Question: Please help me solve this and show step by step Second Republic Bank is a lending company that operates in the Southeastern United States. Current

Please help me solve this and show step by step

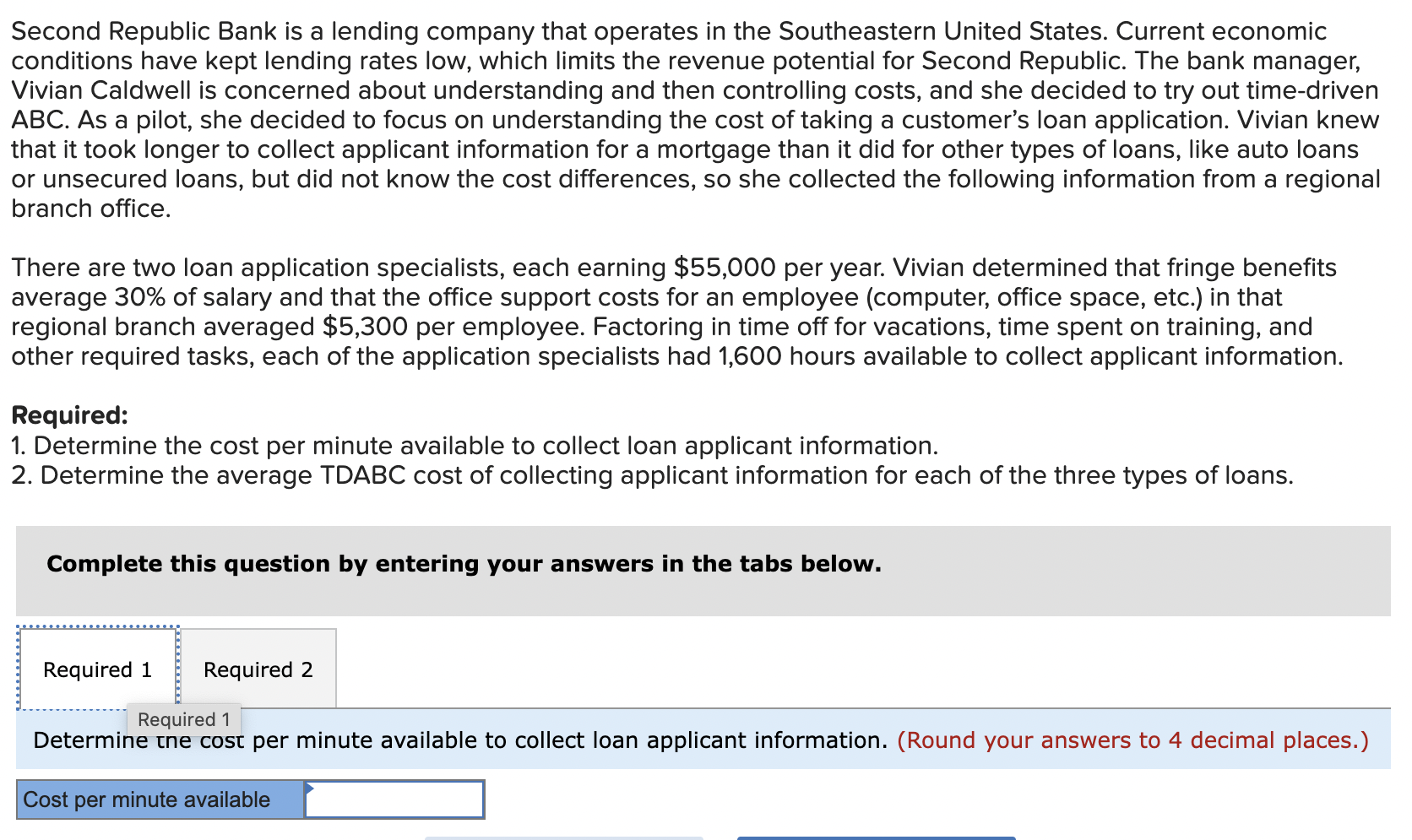

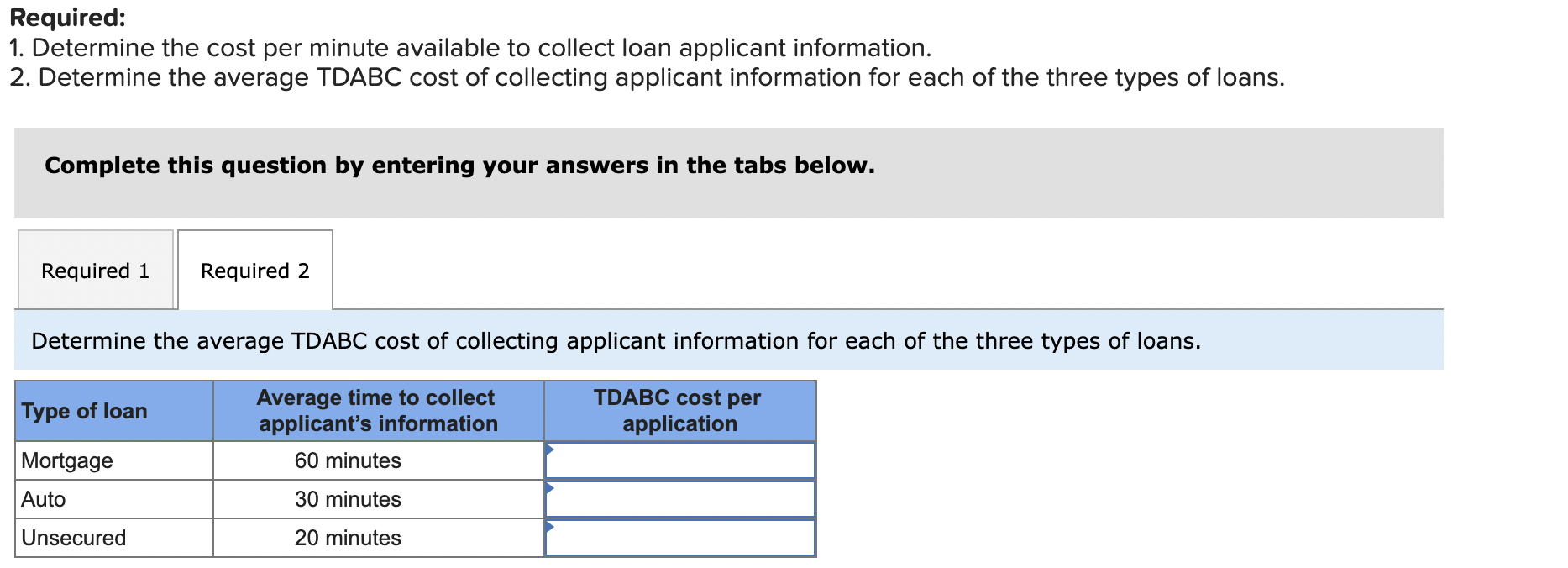

Second Republic Bank is a lending company that operates in the Southeastern United States. Current economic conditions have kept lending rates low, which limits the revenue potential for Second Republic. The bank manager, Vivian Caldwell is concerned about understanding and then controlling costs, and she decided to try out time-driven ABC. As a pilot, she decided to focus on understanding the cost of taking a customer's loan application. Vivian knew that it took longer to collect applicant information for a mortgage than it did for other types of loans, like auto loans or unsecured loans, but did not know the cost differences, so she collected the following information from a regional branch office. There are two loan application specialists, each earning $55,000 per year. Vivian determined that fringe benefits average 30% of salary and that the office support costs for an employee (computer, office space, etc.) in that regional branch averaged $5,300 per employee. Factoring in time off for vacations, time spent on training, and other required tasks, each of the application specialists had 1,600 hours available to collect applicant information. Required: 1. Determine the cost per minute available to collect loan applicant information. 2. Determine the average TDABC cost of collecting applicant information for each of the three types of loans. Complete this question by entering your answers in the tabs below. Determine tne cos per minute available to collect loan applicant information. (Round your answers to 4 decimal places.) Required: 1. Determine the cost per minute available to collect loan applicant information. 2. Determine the average TDABC cost of collecting applicant information for each of the three types of loans. Complete this question by entering your answers in the tabs below. Determine the average TDABC cost of collecting applicant information for each of the three types of loans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts