Question: Please help me solve this, how long it even take, I do not need it fast. I need it precisely as possible. Thank you so

Please help me solve this, how long it even take, I do not need it fast. I need it precisely as possible. Thank you so much for helping. If you can, please present each question separately. I had someone done it for me but I did not understand anything so I am posting once again in hope of getting something that answers the questions for me.

![103, 105] Kolbec Community College (KCC) has 4,000 full-time students and offers](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717b1ac074c5_0596717b1ab4e403.jpg)

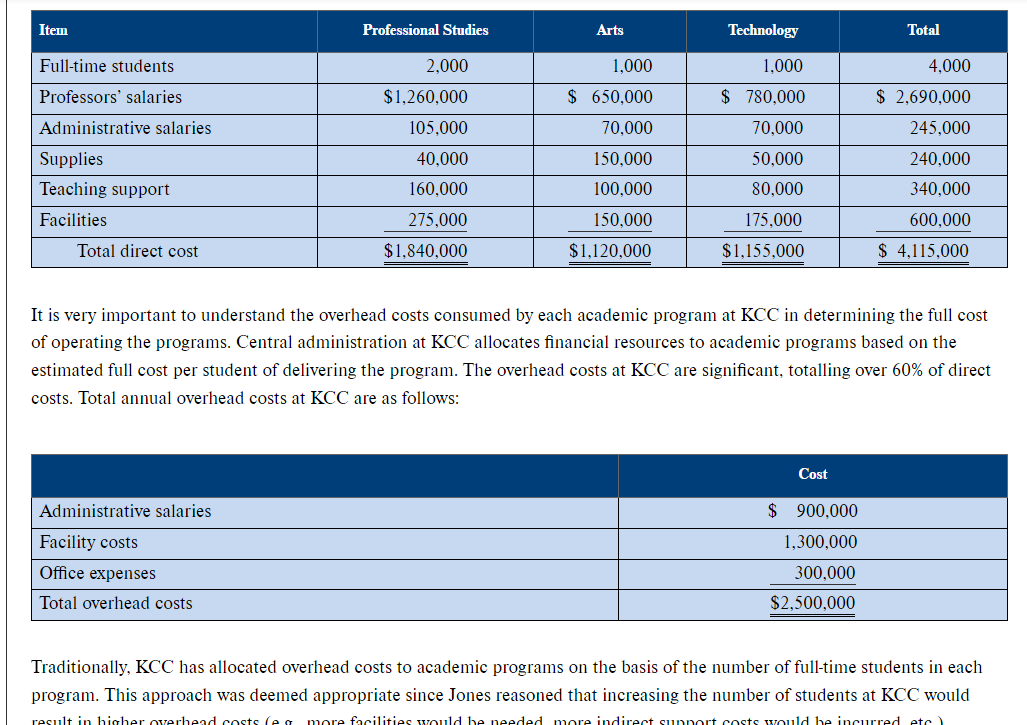

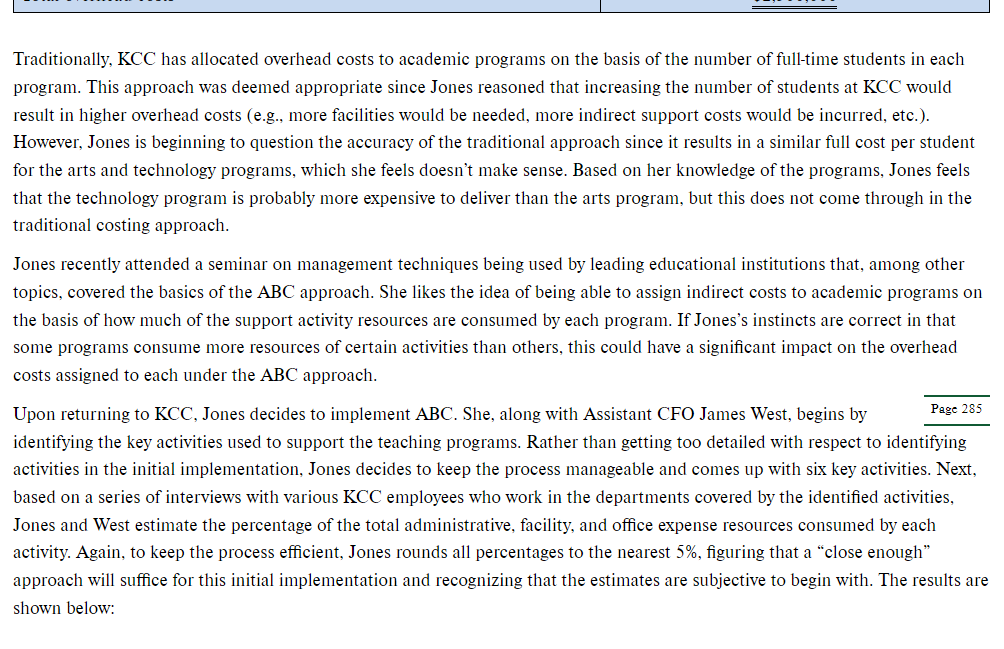

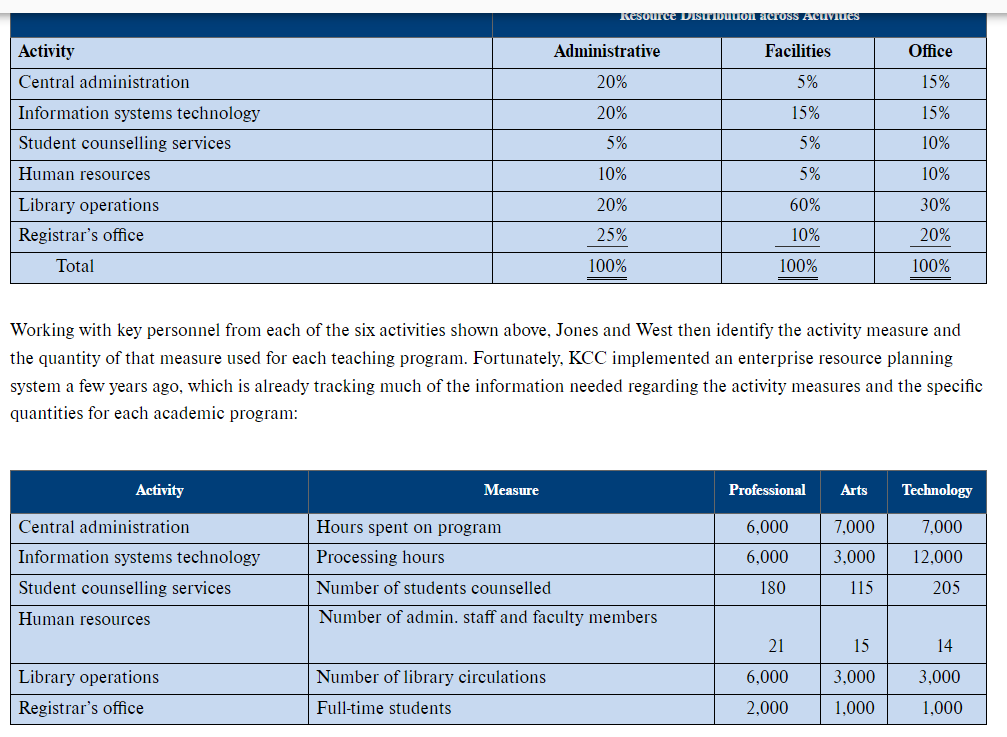

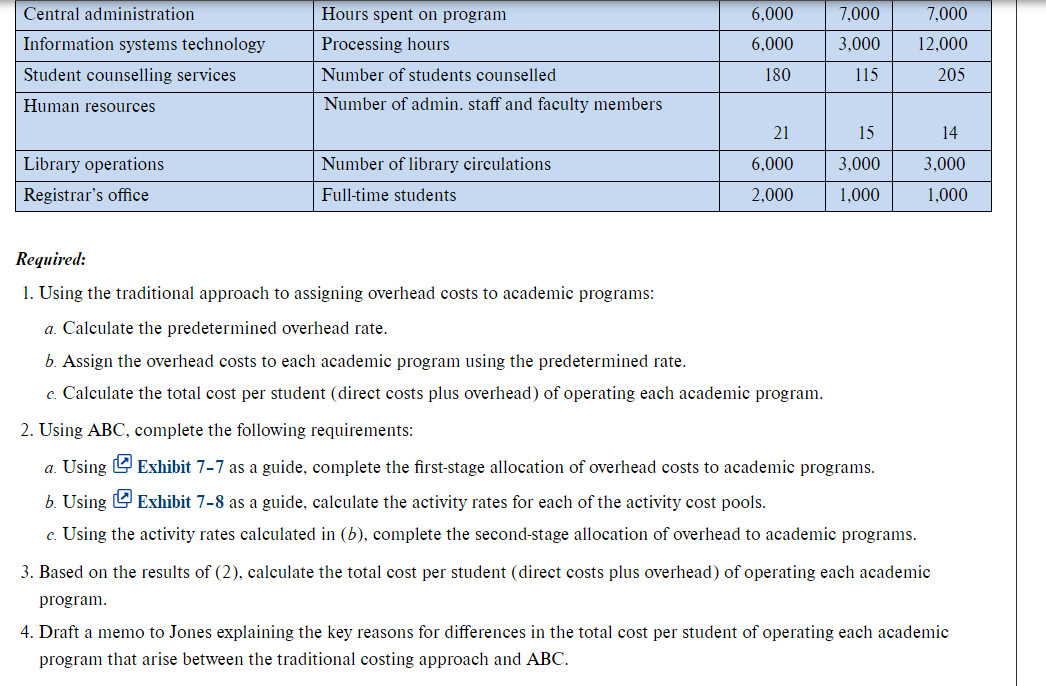

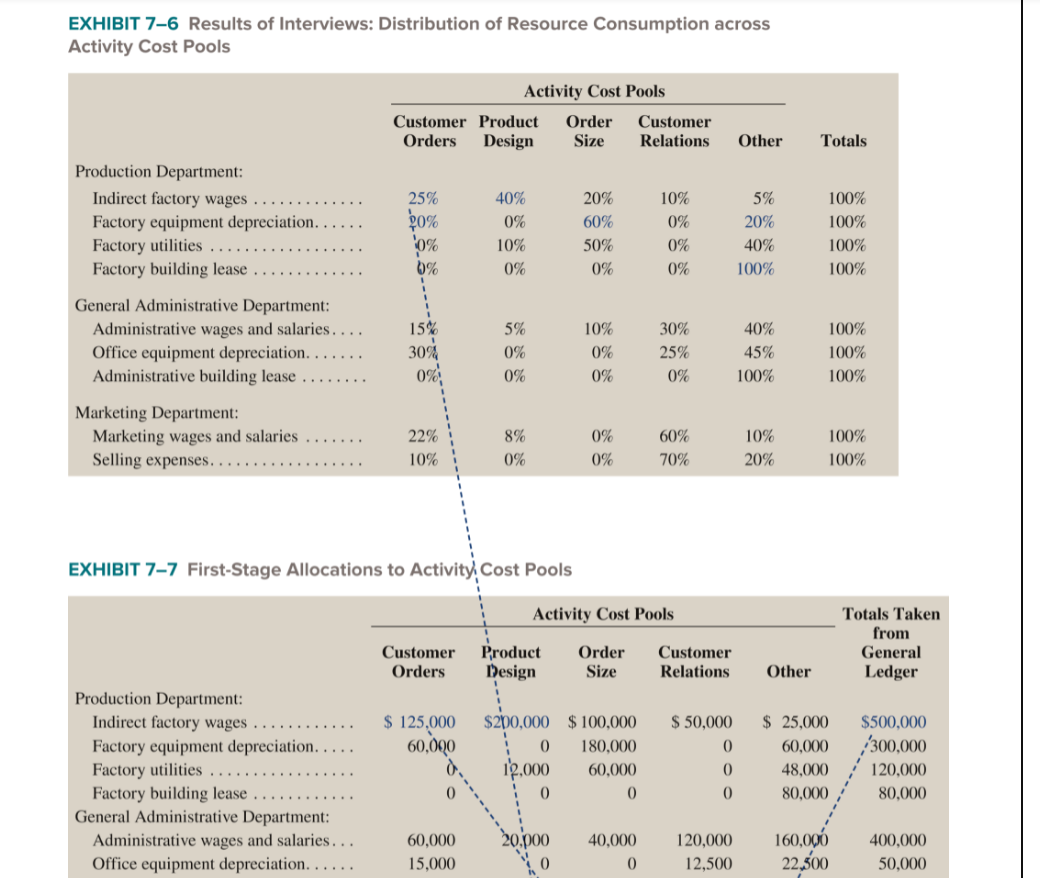

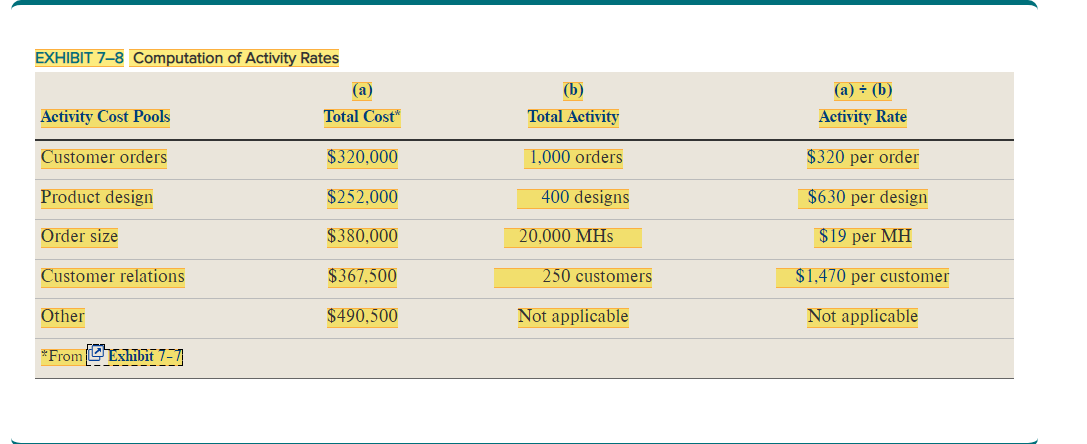

CASE 7-26 Comprehensive Activity-Based Costing [102, 103, 105] Kolbec Community College (KCC) has 4,000 full-time students and offers a variety of academic programs in three areas: professional studies, arts, and technology. The professional studies programs prepare students for administrative and clerical jobs in a variety of professional settings, including accounting, medicine, and law. The arts program's offerings are wide ranging and include graphic design, digital animation, culinary arts, cosmetology, and music arts. The technology programs are also varied, including information technology, medical laboratory technology, electrical engineering technology, pharmacy technology, and natural resources technology. The chief financial officer of KCC, Lynn Jones, has consistently emphasized to other members of the senior management team the importance of understanding the costs of delivering the various academic programs. To that end, the costing system used at KCC tracks the direct costs of each program, which are shown below on an annual basis, along with the number of full-time students: Item Professional Studies Arts Technology Total 2,000 1,000 1,000 Full-time students Professors' salaries 4,000 $ 2,690,000 $1,260,000 $ 780,000 105,000 40,000 Administrative salaries Supplies Teaching support Facilities $ 650,000 70,000 150,000 100,000 150.000 70,000 50,000 80,000 245,000 240,000 340,000 160,000 275,000 175.000 600.000 Item Professional Studies Arts Technology Total Full-time students 2.000 1,000 1.000 $ 650,000 Professors' salaries Administrative salaries $1,260,000 105,000 $ 780,000 70,000 4,000 $ 2,690,000 245,000 240,000 70,000 40,000 150,000 50,000 Supplies Teaching support Facilities 160,000 100,000 80,000 340,000 275,000 600,000 150,000 $1,120,000 175,000 $1,155,000 Total direct cost $1,840,000 $ 4,115,000 It is very important to understand the overhead costs consumed by each academic program at KCC in determining the full cost of operating the programs. Central administration at KCC allocates financial resources to academic programs based on the estimated full cost per student of delivering the program. The overhead costs at KCC are significant, totalling over 60% of direct costs. Total annual overhead costs at KCC are as follows: Cost Administrative salaries $ 900,000 Facility costs Office expenses Total overhead costs 1,300,000 300,000 $2,500,000 Traditionally, KCC has allocated overhead costs to academic programs on the basis of the number of full-time students in each program. This approach was deemed appropriate since Jones reasoned that increasing the number of students at KCC would result in higher overhead costs (eg more facilities would be needed more indirect support costs would be incurred etc) Traditionally, KCC has allocated overhead costs to academic programs on the basis of the number of full-time students in each program. This approach was deemed appropriate since Jones reasoned that increasing the number of students at KCC would result in higher overhead costs (e.g., more facilities would be needed, more indirect support costs would be incurred, etc.). However, Jones is beginning to question the accuracy of the traditional approach since it results in a similar full cost per student for the arts and technology programs, which she feels doesn't make sense. Based on her knowledge of the programs, Jones feels that the technology program is probably more expensive to deliver than the arts program, but this does not come through in the traditional costing approach. Jones recently attended a seminar on management techniques being used by leading educational institutions that, among other topics, covered the basics of the ABC approach. She likes the idea of being able to assign indirect costs to academic programs on the basis of how much of the support activity resources are consumed by each program. If Jones's instincts are correct in that some programs consume more resources of certain activities than others, this could have a significant impact on the overhead costs assigned to each under the ABC approach. Upon returning to KCC, Jones decides to implement ABC. She, along with Assistant CFO James West, begins by Page 285 identifying the key activities used to support the teaching programs. Rather than getting too detailed with respect identifying activities in the initial implementation, Jones decides to keep the process manageable and comes up with six key activities. Next, based on a series of interviews with various KCC employees who work in the departments covered by the identified activities, Jones and West estimate the percentage of the total administrative, facility, and office expense resources consumed by each activity. Again, to keep the process efficient, Jones rounds all percentages to the nearest 5%, figuring that a "close enough" approach will suffice for this initial implementation and recognizing that the estimates are subjective to begin with. The results are shown below: Kresource Disruuton across Acuvues Administrative Facilities Office 20% 5% 15% 20% 15% 5% 15% 10% 5% Activity Central administration Information systems technology Student counselling services Human resources Library operations Registrar's office Total 10% 5% 10% 20% 60% 30% 25% 10% 20% 100% 100% 100% Working with key personnel from each of the six activities shown above, Jones and West then identify the activity measure and the quantity of that measure used for each teaching program. Fortunately, KCC implemented an enterprise resource planning system a few years ago, which is already tracking much of the information needed regarding the activity measures and the specific quantities for each academic program: Activity Measure Professional Arts Technology 6,000 7,000 7,000 6,000 3.000 12,000 Central administration Information systems technology Student counselling services Human resources Hours spent on program Processing hours Number of students counselled Number of admin. staff and faculty members 180 115 205 21 14 6,000 Library operations Registrar's office Number of library circulations Full-time students 15 3,000 1,000 3,000 1,000 2,000 6,000 7.000 7,000 6,000 3,000 12,000 Central administration Information systems technology Student counselling services Human resources Hours spent on program Processing hours Number of students counselled Number of admin. staff and faculty members 180 115 205 21 15 14 6,000 3,000 3,000 Library operations Registrar's office Number of library circulations Full-time students 2.000 1,000 1,000 Required: 1. Using the traditional approach to assigning overhead costs to academic programs: a. Calculate the predetermined overhead rate. b. Assign the overhead costs to each academic program using the predetermined rate. c. Calculate the total cost per student (direct costs plus overhead) of operating each academic program. 2. Using ABC, complete the following requirements: a. Using Exhibit 7-7 as a guide, complete the first-stage allocation of overhead costs to academic programs. b. Using Exhibit 7-8 as a guide, calculate the activity rates for each of the activity cost pools. c. Using the activity rates calculated in (b), complete the second-stage allocation of overhead to academic programs. 3. Based on the results of (2), calculate the total cost per student (direct costs plus overhead) of operating each academic program 4. Draft a memo to Jones explaining the key reasons for differences in the total cost per student of operating each academic program that arise between the traditional costing approach and ABC. EXHIBIT 76 Results of Interviews: Distribution of Resource Consumption across Activity Cost Pools Activity Cost Pools Customer Product Order Customer Orders Design Size Relations Other Totals Production Department: Indirect factory wages Factory equipment depreciation. Factory utilities Factory building lease 25% 90% 0% 0% 40% 0% 10% 0% 20% 60% 50% 0% 10% 0% 0% 0% 5% 20% 40% 100% 100% 100% 100% 100% 15% 10% General Administrative Department: Administrative wages and salaries.... Office equipment depreciation.... Administrative building lease 30% 0% 5% 0% 0% 0% 0% 30% 25% 0% 40% 45% 100% 100% 100% 100% Marketing Department: Marketing wages and salaries Selling expenses... 22% 10% 8% 0% 0% 0% 60% 70% 10% 20% 100% 100% EXHIBIT 7-7 First-Stage Allocations to Activity Cost Pools Activity Cost Pools Customer Orders Product Tesign Totals Taken from General Ledger Order Size Customer Relations Other $ 125,000 60,000 Production Department: Indirect factory wages Factory equipment depreciation.. Factory utilities Factory building lease General Administrative Department: Administrative wages and salaries... Office equipment depreciation..... $200,000 $100,000 0 180,000 10,000 60,000 0 0 $ 50,000 0 0 $ 25,000 60,000 48,000 80,000 $500,000 300,000 120,000 80,000 0 0 60,000 15,000 20.000 0 40,000 0 120,000 12,500 160,000 22.500 400,000 50,000 Marketing Department: Marketing wages and salaries ....... Selling expenses..... 22% 10% 8% 0% 0% 0% 60% 70% 10% 20% 100% 100% EXHIBIT 7-7 First-Stage Allocations to Activity Cost Pools Activity Cost Pools Customer Orders Product Design Order Size Customer Relations Totals Taken from General Ledger Other $ 125,000 60,000 $200,000 $100,000 0 180,000 12,000 60,000 : 0 0 $ 50,000 0 0 0 $ 25,000 60,000 48,000 80,000 $500,000 ,300,000 120,000 80,000 0 Production Department: Indirect factory wages Factory equipment depreciation. . Factory utilities Factory building lease .... General Administrative Department: Administrative wages and salaries... Office equipment depreciation. ... Administrative building lease Marketing Department: Marketing wages and salaries Selling expenses... 60,000 15,000 0 20.000 0 40,000 0 120,000 12,500 0 160,096 22,500 60,000 400,000 50,000 60,000 0 20,000 55,000 5,000 $320,000 0 0 $380,000 150,000 35,000 $367,500 25,000 10,000 $490,500 250,000 50.000 $1,810,000 Total. 5252,000 Exhibit 76 shows that Customer Orders consume 25% of the resources represented by the $500,000 of indirect factory wages: 25% x $500,000 = $125,000 Other entries in the spreadsheet are computed in a similar fashion. EXHIBIT 78 Computation of Activity Rates (a) (b) Total Activity (a) = (b) Activity Rate Activity Cost Pools Total Cost" Customer orders $320.000 1,000 orders $320 per order Product design $252,000 400 designs $630 per design Order size $380,000 20,000 MHS $19 per MH Customer relations $367,500 250 customers $1,470 per customer Other $490,500 Not applicable Not applicable *From Exhibit 7-7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts