Question: Please help me solve this A financial institution has the following market value balance sheet structure: A bond has a 3-year maturity, a fixed-rate coupon

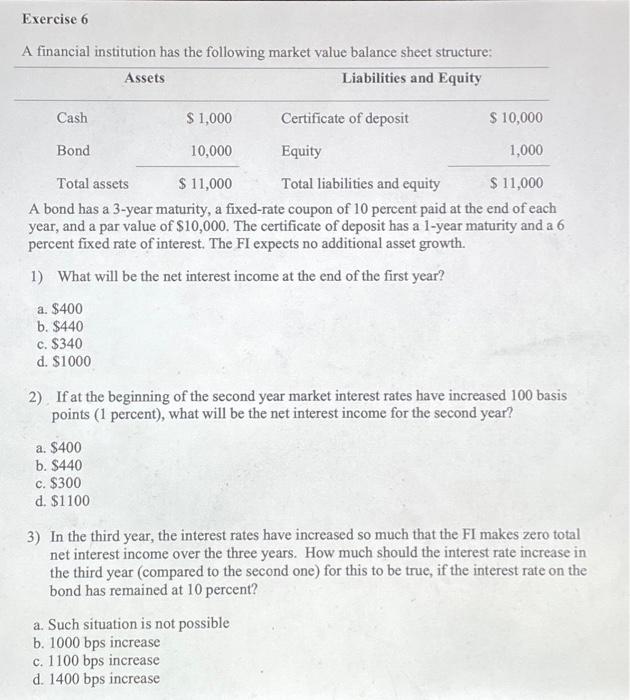

A financial institution has the following market value balance sheet structure: A bond has a 3-year maturity, a fixed-rate coupon of 10 percent paid at the end of each year, and a par value of $10,000. The certificate of deposit has a 1-year maturity and a 6 percent fixed rate of interest. The FI expects no additional asset growth. 1) What will be the net interest income at the end of the first year? a. $400 b. $440 c. $340 d. $1000 2). If at the beginning of the second year market interest rates have increased 100 basis points ( 1 percent), what will be the net interest income for the second year? a. $400 b. $440 c. $300 d. $1100 3) In the third year, the interest rates have increased so much that the FI makes zero total net interest income over the three years. How much should the interest rate increase in the third year (compared to the second one) for this to be true, if the interest rate on the bond has remained at 10 percent? a. Such situation is not possible b. 1000 bps increase c. 1100 bps increase d. 1400bps increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts