Question: Please help me solve this Blueprint: Problem: Bonds Issued at Premium Bonds When a company requires more cash than it currently has, it can acquire

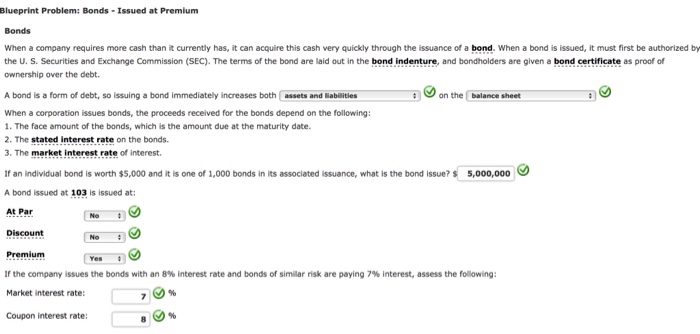

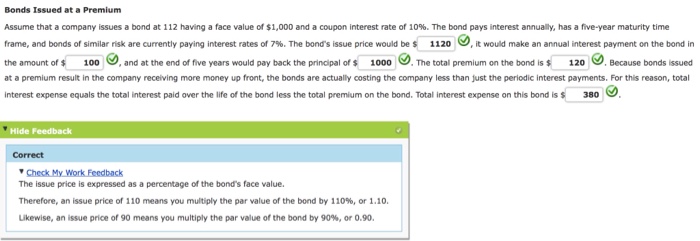

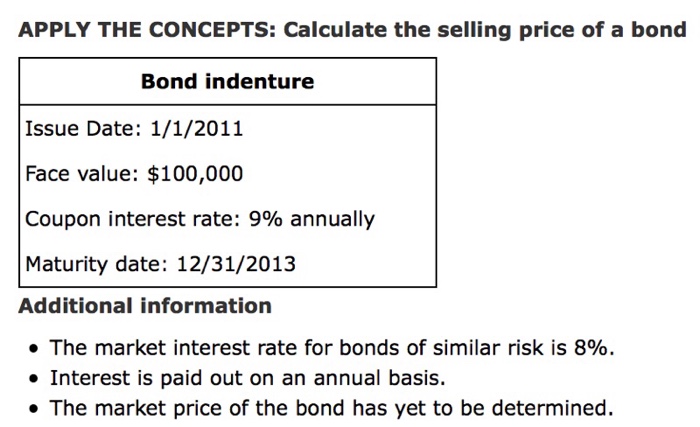

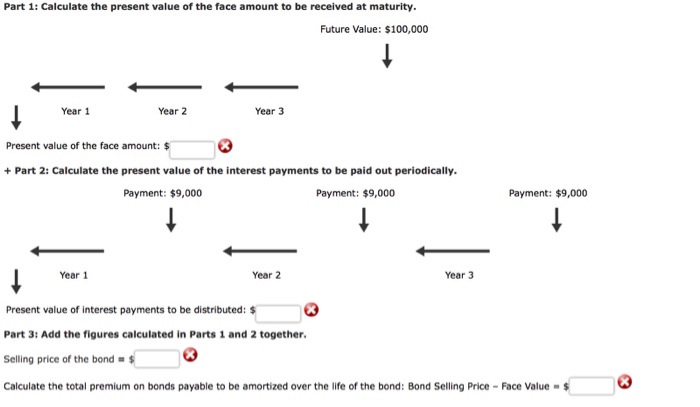

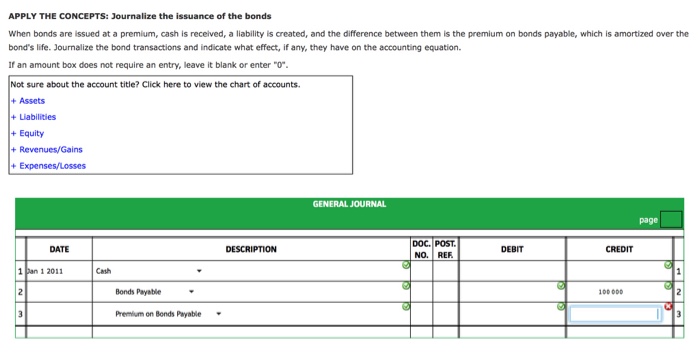

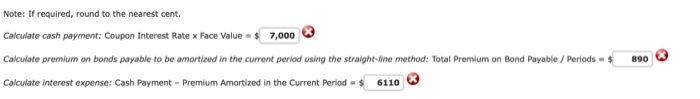

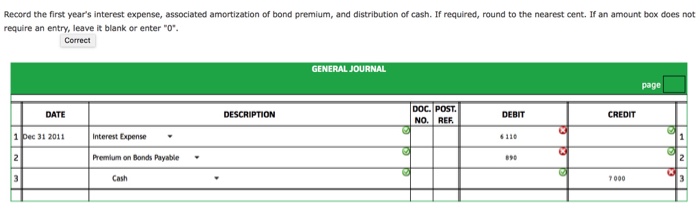

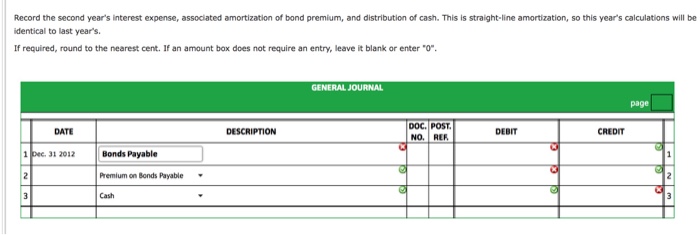

Blueprint: Problem: Bonds Issued at Premium Bonds When a company requires more cash than it currently has, it can acquire this cash very quickly through the issuance of a bond. When a bond is issued, it must first be authorized by the U. S. Securities and Exchange Commission (SEC). The terms of the bond are laid out in the bond indenture, and bondholders are given a bond certificate as proof of ownership over the debt. on the A bond is a form of debt, so issuing a bond immediately increases both assets and liabilities When a corporation issues bonds, the proceeds received for the bonds depend on the following: 1. The face amount of the bonds, which is the amount due at the maturity date. 2. The stated interest rate on the bonds. 3. The market interest rate of interest, fan individual bond is worth $5,000 and it is one of 1,000 bonds in its associated issuance, what is the bond issue? s 5,000,000 A bond issued at 103 is issued at: At Par Discount Premium If the company issues the bonds with an 8% interest rate and bonds of similar risk are paying 7% interest, assess the following: Market interest rate Coupon interest rate

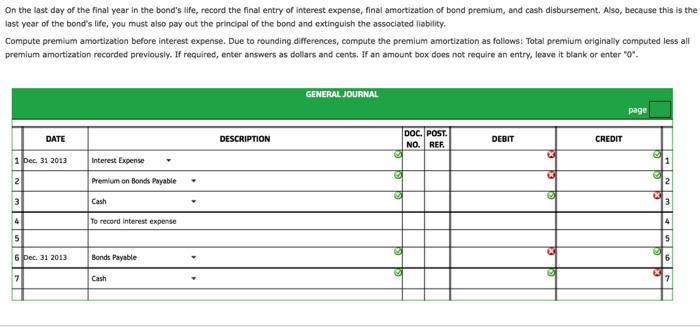

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts