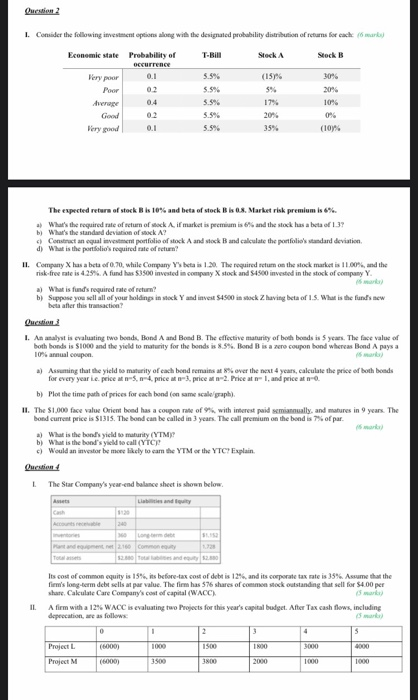

Question: Please help me solve these! Question 2 I. Consider the following investment options along with the designated probability distribution of returns for each marks) Stock

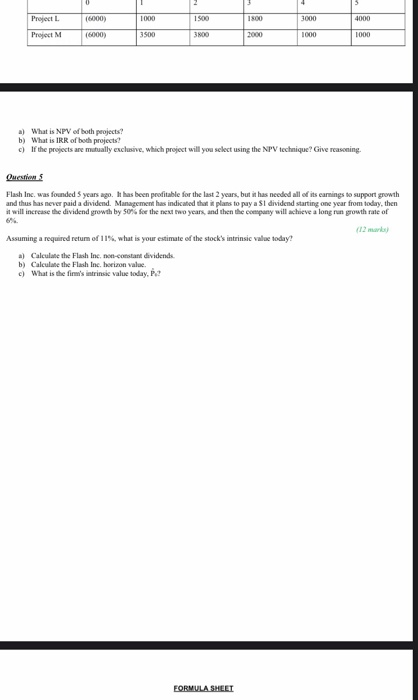

Question 2 I. Consider the following investment options along with the designated probability distribution of returns for each marks) Stock Stock B Economic state Probability of occurrence Very por 0.1 Poor 0.2 Average 0.4 Good Very good 0.1 (15% 5% 5.5% 5.5% 5.5% 5.5% 5.5% 20% 10% 0% (101% 20% 35% The expected return of stock Bis 10% and beta of stock B is ous. Market risk premium is 6% - What's the required rate of retum of sock A. if market is premium is 6% and the stock has a beta of 1:37 What's the standard deviation of stock A? Construct an equal investment portfolio of stock A and stock Band calculate the portfolio's standard deviation d) What is the portfolios required rate of retum? II. Company has a beta of 0.70, while Company Yhta is 1.20. The required retum on the stock market is 11.00%, and the risk-free rate is 42%. A fund has 53500 invested in company stock and S4500 invested in the stock of company Y. a) What is fund's required rate of return b) Suppese you sell all of your holdings in stock Y and invest S4500 in stack Z having beta of 1.5. What is the fund's new beta after this transaction? Question I. An analyst is evaluating two bonds. Bond A and Bond B. The effective maturity of both bonds is 5 years. The face value of both bonds is 1000 and the yield to maturity for the bends is 8.5%. Bond B is a zero coupon bond whereas Bond A pays a 10% al coupon a) Assuming that the yield to maturity of cach bond remains at 8% over the next 4 years, calculate the price of both bonds for every year i.e.price-8, 4. price 3, price at 1-2. Price at r1, and price at - b) Pot the time path of prices for each bond (on same scalegraph). II. The $1,000 face value Orient bond has a coupon rate of with interest paid semiannually and matures in 9 years. The hond current price is $1315. The band can be called in 3 years. The call premium on the bond is of par. a) What is the band's yield to maturity (YTM b) What is the band's yield to call (YTC c) Would an investorbe me likely to cam the YTM or the YTC? Explain. Question The Star Company's year-end balance sheet is shown below. 24 Prand on 2100 cm 12.30 Tours and 2.0 Its cost of common equity is 15% its before-tax cost of debt is 12%and its corporate tax rate is 35%. Assume that the firm's long-term debt sells at par value. The firm has 576 shares of common stock outstanding that sell for 54.00 per share. Calculate Care Company's cost of capital (WACC) IL A firm with a 12% WACC is evaluating two Projects for this year's capital budget. After Tax cash flows, including deprecation are as follows 0 1 2 3 5 Project L (6000) 1000 1500 3000 Project M (6000) 3500 2000 1000 1000 INDO Project L (6000) 1000 1500 ISO 3000 4000 Project M (6000) 3500 3RDO 2000 1000 1000 a) What is NPV of both projects! b) What is IRR of both projects! c) If the projects are mutually exclusive, which project will you select using the NPV technique? Give reasoning Questions Flash Inc. was founded 5 years ago. It has been profitable for the last 2 years, but it has needed all of its earnings to support growth and thus has never paid a dividend. Management has indicated that it plans to pay a SI dividend starting one year from today, then it will increase the dividend growth by 50 for the next two years, and then the company will achieve a long run growth rate of Assuming a required retum of 11%, what is your estimate of the stock's intrinsic value today! a) Calculate the Flash Inc, non-constant dividends. b) Calculate the Flash Inc. boeiron value. c) What is the firm's intrinsic value today, FORMULA SHLLT Question 2 I. Consider the following investment options along with the designated probability distribution of returns for each marks) Stock Stock B Economic state Probability of occurrence Very por 0.1 Poor 0.2 Average 0.4 Good Very good 0.1 (15% 5% 5.5% 5.5% 5.5% 5.5% 5.5% 20% 10% 0% (101% 20% 35% The expected return of stock Bis 10% and beta of stock B is ous. Market risk premium is 6% - What's the required rate of retum of sock A. if market is premium is 6% and the stock has a beta of 1:37 What's the standard deviation of stock A? Construct an equal investment portfolio of stock A and stock Band calculate the portfolio's standard deviation d) What is the portfolios required rate of retum? II. Company has a beta of 0.70, while Company Yhta is 1.20. The required retum on the stock market is 11.00%, and the risk-free rate is 42%. A fund has 53500 invested in company stock and S4500 invested in the stock of company Y. a) What is fund's required rate of return b) Suppese you sell all of your holdings in stock Y and invest S4500 in stack Z having beta of 1.5. What is the fund's new beta after this transaction? Question I. An analyst is evaluating two bonds. Bond A and Bond B. The effective maturity of both bonds is 5 years. The face value of both bonds is 1000 and the yield to maturity for the bends is 8.5%. Bond B is a zero coupon bond whereas Bond A pays a 10% al coupon a) Assuming that the yield to maturity of cach bond remains at 8% over the next 4 years, calculate the price of both bonds for every year i.e.price-8, 4. price 3, price at 1-2. Price at r1, and price at - b) Pot the time path of prices for each bond (on same scalegraph). II. The $1,000 face value Orient bond has a coupon rate of with interest paid semiannually and matures in 9 years. The hond current price is $1315. The band can be called in 3 years. The call premium on the bond is of par. a) What is the band's yield to maturity (YTM b) What is the band's yield to call (YTC c) Would an investorbe me likely to cam the YTM or the YTC? Explain. Question The Star Company's year-end balance sheet is shown below. 24 Prand on 2100 cm 12.30 Tours and 2.0 Its cost of common equity is 15% its before-tax cost of debt is 12%and its corporate tax rate is 35%. Assume that the firm's long-term debt sells at par value. The firm has 576 shares of common stock outstanding that sell for 54.00 per share. Calculate Care Company's cost of capital (WACC) IL A firm with a 12% WACC is evaluating two Projects for this year's capital budget. After Tax cash flows, including deprecation are as follows 0 1 2 3 5 Project L (6000) 1000 1500 3000 Project M (6000) 3500 2000 1000 1000 INDO Project L (6000) 1000 1500 ISO 3000 4000 Project M (6000) 3500 3RDO 2000 1000 1000 a) What is NPV of both projects! b) What is IRR of both projects! c) If the projects are mutually exclusive, which project will you select using the NPV technique? Give reasoning Questions Flash Inc. was founded 5 years ago. It has been profitable for the last 2 years, but it has needed all of its earnings to support growth and thus has never paid a dividend. Management has indicated that it plans to pay a SI dividend starting one year from today, then it will increase the dividend growth by 50 for the next two years, and then the company will achieve a long run growth rate of Assuming a required retum of 11%, what is your estimate of the stock's intrinsic value today! a) Calculate the Flash Inc, non-constant dividends. b) Calculate the Flash Inc. boeiron value. c) What is the firm's intrinsic value today, FORMULA SHLLT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts