Question: Please help me solve the ones I got wrong. The following data from the just completed year are taken from the accounting records of Mason

Please help me solve the ones I got wrong.

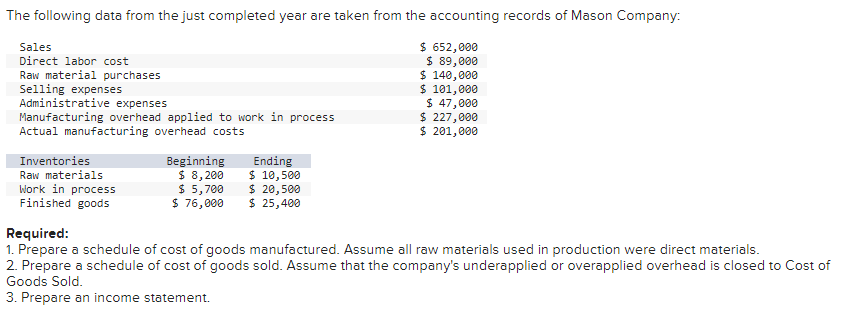

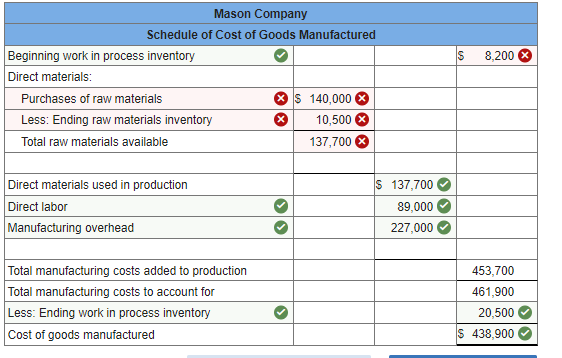

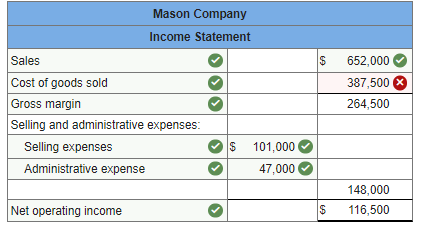

The following data from the just completed year are taken from the accounting records of Mason Company: Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs Inventories Beginning Ending Raw materials $ 8,200 $ 10,500 Work in process $ 5,700 $ 20,500 Finished goods $ 76,000 $ 25,400 $ 652,000 $ 89,000 $ 140,000 $ 101,000 $ 47,000 $ 227,000 $ 201,000 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement. S 8,200 Mason Company Schedule of Cost of Goods Manufactured Beginning work in process inventory Direct materials: Purchases of raw materials $ 140,000 $ Less: Ending raw materials inventory 10,500 Total raw materials available 137,700 Direct materials used in production Direct labor Manufacturing overhead S 137,700 89,000 227,000 Total manufacturing costs added to production Total manufacturing costs to account for Less: Ending work in process inventory Cost of goods manufactured 453,700 461,900 20,500 $ 438,900 S Mason Company Schedule of Cost of Goods Sold Beginning finished goods inventory Add: Cost of goods manufactured Cost of goods available for sale Less: Ending finished goods inventory Unadjusted cost of goods sold Less: Overapplied overhead Adjusted cost of goods sold 76,000 438,900 413,500 X 254,000 X 413,500 26,000 387,500 X S Mason Company Income Statement $ 652,000 387,500 X 264,500 Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expense $ 101,000 47,000 148,000 116,500 Net operating income $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts