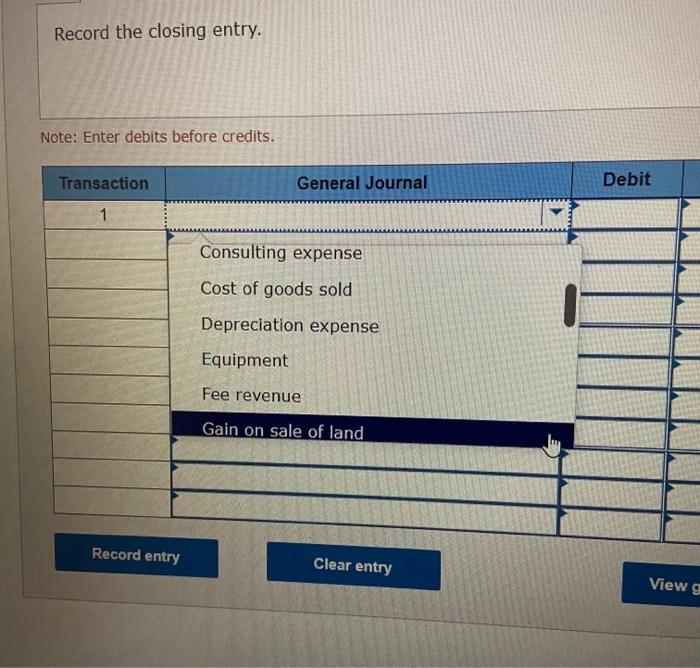

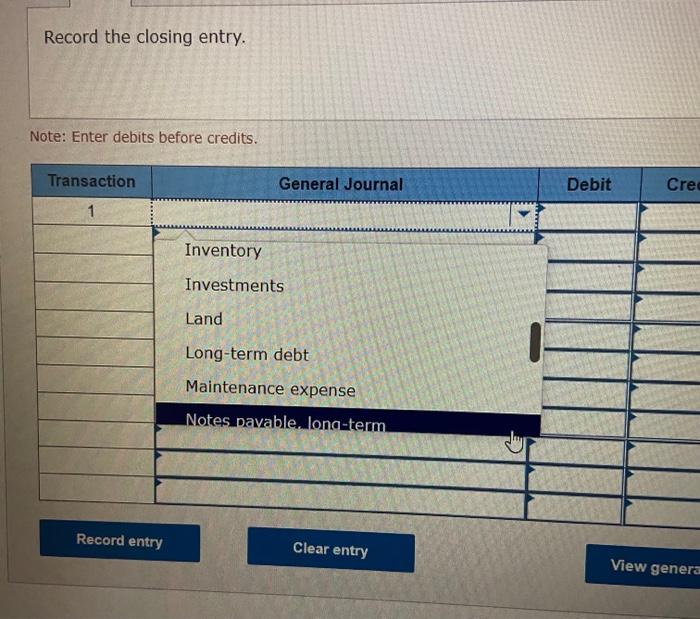

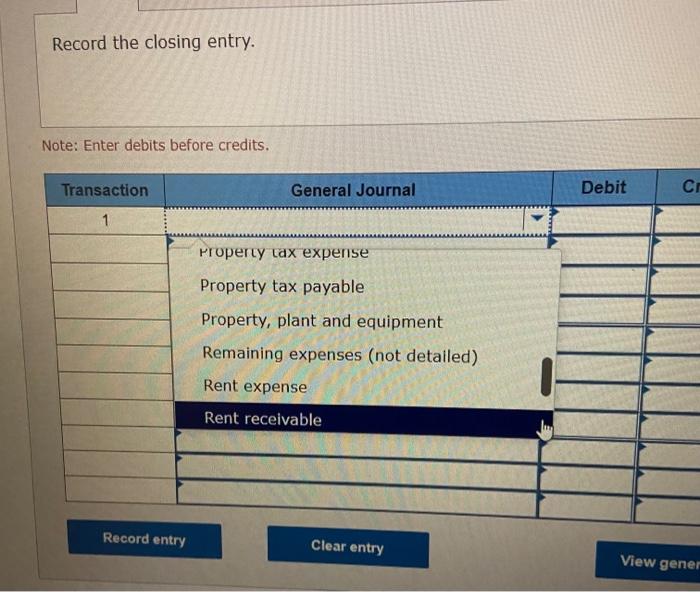

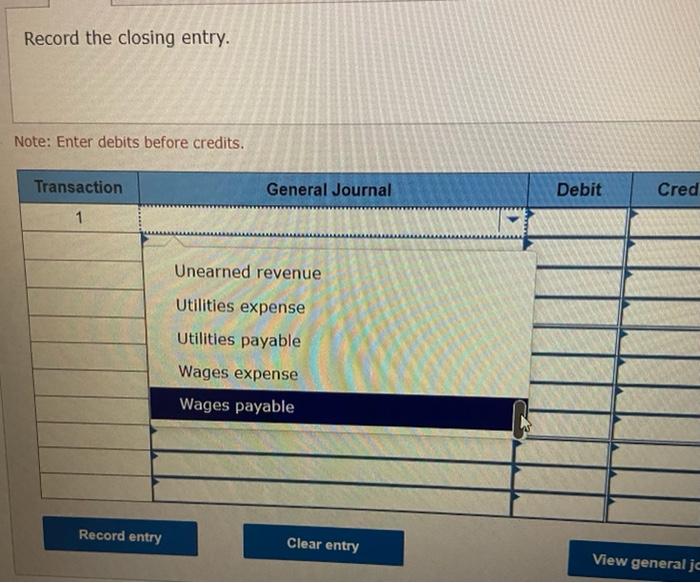

Question: Please help me solve this homework problem! Thank you. Here are the list of options. I could not include all the options, but this will

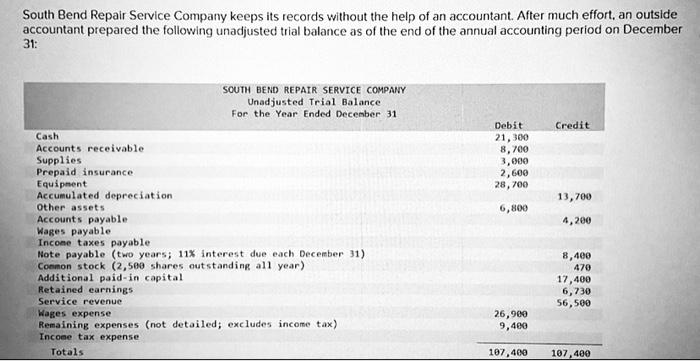

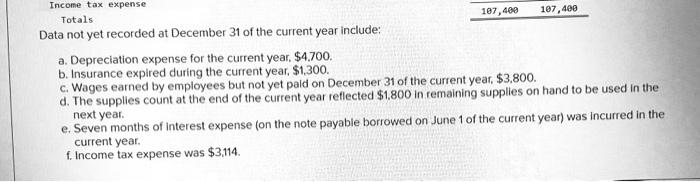

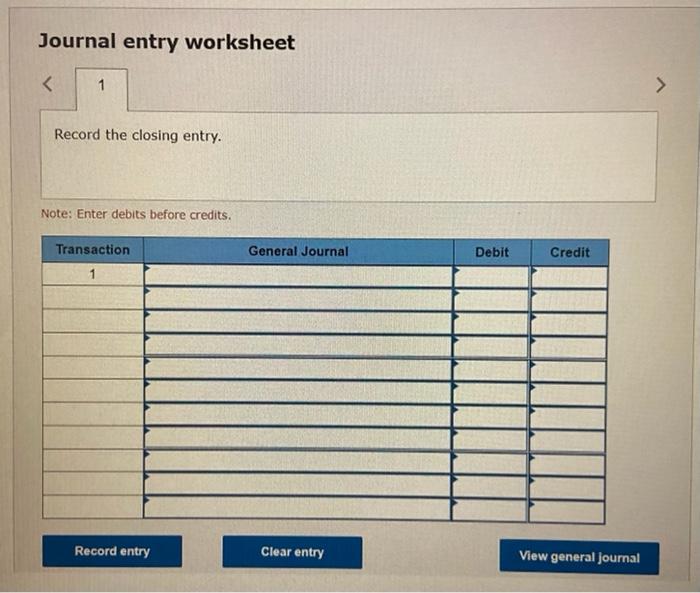

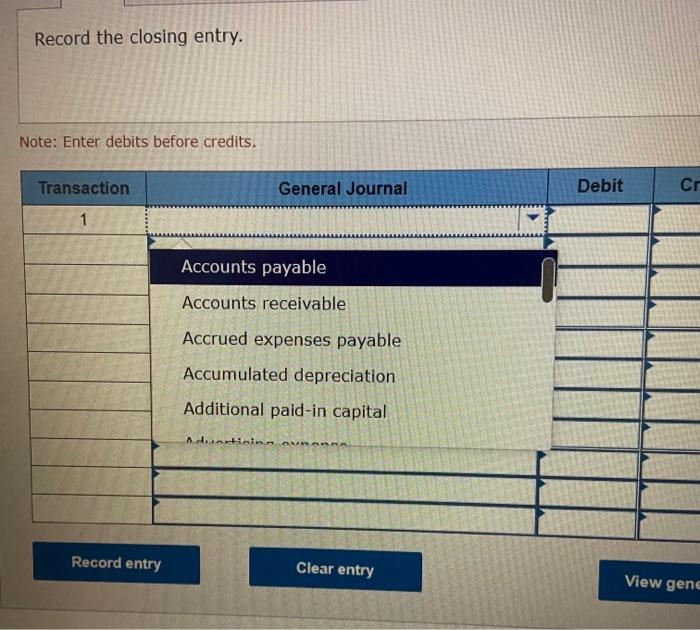

South Bend Repair Service Company keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted trial balance as of the end of the annual accounting period on December 31: SOUTH BEND REPAIR SERVICE COMPANY Unadjusted Trial Balance For the Year Ended December 31 Debit Credit Cash 21,300 Accounts receivable 8,700 Supplies 3,000 Prepaid insurance 2,600 Equipment 28,700 Accumulated depreciation 13,700 Other assets 6,800 Accounts payable Wages paya 4,200 Income taxes payable. Note payable (two years; 11% interest due each December 31) Common stock (2,500 shares outstanding all year) 8,400 470 Additional paid-in capital Retained earnings 17,400 6,730 Service revenue 56,500 Wages expense Remaining expenses (not detailed; excludes income tax) Income tax expense 26,900 9,400 Totals 107,400 107,400 Income tax expense Totals 107,400 107,400 Data not yet recorded at December 31 of the current year include: a. Depreciation expense for the current year, $4,700. b. Insurance expired during the current year, $1,300. c. Wages earned by employees but not yet paid on December 31 of the current year, $3,800. d. The supplies count at the end of the current year reflected $1,800 in remaining supplies on hand to be used in the next year. e. Seven months of interest expense (on the note payable borrowed on June 1 of the current year) was incurred in the current year. f. Income tax expense was $3,114. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts