Question: please help me solve the question b ianf bii with step by step Qucstion 2(20 marks) a) Carter expects to live for 30 years more

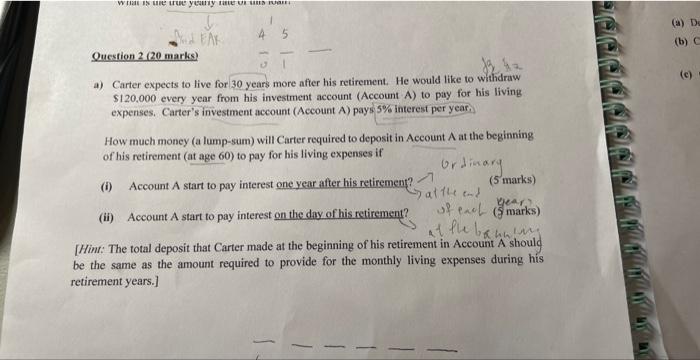

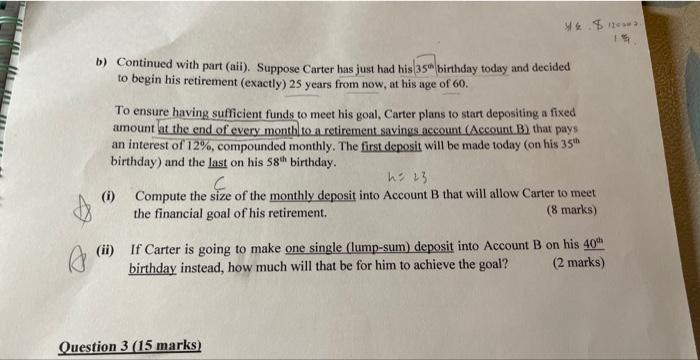

Qucstion 2(20 marks) a) Carter expects to live for 30 years more after his retirement. He would like to withdraw $120.000 every year from his investment account (Account A) to pay for his living expenses. Carter's investment account (Account A) pays 5% interest per year. How much money (a lump-sum) will Carter required to deposit in Account A at the beginning of his retirement (at age 60 ) to pay for his living expenses if (i) Account A start to pay interest one year after his retirement? 7 O dinary (ii) Account A start to pay interest on the day of his retirement? of eac (S marks) Him: The total deposit that Carter made at the beginning of his retirement in Account A should the same as the amount required to provide for the monthly living expenses during his tirement years.] b) Continued with part (aii). Suppose Carter has just had his 35m birthday today and decided to begin his retirement (exactly) 25 years from now, at his age of 60 . To ensure having sufficient funds to meet his goal, Carter plans to start depositing a fixed amount at the end of every month) to a retirement savings account (Account B ) that pays an interest of 12%, compounded monthly. The first deposit will be made today (on his 35th birthday) and the last on his 58th birthday. (i) Compute the size of the monthly deposit into Account B that will allow Carter to meet the financial goal of his retirement. ( 8 marks) (ii) If Carter is going to make one single (lump-sum) deposit into Account B on his 40th birthday instead, how much will that be for him to achieve the goal? ( 2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts