Question: please help me solve this. Comprehenslve Problem 1 - Part 1: Taxpayer Information, Form 1040, Schedules 1, 2, and 3, Schedule A, and Schedule B.

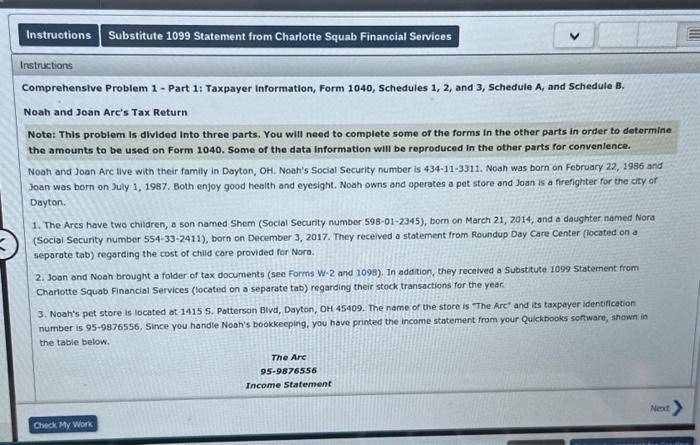

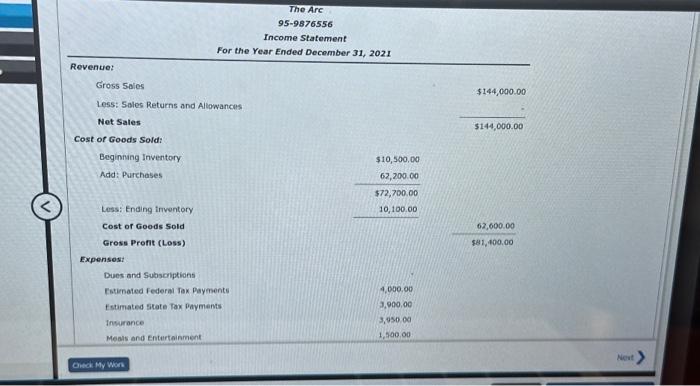

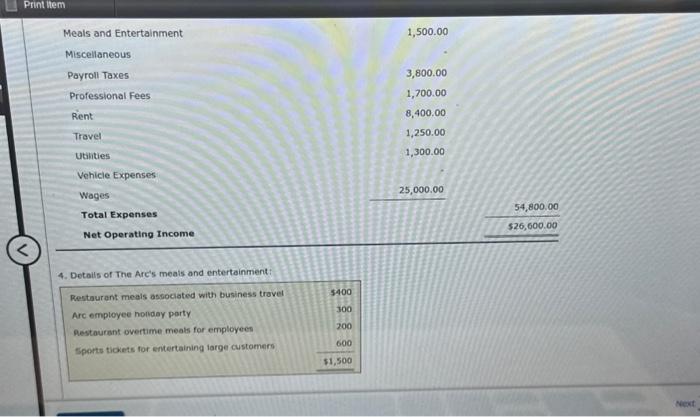

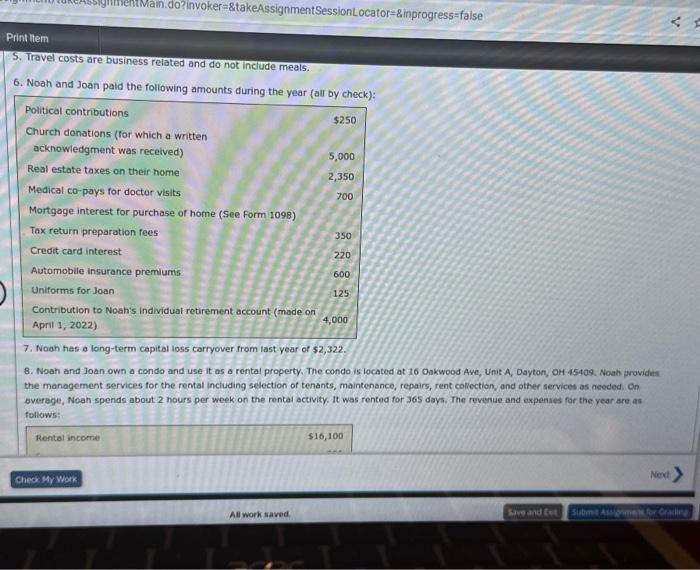

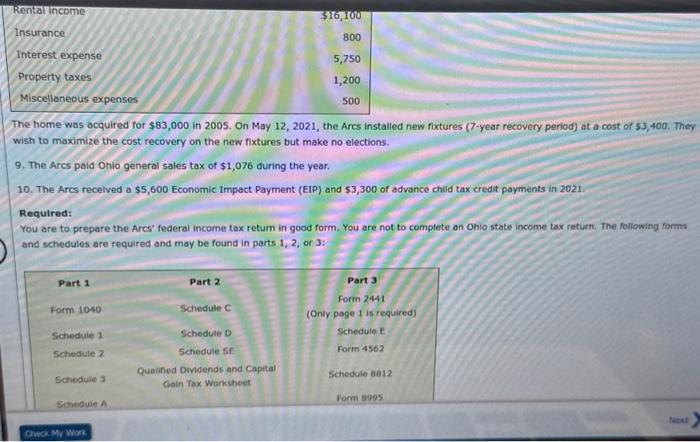

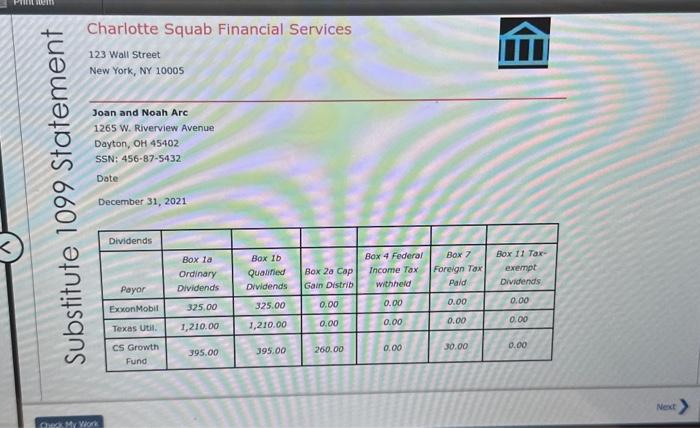

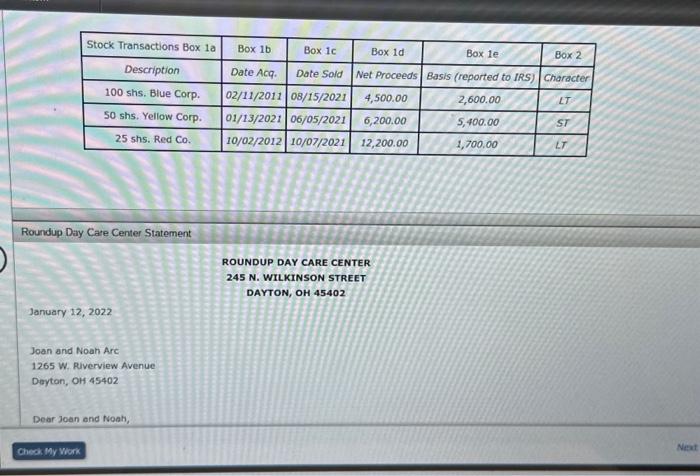

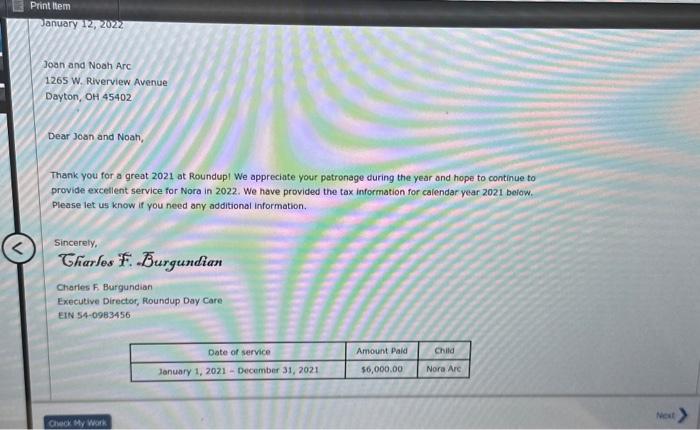

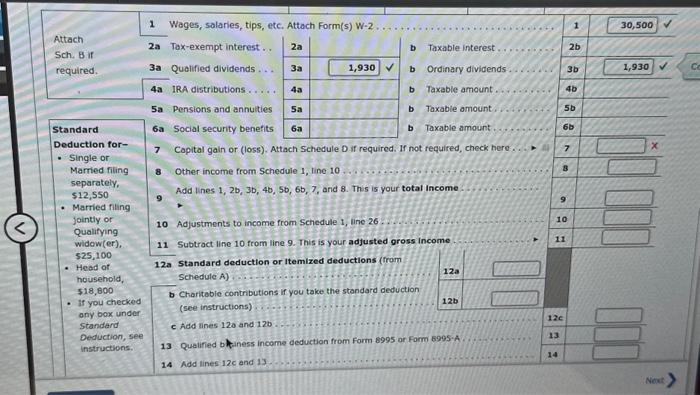

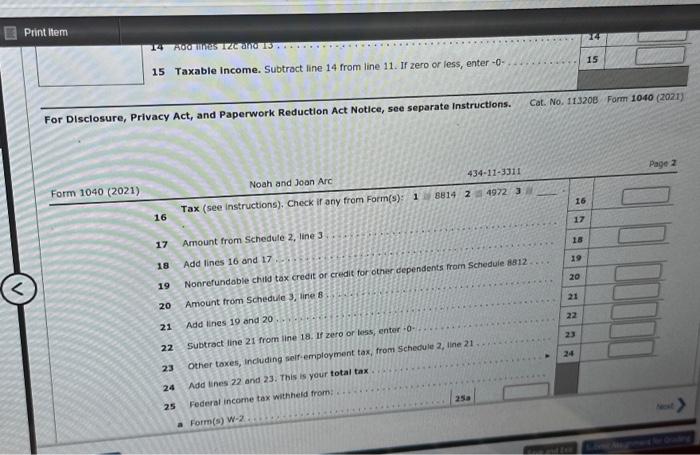

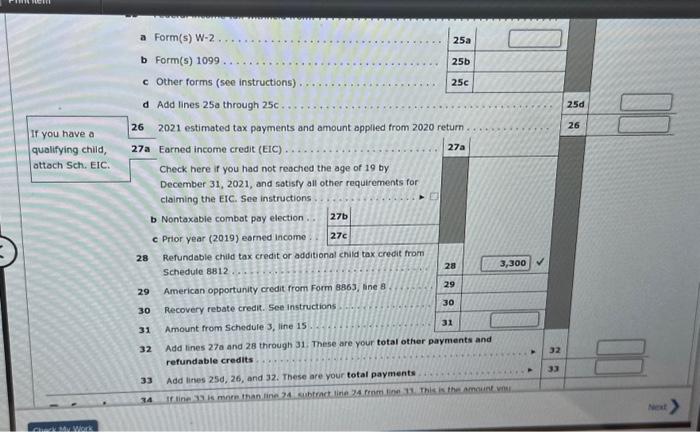

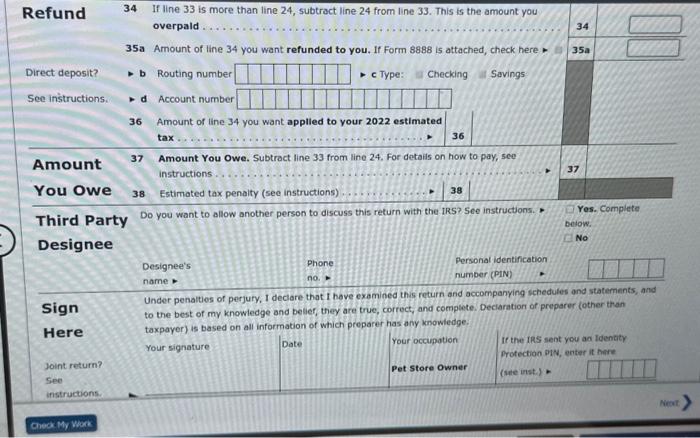

Comprehenslve Problem 1 - Part 1: Taxpayer Information, Form 1040, Schedules 1, 2, and 3, Schedule A, and Schedule B. Noah and Joan Arc's Tax Return Note: This problem is divided Into three parts. You will need to complete some of the forms In the other parts in order to determine the amounts to be used on Form 1040. Some of the data Information will be reproduced in the other parts for convenfence. Noah and Joan Arc flve with their family in Dayton, OH. Noah's Social Security number is 434-11-3311. Noah was born on February 22, 1986 and Joan was born on July 1, 1987. Both enjoy good health and eyesight. Noah owns and operates a pet store and Joan is a firefighter for the city or Dayton. 1. The Arcs have two children, a son named Shem (Social Security number 598-01-2345), born on March 21, 2014, and a daughter named Nora (Social Security number 554-33-2411), born on December 3, 2017. They recelved a statement from Roundup Day Care Center (located on a separate tab) regarding the cost of child care provided for Nora. 2. Joan and Noah brought a folder of tax documents (see Forms W-2 and 1098). In ddaition, they received a Substitute 1099 Statement from Charlotte Squab Financial Services (located on a separate tab) regarding their stock transactions for the year. 3. Noah's pet store is located at 1415S. Pattersan Bivd, Dayton, OH 45409 . The name of the store is "The Arc" and its taxpayer identification number is 959876556. Since you handte Noah's bookkecping, you have printed the income statement from your Qukkbooks sorkare, shown in the table below. The Are 95-9876556 Income statement For the Year Ended December 31, 2021 Revenue: Gross saies $144,000.00 Less: Sales Returns and Allowances Net Sales Cost or Goods Sold: Beginnang Inventory Add: Purchases Less: Ending inventory Cost of Goods Sold Gross Pront (Loss) Expensest Dues and Subscriptions Fstimated federal Tox Payments Estamated state Pax Paymens Inwurance Meals and entertainment $10,500,00 62,200.00 $72,700.00 10,100.00 4,000.00 13,900,00 3,950 od 1,400.00 4. Details of The Arc's meais and entertainment: 6. Noah and Joan paid the following amounts during the year (all by check): 7. Noah has a long-term capital loss carryover from last year of 52,322 . 8. Noah and Joan own a condo and use it as a rental property. The condo is located at 16 Oakwood Aye, Unit A, Dayton, OH 45409. Noah provides the management services for the rental inciuding selection of tenants, maintenance, repairs, rent coliection, and other services as aeeded. On overage, Noah spends about 2 hours per week on the rental activity. It was rented for 365 days. The revenue and expenses for the year are as The home was acquired for $83,000 in 2005 . On May 12, 2021, the Arcs installed new fixtures (7-year recovery period) at a cost of 53,400 , They wish to maximize the cost recovery on the new fixtures but make no elections. 9. The Ares paid Ohio general sales tax of $1,076 during the year. 10. The Arcs received a $5,600 Economic impact Payment (EIP) and $3,300 of advance chlld tax credit payments in 2021. Required: You are to prepare the Arcs' federal income tax return in good form. You are not to complete an Ohio state income tax return. The folliowing forms and schedules are required and may be found in parts 1, 2, or 3: Charlotte Squab Financial Services 123 Wall Street New York, NY 10005 Roundup Day Care Center Statement Thank you for a great 2021 at Roundupi We appreciate your patronage during the year and hope to continue to provide excellent service for Nora in 2022. We have provided the tax information for calendar year 2021 beiow. Please let us know if you need any additional information. Sincerely, Gharfes F. Burgundian Charles F. Burgundian Executive Director, Foundup Day Care EIN 54-0983456 Print ltem 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter -0 . For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate Instructions. Cat. No, 113208 Form 1040 (2021) Form 1040(2021) Noah and Joan Are 16 Tax (see instructions), Check if any from Form(s): 18814249723 17 Amount from schedule 2, line 3 .. 18 Add lines 16 and 17 19 Nonrefundable ctili tax credit or credit for othar cependents trom Scheduie 8812 ... 20 Amount from Schedule 3 , ine 8 21 Add lines 19 and 20 22 Subtroct ine 21 from line 18. If zero or less, enter .0. 23 Other toxes, incluaing seir-employment tax, from schedule 2 , line 21 24 Add ines 22 and 23. This is your total tax 25 Federal income tax witheld from: ... 253 a form(s) w2 a Form(5) W-2 b Form(5)1099 c Other forms (see instructions) d Add lines 25a through 25c 262021 estimated tax payments and amount applied from 2020 retum. If you have a 27a Earned income credit (EIC) qualifying child, Check here if you had not reached the age of 19 by December 31,2021 , and satisfy all other requirements for claiming the EIC. See instructions b Nontaxable combot pay election.. c Prior year (2019) earned income. \begin{tabular}{|c|} 27b \\ 27c \end{tabular} 28 Refundable child tax credit or additional child tax credit from Schedute 8812 29 American opportunity credit from Form 8863, line 8 . 30 Recovery rebate credit. See instructions. ... 31. Amount from schedule 3, line 15 . 27a attach Sch. EIC. 32 Add lines 27 and 28 through 31. These are your total other payments and refundable credits 33 Add lines 25d, 26, and 32. These are vour total payments 34 If line 33 is more than line 24 subtract line 24 frome ling 31. This is the amouat wiol Refund 34 If line 33 is more than line 24 , subtract line 24 from line 33 . This is the amount you overpald 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here * 34 Direct deposit? b Routing number - Type: Checking Savings See instructions. - d Account number 36 Amount of line 34 you want applied to your 2022 estimated tax 36 Amount 37 Amount You Owe. Subtract line 33 from line 24. For details on how to pay, see instructions. You Owe 38 Estimated tax penalty (see instructions) 38 Third Party Do you want to allow another person to discuss this return with the IRS? See instructions. ? Designee Designee's Phone Personat identification name no. = number (PIN) Sign Under penaltios of perjury, I declare that I have examined this return and accompanying schedules and statements, and Here taxpayer) is based on all information of which preparer has any knowledge. Your signature Date Joint return? see sec instructions. Your occupotion Pet store owner Yes. Compiete beiow. No No If the IRS sent you an Identity Protection 91N, enter it here (ste inst.) = Gheck My Work Comprehenslve Problem 1 - Part 1: Taxpayer Information, Form 1040, Schedules 1, 2, and 3, Schedule A, and Schedule B. Noah and Joan Arc's Tax Return Note: This problem is divided Into three parts. You will need to complete some of the forms In the other parts in order to determine the amounts to be used on Form 1040. Some of the data Information will be reproduced in the other parts for convenfence. Noah and Joan Arc flve with their family in Dayton, OH. Noah's Social Security number is 434-11-3311. Noah was born on February 22, 1986 and Joan was born on July 1, 1987. Both enjoy good health and eyesight. Noah owns and operates a pet store and Joan is a firefighter for the city or Dayton. 1. The Arcs have two children, a son named Shem (Social Security number 598-01-2345), born on March 21, 2014, and a daughter named Nora (Social Security number 554-33-2411), born on December 3, 2017. They recelved a statement from Roundup Day Care Center (located on a separate tab) regarding the cost of child care provided for Nora. 2. Joan and Noah brought a folder of tax documents (see Forms W-2 and 1098). In ddaition, they received a Substitute 1099 Statement from Charlotte Squab Financial Services (located on a separate tab) regarding their stock transactions for the year. 3. Noah's pet store is located at 1415S. Pattersan Bivd, Dayton, OH 45409 . The name of the store is "The Arc" and its taxpayer identification number is 959876556. Since you handte Noah's bookkecping, you have printed the income statement from your Qukkbooks sorkare, shown in the table below. The Are 95-9876556 Income statement For the Year Ended December 31, 2021 Revenue: Gross saies $144,000.00 Less: Sales Returns and Allowances Net Sales Cost or Goods Sold: Beginnang Inventory Add: Purchases Less: Ending inventory Cost of Goods Sold Gross Pront (Loss) Expensest Dues and Subscriptions Fstimated federal Tox Payments Estamated state Pax Paymens Inwurance Meals and entertainment $10,500,00 62,200.00 $72,700.00 10,100.00 4,000.00 13,900,00 3,950 od 1,400.00 4. Details of The Arc's meais and entertainment: 6. Noah and Joan paid the following amounts during the year (all by check): 7. Noah has a long-term capital loss carryover from last year of 52,322 . 8. Noah and Joan own a condo and use it as a rental property. The condo is located at 16 Oakwood Aye, Unit A, Dayton, OH 45409. Noah provides the management services for the rental inciuding selection of tenants, maintenance, repairs, rent coliection, and other services as aeeded. On overage, Noah spends about 2 hours per week on the rental activity. It was rented for 365 days. The revenue and expenses for the year are as The home was acquired for $83,000 in 2005 . On May 12, 2021, the Arcs installed new fixtures (7-year recovery period) at a cost of 53,400 , They wish to maximize the cost recovery on the new fixtures but make no elections. 9. The Ares paid Ohio general sales tax of $1,076 during the year. 10. The Arcs received a $5,600 Economic impact Payment (EIP) and $3,300 of advance chlld tax credit payments in 2021. Required: You are to prepare the Arcs' federal income tax return in good form. You are not to complete an Ohio state income tax return. The folliowing forms and schedules are required and may be found in parts 1, 2, or 3: Charlotte Squab Financial Services 123 Wall Street New York, NY 10005 Roundup Day Care Center Statement Thank you for a great 2021 at Roundupi We appreciate your patronage during the year and hope to continue to provide excellent service for Nora in 2022. We have provided the tax information for calendar year 2021 beiow. Please let us know if you need any additional information. Sincerely, Gharfes F. Burgundian Charles F. Burgundian Executive Director, Foundup Day Care EIN 54-0983456 Print ltem 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter -0 . For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate Instructions. Cat. No, 113208 Form 1040 (2021) Form 1040(2021) Noah and Joan Are 16 Tax (see instructions), Check if any from Form(s): 18814249723 17 Amount from schedule 2, line 3 .. 18 Add lines 16 and 17 19 Nonrefundable ctili tax credit or credit for othar cependents trom Scheduie 8812 ... 20 Amount from Schedule 3 , ine 8 21 Add lines 19 and 20 22 Subtroct ine 21 from line 18. If zero or less, enter .0. 23 Other toxes, incluaing seir-employment tax, from schedule 2 , line 21 24 Add ines 22 and 23. This is your total tax 25 Federal income tax witheld from: ... 253 a form(s) w2 a Form(5) W-2 b Form(5)1099 c Other forms (see instructions) d Add lines 25a through 25c 262021 estimated tax payments and amount applied from 2020 retum. If you have a 27a Earned income credit (EIC) qualifying child, Check here if you had not reached the age of 19 by December 31,2021 , and satisfy all other requirements for claiming the EIC. See instructions b Nontaxable combot pay election.. c Prior year (2019) earned income. \begin{tabular}{|c|} 27b \\ 27c \end{tabular} 28 Refundable child tax credit or additional child tax credit from Schedute 8812 29 American opportunity credit from Form 8863, line 8 . 30 Recovery rebate credit. See instructions. ... 31. Amount from schedule 3, line 15 . 27a attach Sch. EIC. 32 Add lines 27 and 28 through 31. These are your total other payments and refundable credits 33 Add lines 25d, 26, and 32. These are vour total payments 34 If line 33 is more than line 24 subtract line 24 frome ling 31. This is the amouat wiol Refund 34 If line 33 is more than line 24 , subtract line 24 from line 33 . This is the amount you overpald 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here * 34 Direct deposit? b Routing number - Type: Checking Savings See instructions. - d Account number 36 Amount of line 34 you want applied to your 2022 estimated tax 36 Amount 37 Amount You Owe. Subtract line 33 from line 24. For details on how to pay, see instructions. You Owe 38 Estimated tax penalty (see instructions) 38 Third Party Do you want to allow another person to discuss this return with the IRS? See instructions. ? Designee Designee's Phone Personat identification name no. = number (PIN) Sign Under penaltios of perjury, I declare that I have examined this return and accompanying schedules and statements, and Here taxpayer) is based on all information of which preparer has any knowledge. Your signature Date Joint return? see sec instructions. Your occupotion Pet store owner Yes. Compiete beiow. No No If the IRS sent you an Identity Protection 91N, enter it here (ste inst.) = Gheck My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts