Question: please help me solve this and show the steps on how you got the answer 28. On December 1, 2022 Morgan needed a little extra

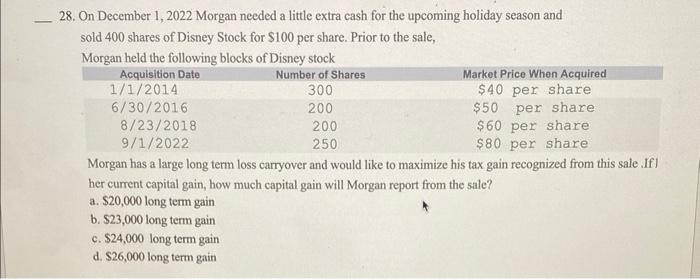

28. On December 1, 2022 Morgan needed a little extra cash for the upcoming holiday season and sold 400 shares of Disney Stock for $100 per share. Prior to the sale, Morgan held the following blocks of Disnev stock Morgan has a large long term loss carryover and would like to maximize his tax gain recognized from this sale .If I her current capital gain, how much capital gain will Morgan report from the sale? a. $20,000 long term gain b. $23,000 long term gain c. $24,000 long term gain d. $26,000 long term gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts