Question: Please help me solve these problems with explanation, please: Calculate the price of a bond with FV of $1,000, a coupon rate of 12 percent

Please help me solve these problems with explanation, please:

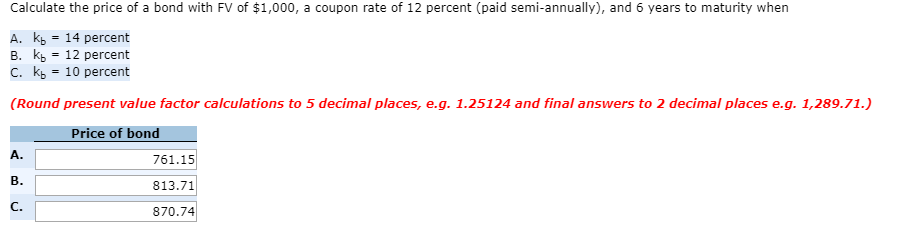

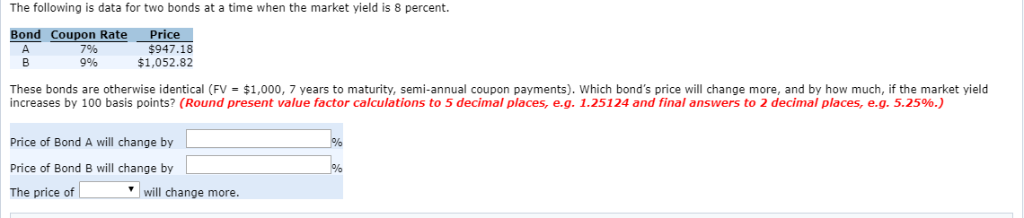

Calculate the price of a bond with FV of $1,000, a coupon rate of 12 percent (paid semi-annually), and 6 years to maturity when A. k B. k C. k 14 percent 12 percent = 10 percent = (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 2 decimal places e.g. 1,289.71.) Price of bond A. 761.15 B. 813.71 C. 870.74 The following is data for two bonds at a time when the market yield is 8 percent. Price $947.18 Bond Coupon Rate A 7% 9% $1,052.82 These bonds are otherwise identical (FV $1,000, 7 years to maturity, semi-annual coupon payments). Which bond's price will change more, and by how much, if the market yield increases by 100 basis points? (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 2 decimal places, e.g. 5.25%.) Price of Bond A will change by Price of Bond B will change by will change more. The price of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts