Question: Please help me solve this Please help me solve this question Question 10 (5 points) A firm's financial managers are evaluating two potential investments with

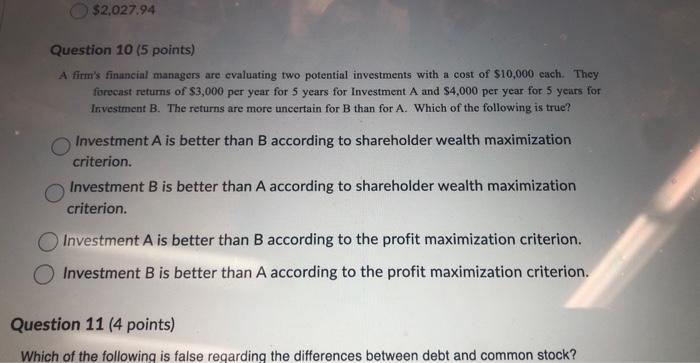

Question 10 (5 points) A firm's financial managers are evaluating two potential investments with a cost of $10,000 each. They forecast returns of $3,000 per year for 5 years for Investment A and $4,000 per year for 5 years for Irvestment B. The returns are more uncertain for B than for A. Which of the following is true? Investment A is better than B according to shareholder wealth maximization criterion. Investment B is better than A according to shareholder wealth maximization criterion. Investment A is better than B according to the profit maximization criterion. Investment B is better than A according to the profit maximization criterion. Question 11 (4 points) Which of the following is false regarding the differences between debt and common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts