Question: please help me solve this! I have been struggling for a while, and mainly I need the process. Give right answer with proper explanation kudos!

please help me solve this! I have been struggling for a while, and mainly I need the process. Give right answer with proper explanation kudos!

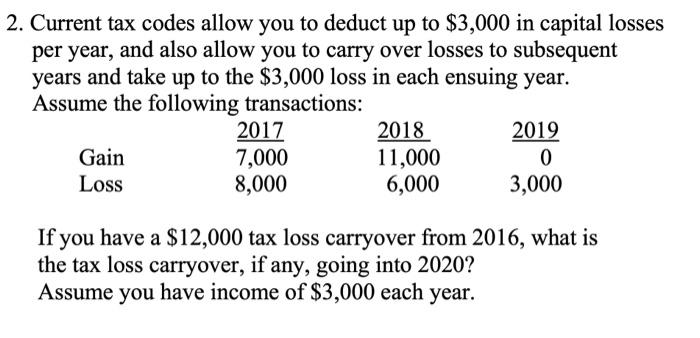

2. Current tax codes allow you to deduct up to $3,000 in capital losses per year, and also allow you to carry over losses to subsequent years and take up to the $3,000 loss in each ensuing year. Assume the following transactions: 2017 2018 2019 Gain 7,000 11,000 0 Loss 8,000 6,000 3,000 If you have a $12,000 tax loss carryover from 2016, what is the tax loss carryover, if any, going into 2020? Assume you have income of $3,000 each year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock