Question: Please help me solve this accounting problem, please solve all of the requirements. (ASAP) please! Will like! Waler Planet is considering purchasing a water park

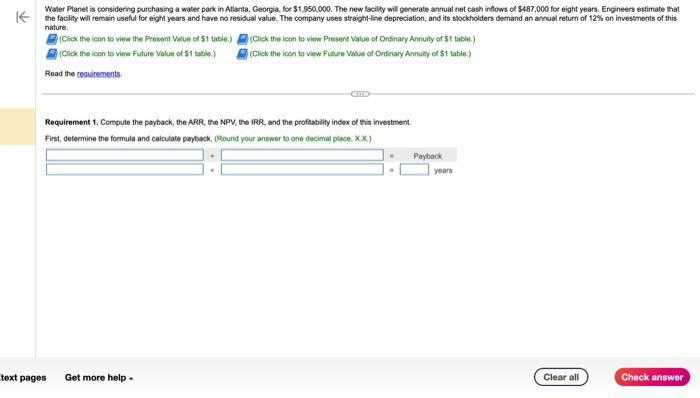

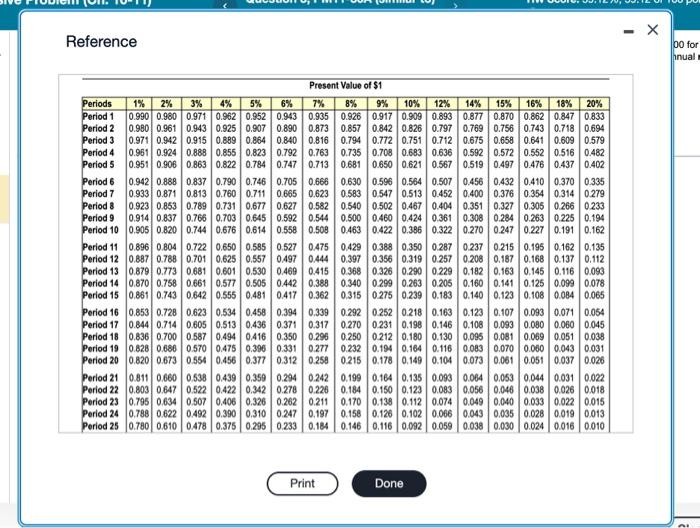

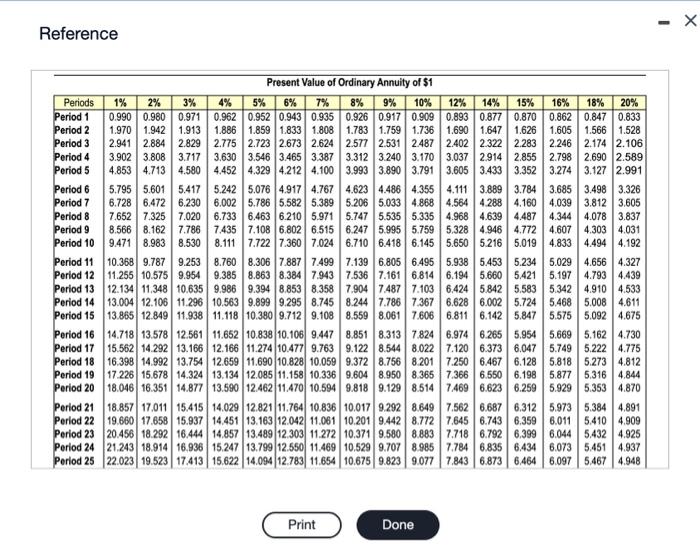

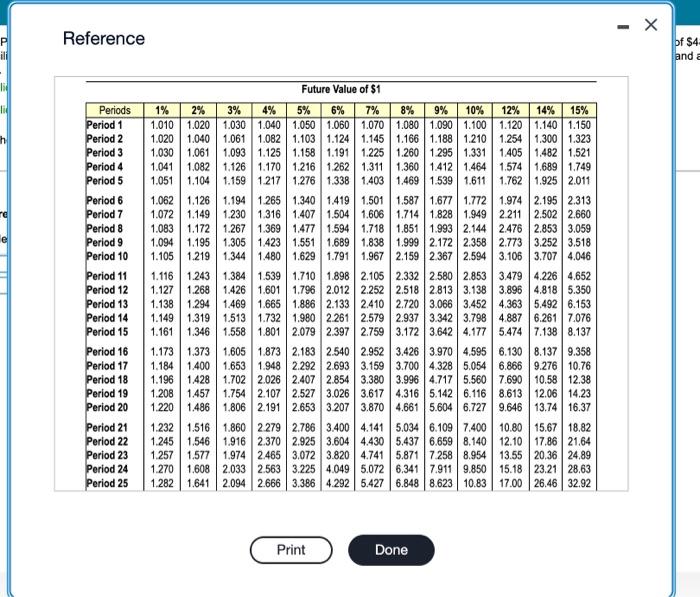

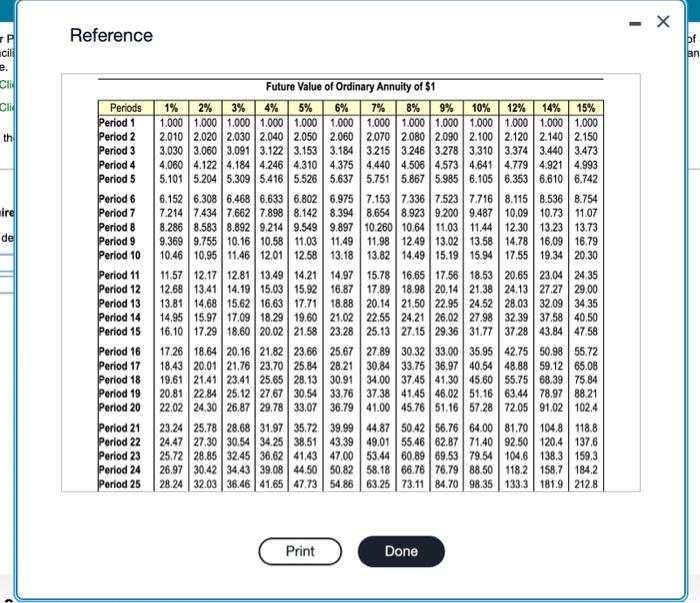

Waler Planet is considering purchasing a water park in Atlants, Georpia, for $1,950,000. The new lacilly will generate annual net eash inflows of s487,000 for eight years. Engineers estimate that the faclity will remain useful for eight years and have no residual value. The company uses straigh-line depreciation, and its stockholders demand an armual return of 12% on investments of this nature. (Cick the icon to view the Present Walue of 51 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Cick the icon to view Future Value of $1 tible.) (Click the ioon to view Futute Vatue of Oedirary Annuity of $1 table.) Read the reauirements. Requirement 1. Compule the payback, the ARR, the NPV, the IRR, and the proftability index of this itrvestment. First, determine the formula and caiculate pwytack. (Pound your anwwer to one decimal place, x.x.) Water Planet is considering purchasing a water park in Atlanta, Georgia, for $1,950,000. The new faclity will generate annusl net cash inflows of $487,000 for eight years. Engineers estimate that the tacility wil remain useful for eight years and have no residual value. The company uses straight-line depreciation, and is stockholders demand an annual return of 12% on investments of thits nature. (Click the icon to view the Present Value of \$1 table.) (Click the icon to view Present Vatue of Ordinary Annulty of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuliy of $1 table.) Read the teouirements. Requirement 1. Compi Requirements First, determine the for 1. Compute the payback, the ARR, the NPV, the 1RR, and the proftability index of this imestment 2. Recomnend whether the company should irves in this project. Reference Reference Reference Reference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts