Question: Please help me solve the question. Thank you! 2. Corey Corporation manufactures joint products W and X. During a recent period, joint costs amounted to

Please help me solve the question. Thank you!

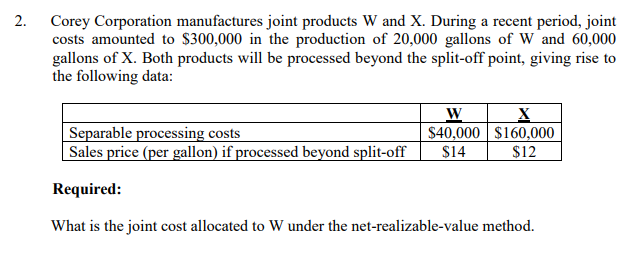

2. Corey Corporation manufactures joint products W and X. During a recent period, joint costs amounted to $300,000 in the production of 20,000 gallons of W and 60,000 gallons of X. Both products will be processed beyond the split-off point, giving rise to the following data: Separable processing costs Sales price (per gallon) if processed beyond split-off W $40,000 $14 X $160,000 | $12 Required: What is the joint cost allocated to W under the net-realizable-value method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts