Question: please help me solve this problem 2019 Ahortica vs Variable Costing - 2019 Fall Term (1) Cost. CUNY 2019 Fall Term (1) Cost Accounting HACE

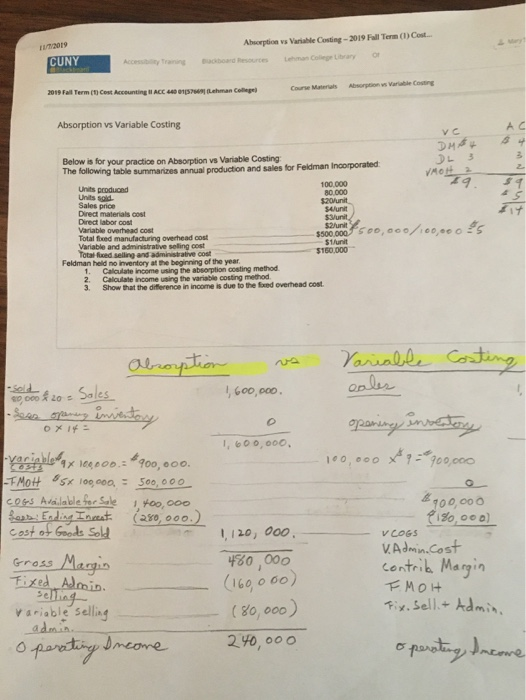

2019 Ahortica vs Variable Costing - 2019 Fall Term (1) Cost. CUNY 2019 Fall Term (1) Cost Accounting HACE 4 S Varble Costing Course Materials a hman College Absorption Absorption vs Variable Costing ve DH 19 Below is for your practice on Absorption vs Variable Costing The following table summarizes annual production and sales for Feldman Incorporated Units produced 100 000 Units said 80 000 Sales price 20/unit Direct materials cost 50/unit Direct labor cost Sunit Variable overhead cost $2/unit Total fixed manufacturing overhead cost $500.000 500,000/100,- 095 Variable and administrative selling cost Totalfixed selling and administrative cost $160.000 Feldman held no inventory at the beginning of the year. 1. Calculate income using the absorption costing method 2. Calculate income using the variable costing method Show that the difference in income is due to the fixed overhead cost. vo Costing absorption do #20 - Sales sees planing inventory Variable cales 1 600,000 OX 1,600,000 opening inventory 100,000 X 9 = 900,000 variable qx 100.000 900,000. -F Mot sx 100,000 = 500,000 COGS Available for Sale 1.400,000 Sob Ending Incest (280,000.) cost of Goods sold Gross Margin 1120,000 480.000 900,000 180,000) VLOGS V. Admin. Cost contrib. Margin EMOH Fix. sell & Admin (160,000) Fixed Admin variable selling (80,000) operating Income 240,000 operating Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts