Question: PLEASE HELP ME SOLVE THIS! 11. As it turns out, some of the Finance professors at Isenberg have been running their own asset allocation businesses.

PLEASE HELP ME SOLVE THIS!

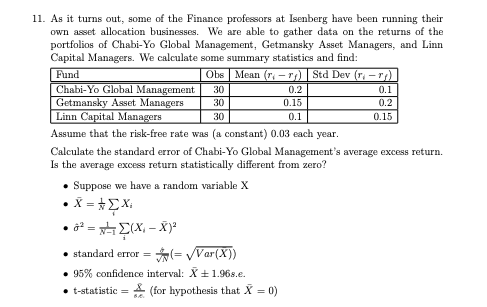

11. As it turns out, some of the Finance professors at Isenberg have been running their own asset allocation businesses. We are able to gather data on the returns of the portfolios of Chabi-Yo Global Management, Getmansky Asset Managers, and Linn Capital Managers. We calculate some summary statistics and find: Fund Obs| Mean (r, - rg)| Std Dev (r. Ts) Chabi-Yo Global Management 30 0.2 0.1 Getmansky Asset Managers 30 0.15 0.2 Linn Capital Managers 30 0.1 0.15 Assume that the risk-free rate was (a constant) 0.03 each year. Calculate the standard error of Chabi-Yo Global Management's average excess return. Is the average excess return statistically different from zero? Suppose we have a random variable X X = *Xi 6 = x= 2(X - X): standard error = (= Var(X)) 95% confidence interval: X+1.968.e. t-statistic = (for hypothesis that X = 0) 11. As it turns out, some of the Finance professors at Isenberg have been running their own asset allocation businesses. We are able to gather data on the returns of the portfolios of Chabi-Yo Global Management, Getmansky Asset Managers, and Linn Capital Managers. We calculate some summary statistics and find: Fund Obs| Mean (r, - rg)| Std Dev (r. Ts) Chabi-Yo Global Management 30 0.2 0.1 Getmansky Asset Managers 30 0.15 0.2 Linn Capital Managers 30 0.1 0.15 Assume that the risk-free rate was (a constant) 0.03 each year. Calculate the standard error of Chabi-Yo Global Management's average excess return. Is the average excess return statistically different from zero? Suppose we have a random variable X X = *Xi 6 = x= 2(X - X): standard error = (= Var(X)) 95% confidence interval: X+1.968.e. t-statistic = (for hypothesis that X = 0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts