Question: Please help me solve these problem step by step 6. A company just paid a dividend of S6.55 on its common stock at the end

Please help me solve these problem step by step

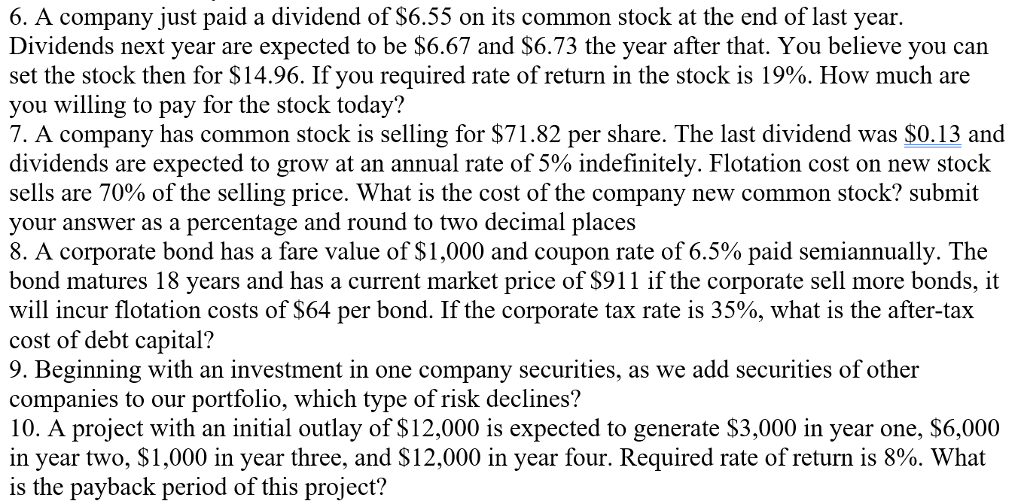

6. A company just paid a dividend of S6.55 on its common stock at the end of last year Dividends next year are expected to be $6.67 and $6.73 the year after that. You believe you can set the stock then for $14.96. If you required rate of return in the stock is 19%. How much are you willing to pay for the stock today? 7. A company has common stock is selling for $71.82 per share. The last dividend was SO.13 and dividends are expected to grow at an annual rate of 5% indefinitely. Flotation cost on new stock sells are 70% of the selling price. What is the cost of the company new common stock? submit your answer as a percentage and round to two decimal places 8. A corporate bond has a fare value of $1,000 and coupon rate of 6.5% paid semiannually. The bond matures 18 years and has a current market price of S911 if the corporate sell more bonds, it will incur flotation costs of $64 per bond. If the corporate tax rate is 35%, what is the after-tax cost of debt capital? 9. Beginning with an investment in one company securities, as we add securities of other companies to our portfolio, which type of risk declines? 10. A project with an initial outlay of $12,000 is expected to generate S3,000 in year one, $6,000 in year two, $1,000 in year three, and $12,000 in year four. Required rate of return is 8%. What is the payback period of this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts