Question: please help me solve this part, ive provided the question. hope thats enough Blue Spruce Corp. prepares quarterly financial statements. The post-closing trial balance at

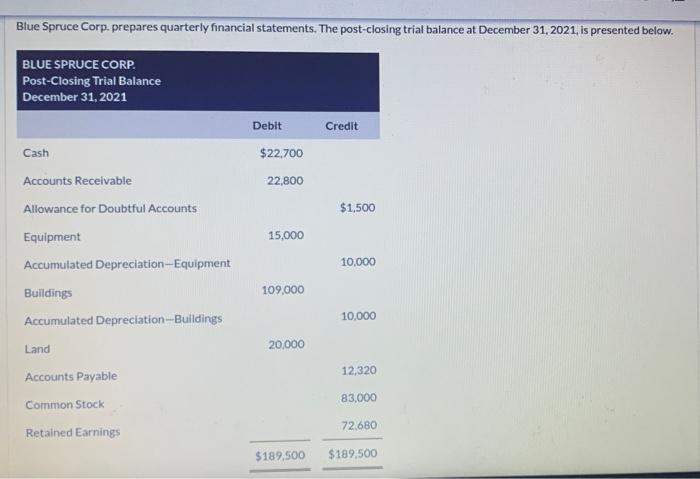

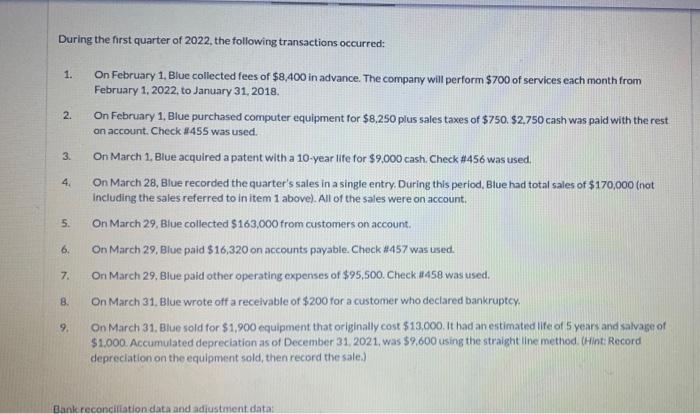

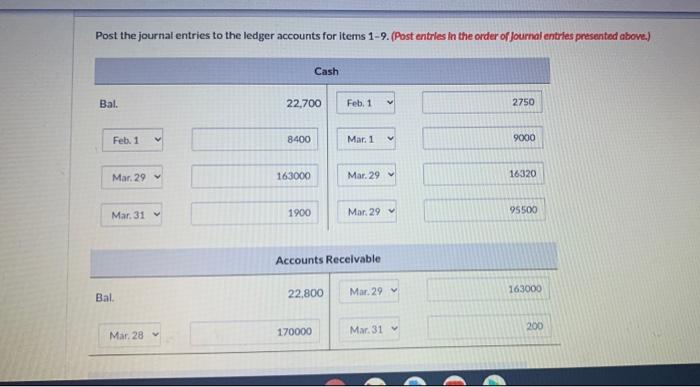

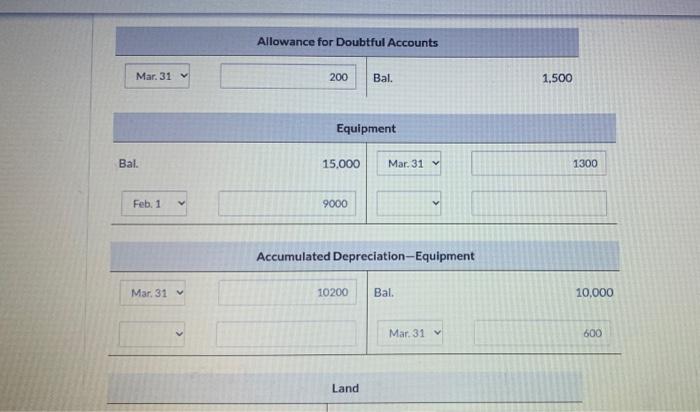

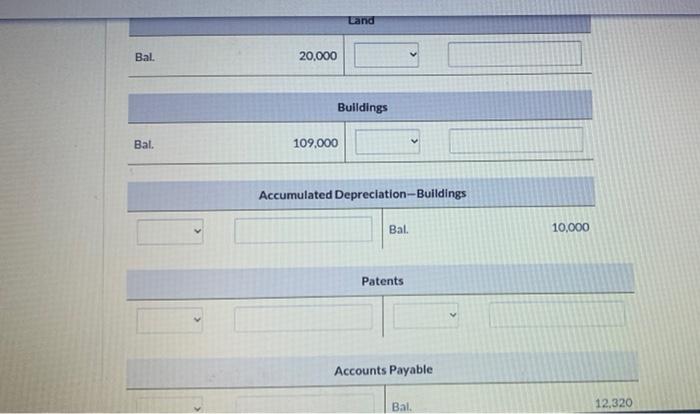

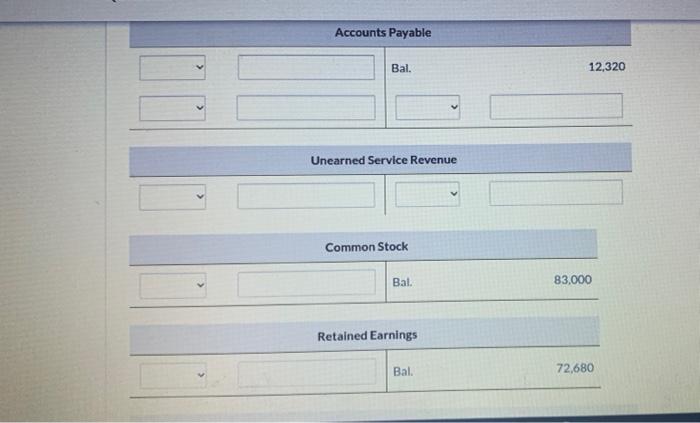

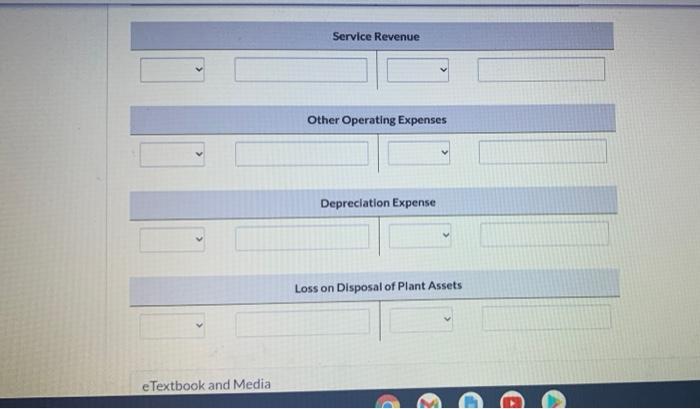

Blue Spruce Corp. prepares quarterly financial statements. The post-closing trial balance at December 31, 2021. is presented below. BLUE SPRUCE CORP Post-Closing Trial Balance December 31, 2021 Debit Credit $22,700 22,800 $1,500 15,000 Cash Accounts Receivable Allowance for Doubtful Accounts Equipment Accumulated Depreciation-Equipment Buildings Accumulated Depreciation - Buildings Land 10,000 109,000 10,000 20,000 Accounts Payable 12,320 Common Stock 83,000 72.680 Retained Earnings $189.500 $189,500 During the first quarter of 2022, the following transactions occurred: 1. 2. 3. 4. . On February 1, Blue collected fees of $8,400 in advance. The company will perform $700 of services each month from February 1, 2022, to January 31, 2018 On February 1, Blue purchased computer equipment for $8,250 plus sales taxes of $750 $2,750 cash was paid with the rest on account Check 8455 was used. On March 1, Blue acquired a patent with a 10-year life for $9.000 cash. Check #456 was used. On March 28, Blue recorded the quarter's sales in a single entry. During this period, Blue had total sales of $170,000 (not Including the sales referred to in item 1 above). All of the sales were on account. On March 29, Blue collected $163,000 from customers on account. On March 29, Blue paid $16,320 on accounts payable. Check #457 was used. On March 29, Blue paid other operating expenses of $95,500. Check #458 was used. On March 31, Blue wrote off a receivable of $200 for a customer who declared bankruptcy, On March 31. Blue sold for $1,900 equipment that originally cost $13,000. It had an estimated life of 5 years and salvage of $1.000. Accumulated depreciation as of December 31, 2021. was $9.600 using the straight line method Hint Record depreciation on the equipment sold, then record the sale.) 5. 6. 7. 8. a 9. Bank reconciliation data and adjustment data Post the journal entries to the ledger accounts for Items 1-9. (Post entries in the order of Journal entries presented above.) Cash Bal. 22.700 Feb. 1 2750 Feb. 1 v 8400 Mar. 1 9000 Mar 29 163000 Mar. 29 16320 1900 Mar 31 95500 Mar 29 Accounts Receivable Bal. 163000 22,800 Mar. 29 170000 Mar. 28 200 Mar 31 Allowance for Doubtful Accounts Mar. 31 200 Bal. 1,500 Equipment Bal. 15.000 Mar. 31 1300 Feb. 1 V 9000 Accumulated Depreciation-Equipment Mar 31 10200 Bal. 10,000 Mar. 31 600 Land Land Bal. 20,000 Buildings Bal. 109,000 Accumulated Depreciation--Buildings Bal 10,000 Patents Accounts Payable Bal 12,320 Accounts Payable Bal. 12,320 Unearned Service Revenue Common Stock Bal. 83,000 Retained Earnings Bal. 72,680 Service Revenue Other Operating Expenses Depreciation Expense Loss on Disposal of Plant Assets e Textbook and Media D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts