Question: please help me solve this 3 part question! Covan, Inc. is expected to have the following free cash flow: a. Covan has 6 million shares

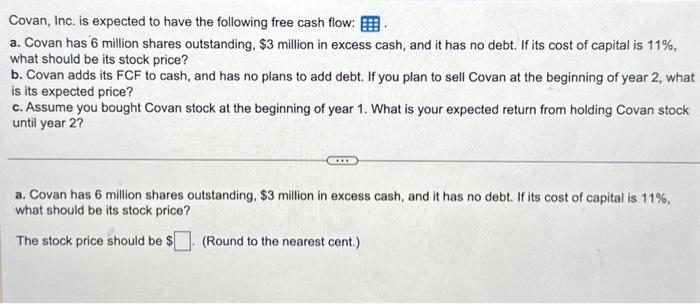

Covan, Inc. is expected to have the following free cash flow: a. Covan has 6 million shares outstanding, $3 million in excess cash, and it has no debt. If its cost of capital is 11%, what should be its stock price? b. Covan adds its FCF to cash, and has no plans to add debt. If you plan to sell Covan at the beginning of year 2 , what is its expected price? c. Assume you bought Covan stock at the beginning of year 1. What is your expected return from holding Covan stock until year 2 ? a. Covan has 6 million shares outstanding, $3 million in excess cash, and it has no debt. If its cost of capital is 11%, what should be its stock price? The stock price should be $ (Round to the nearest cent.) Covan, Inc. is expected to have the following free cash flow: a. Covan has 6 million shares outstanding, $3 million in excess cash, and it has no debt. If its cost of capital is 11%, what should be its stock price? b. Covan adds its FCF to cash, and has no plans to add debt. If you plan to sell Covan at the beginning of year 2 , what is its expected price? c. Assume you bought Covan stock at the beginning of year 1. What is your expected return from holding Covan stock until year 2 ? a. Covan has 6 million shares outstanding, $3 million in excess cash, and it has no debt. If its cost of capital is 11%, what should be its stock price? The stock price should be $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts