Question: PLEASE HELP ME SOLVE THESE!! very urgent! Help Save & Exit Lake Co. receives nonrefundable advance payments with special orders for containers constructed to customer

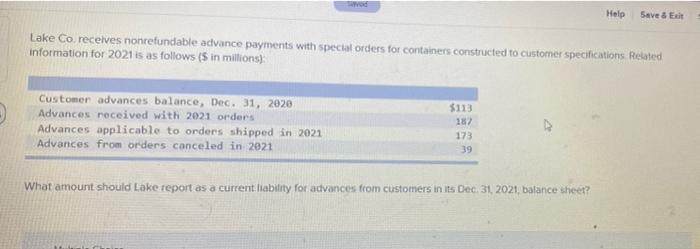

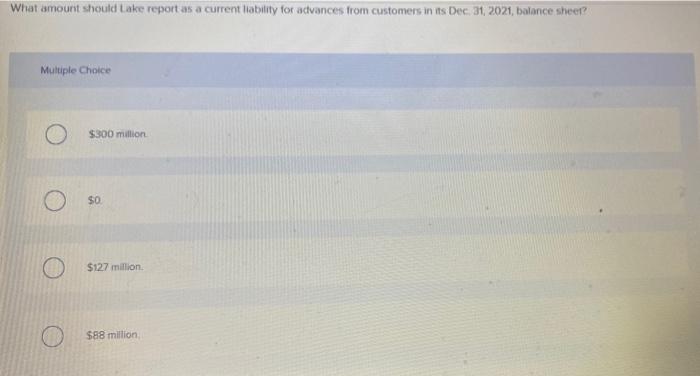

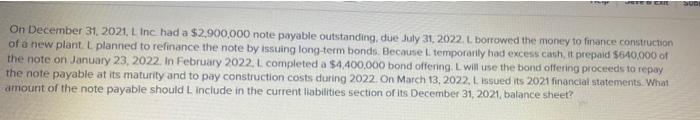

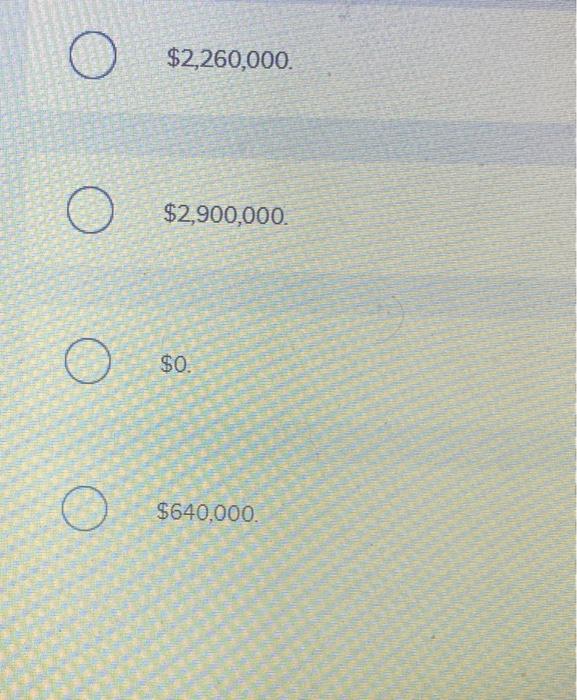

Help Save & Exit Lake Co. receives nonrefundable advance payments with special orders for containers constructed to customer specifications Related information for 2021 is as follows ($ in millions): $113 Customer advances balance, Dec. 31, 2020 Advances received with 2021 orders 187 Advances applicable to orders shipped in 2021 173 Advances from orders canceled in 2021 39 What amount should Lake report as a current liability for advances from customers in its Dec. 31, 2021, balance sheet? What amount should Lake report as a current liability for advances from customers in its Dec. 31, 2021, balance sheet? Multiple Choice O $300 million $0. $127 million. $88 million SITE CRE SUDE On December 31, 2021, L Inc. had a $2,900,000 note payable outstanding, due July 31, 2022. L borrowed the money to finance construction of a new plant. L planned to refinance the note by issuing long-term bonds. Because L temporarily had excess cash, it prepaid $640,000 of the note on January 23, 2022. In February 2022, L. completed a $4,400,000 bond offering. L will use the bond offering proceeds to repay the note payable at its maturity and to pay construction costs during 2022. On March 13, 2022, L issued its 2021 financial statements. What amount of the note payable should L include in the current liabilities section of its December 31, 2021, balance sheet? O $2,260,000. $2,900,000. $0. $640,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts