Question: Please help me solve this problem 5. (25p) The price of a non-dividendpaying stock is $100 and the continuously compounded risk-free rate is 5%. A

Please help me solve this problem

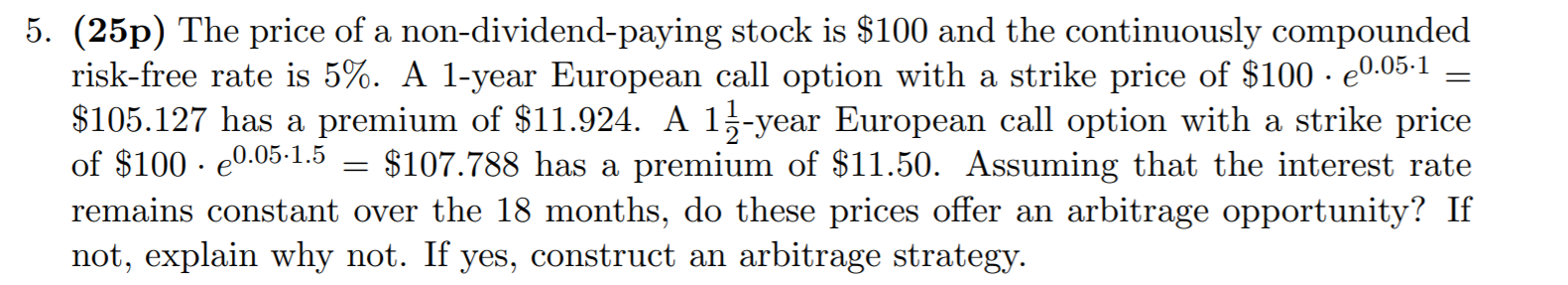

5. (25p) The price of a non-dividendpaying stock is $100 and the continuously compounded risk-free rate is 5%. A 1-year European call option with a strike price of $100 - 60'05'1 = $105127 has a premium of $11924. A 1%-year European call option with a strike price of $100 - 60'05'1'5 = $107.788 has a premium of $11.50. Assuming that the interest rate remains constant over the 18 months, do these prices offer an arbitrage Opportunity? If not, explain why not. If yes, construct an arbitrage strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts