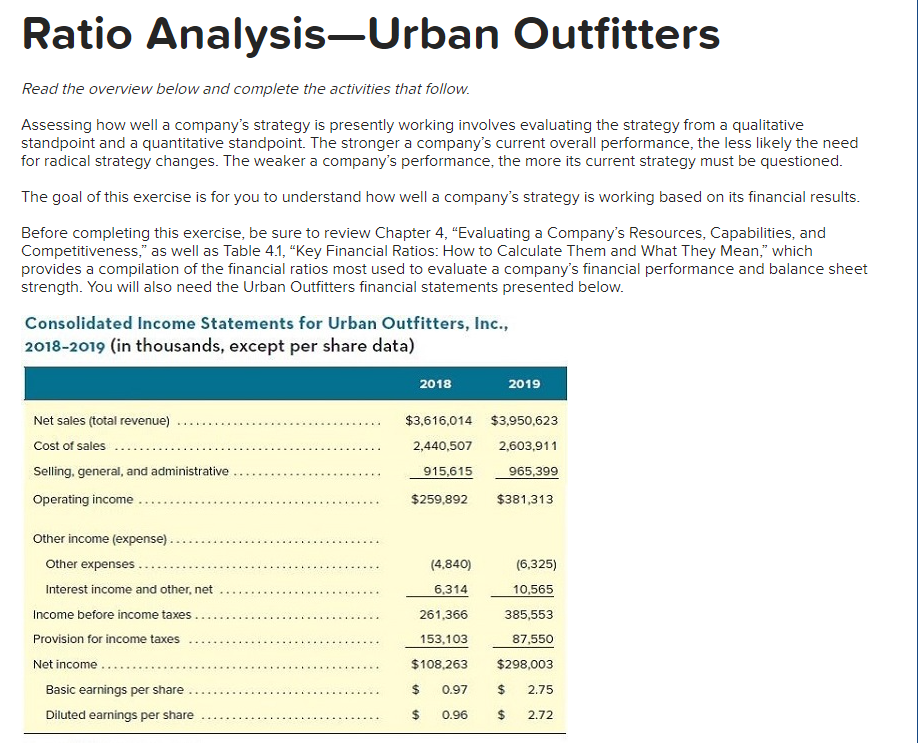

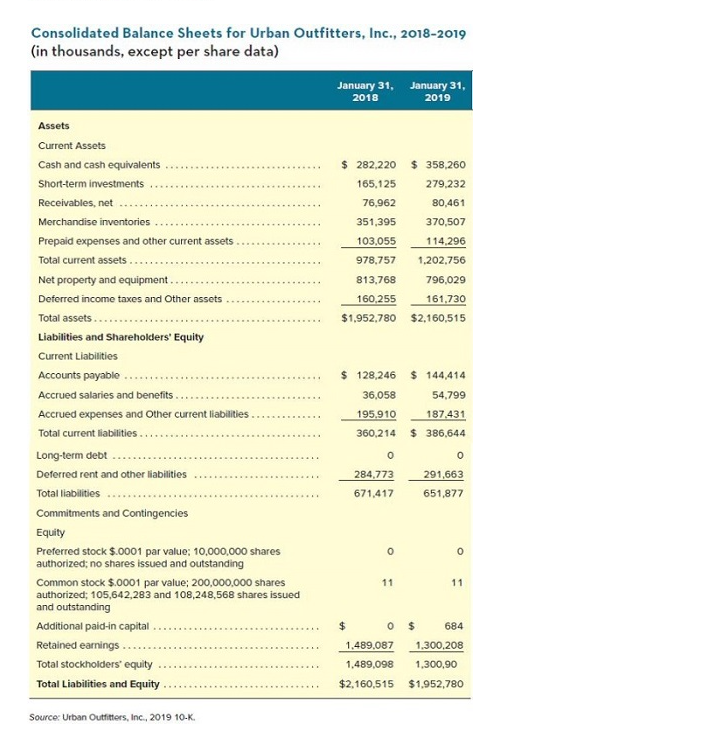

Ratio Analysis-Urban Outfitters Read the overview below and complete the activities that follow. Assessing how well a company's strategy is presently working involves evaluating the strategy from a qualitative standpoint and a quantitative standpoint. The stronger a company's current overall performance, the less likely the need for radical strategy changes. The weaker a company's performance, the more its current strategy must be questioned. The goal of this exercise is for you to understand how well a company's strategy is working based on its financial results. Before completing this exercise, be sure to review Chapter 4, "Evaluating a Company's Resources, Capabilities, and Competitiveness," as well as Table 4.1, "Key Financial Ratios: How to Calculate Them and What They Mean," which provides a compilation of the financial ratios most used to evaluate a company's financial performance and balance sheet strength. You will also need the Urban Outfitters financial statements presented below. Consolidated Income Statements for Urban Outfitters, Inc., 2018-2019 (in thousands, except per share data) Consolidated Balance Sheets for Urban Outfitters, Inc., 2018-2019 (in thousands, except per share data) \begin{tabular}{|ccc} \hlinex & January 31, January 31, \\ 2019 \end{tabular} Assets Current Assets Cash and cash equivalents Short-term investments Receivables, net \begin{tabular}{rrr} $282,220 & $358,260 \\ 165,125 & & 279,232 \\ 76,962 & & 80,461 \\ 351,395 & & 370,507 \\ 103,055 & & 114,296 \\ 978,757 & & 1,202,756 \\ 813,768 & & 796,029 \\ 160,255 & & 161,730 \\ \hline$1,952,780 & $2,160,515 \end{tabular} Merchandise inventories Prepaid expenses and other current assets Total current assets. Net property and equipment . Deferred income taxes and Other assets Total assets. Liabilities and Shareholders' Equity Current Liabilities Accounts payable Accrued salaries and benefits Accrued expenses and Other current liabilities Total current liabilities Long-term debt Deferred rent and other liabilities Total liabilities Commitments and Contingencies Equilty Preferred stock $.0001 par value; 10,000,000 shares authorized; no shares issued and outstanding Common stock $.0001 par value; 200,000,000 shares authorized; 105,642,283 and 108,248,568 shares issued and outstanding Additional paid-in capital Retained earnings Total stockholders' equity 671,417284,773651,877291,663 Total Liabilities and Equity 11 Total Liabilities and Equity Source: Urban Outfitters, Inc, 201910K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts