Question: PLEASE HELP ME SOLVE THESE, PLEASE NUMBER THEM ACCORDINGLY OR IT IS CONFUSING I WILL UPVOTE FOR CORRECT ANSWERS *ALSO ANSWER IN IMAGES* SOMEONE PREVIOUSLY

PLEASE HELP ME SOLVE THESE, PLEASE NUMBER THEM ACCORDINGLY OR IT IS CONFUSING I WILL UPVOTE FOR CORRECT ANSWERS *ALSO ANSWER IN IMAGES* SOMEONE PREVIOUSLY ANSWERED WRONG AND WASTED ONE OF MY QUESTION, PLEASE DONT DO THAT, I WILL UPVOTE FOR CORRECT ANSWER

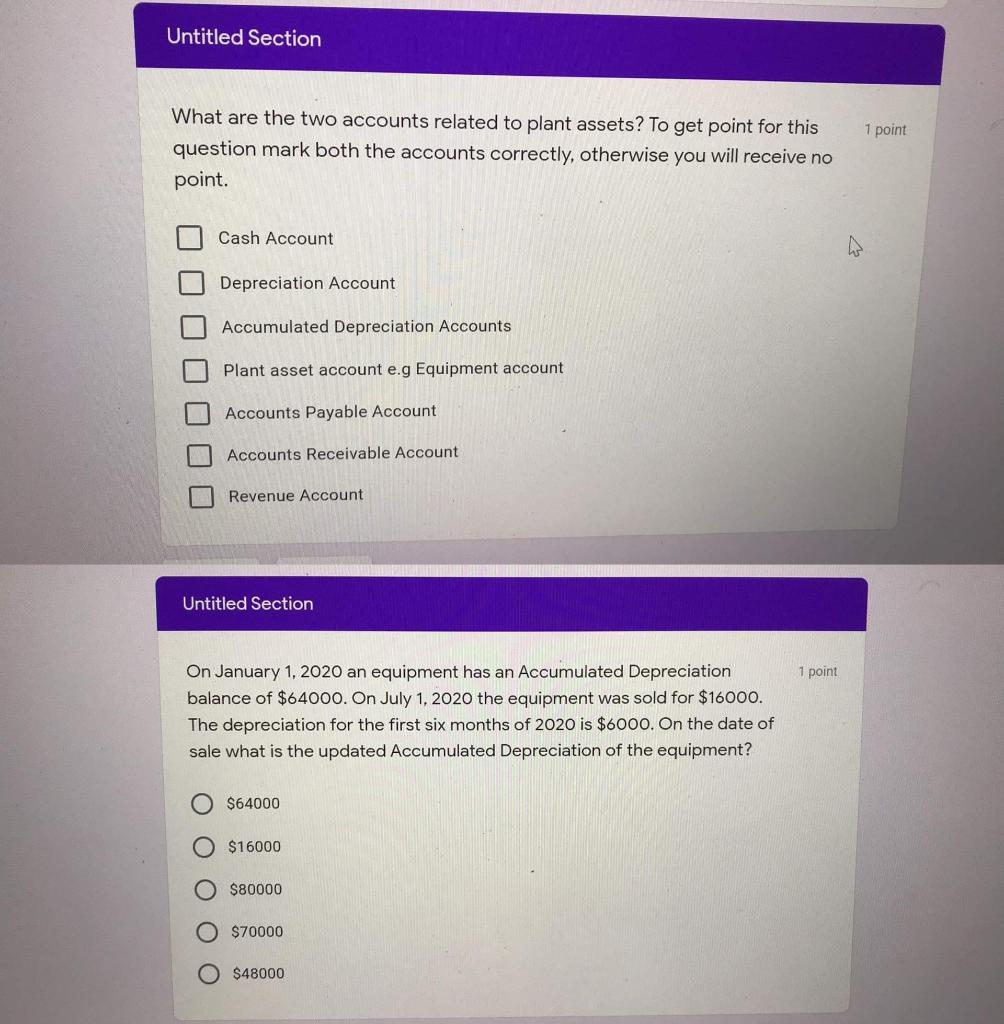

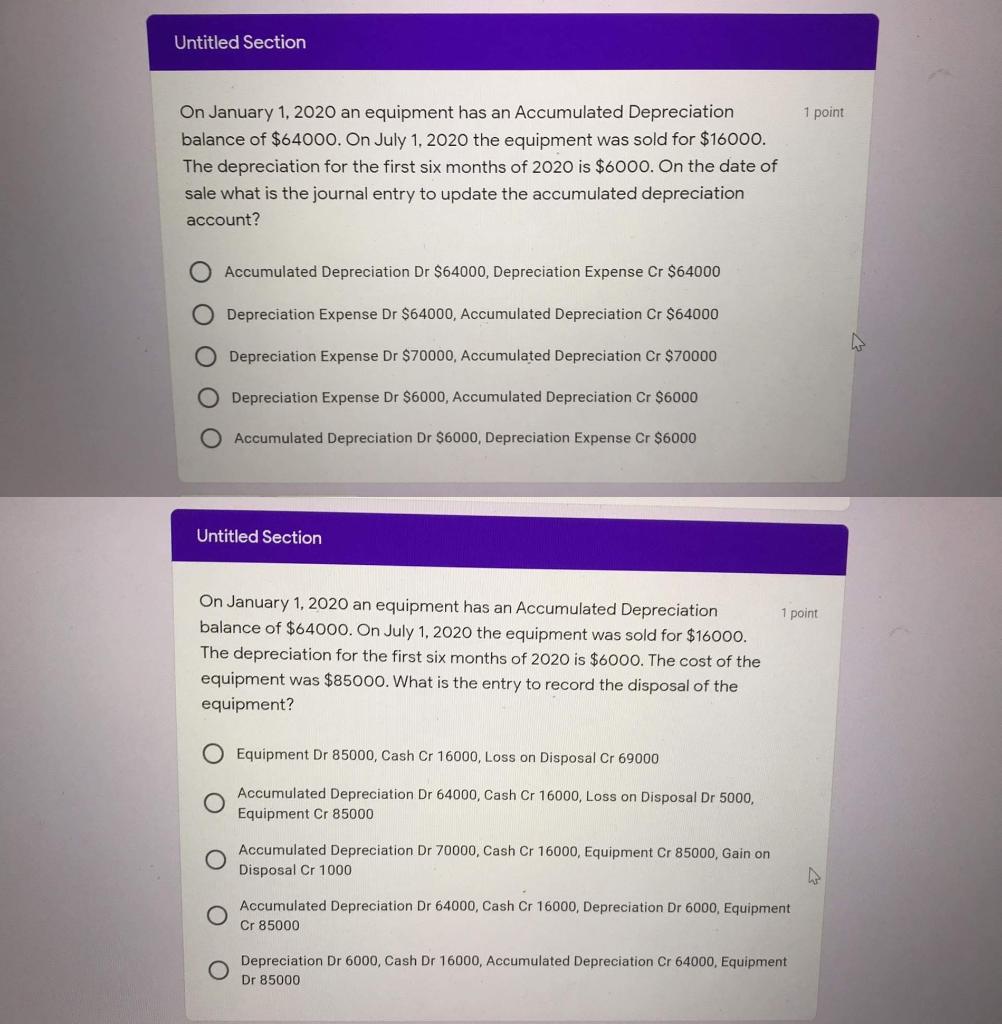

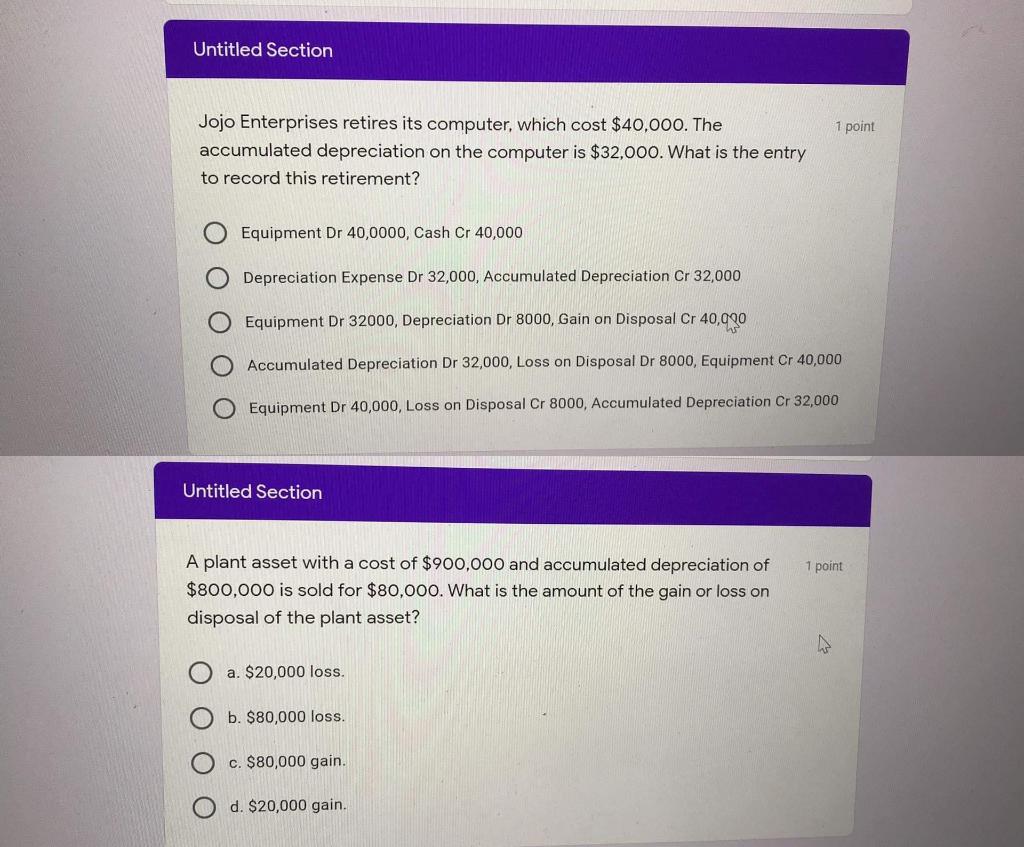

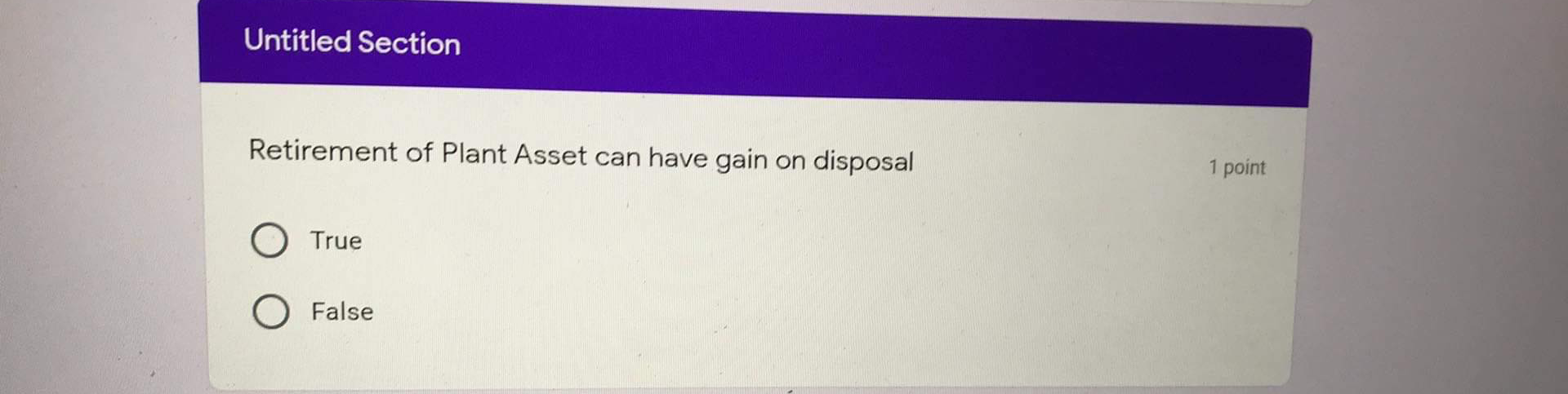

Untitled Section 1 point What are the two accounts related to plant assets? To get point for this question mark both the accounts correctly, otherwise you will receive no point. Cash Account Depreciation Account Accumulated Depreciation Accounts Plant asset account e.g Equipment account Accounts Payable Account Accounts Receivable Account Revenue Account Untitled Section 1 point On January 1, 2020 an equipment has an Accumulated Depreciation balance of $64000. On July 1, 2020 the equipment was sold for $16000. The depreciation for the first six months of 2020 is $6000. On the date of sale what is the updated Accumulated Depreciation of the equipment? $64000 $16000 $80000 $70000 O $48000 Untitled Section 1 point Jojo Enterprises retires its computer, which cost $40,000. The accumulated depreciation on the computer is $32,000. What is the entry to record this retirement? Equipment Dr 40,0000, Cash 40,000 O Depreciation Expense Dr 32,000, Accumulated Depreciation Cr 32,000 Equipment Dr 32000, Depreciation Dr 8000, Gain on Disposal Cr 40,990 Accumulated Depreciation Dr 32,000, Loss on Disposal Dr 8000, Equipment Cr 40,000 Equipment Dr 40,000, Loss on Disposal Cr 8000, Accumulated Depreciation Cr 32,000 Untitled Section 1 point A plant asset with a cost of $900,000 and accumulated depreciation of $800,000 is sold for $80,000. What is the amount of the gain or loss on disposal of the plant asset? a. $20,000 loss. b. $80,000 loss. c. $80,000 gain. d. $20,000 gain. Untitled Section Retirement of Plant Asset can have gain on disposal 1 point O True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts