Question: Please help me solve this problem ASAP! Thank you so much! 8-17. LO 4 Assume that you are using attributes sampling to test the controls

Please help me solve this problem ASAP!

Thank you so much!

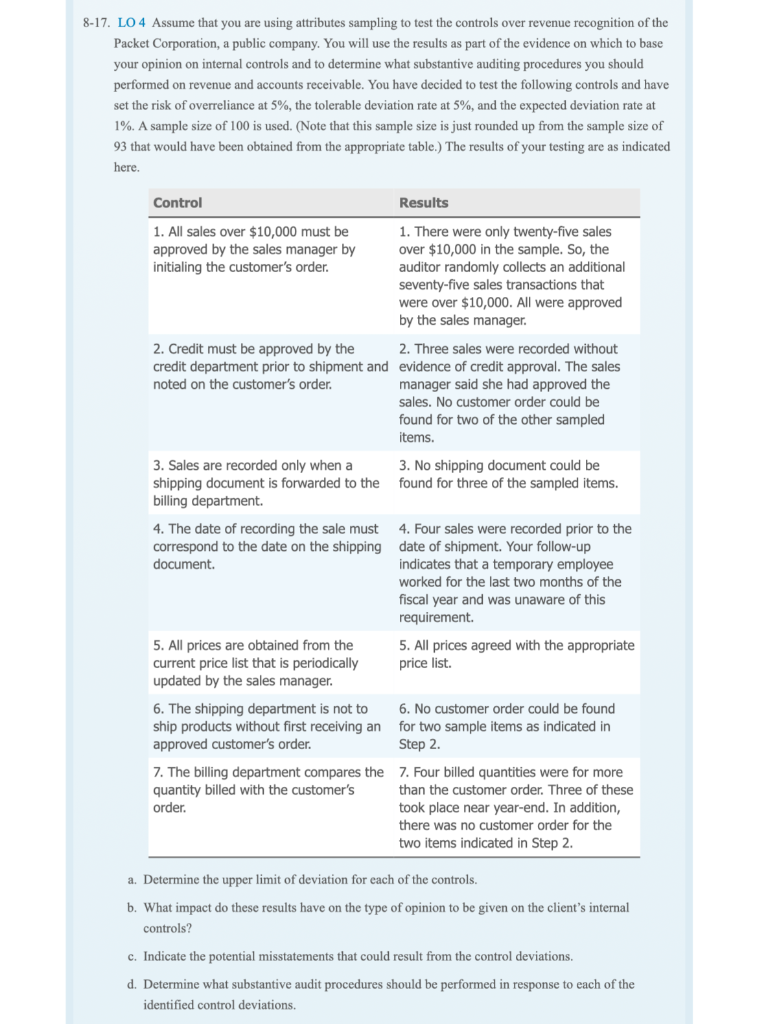

8-17. LO 4 Assume that you are using attributes sampling to test the controls over revenue recognition of the Packet Corporation, a public company. You will use the results as part of the evidence on which to base your opinion on internal controls and to determine what substantive auditing procedures you should performed on revenue and accounts receivable. You have decided to test the following controls and have set the risk of overreliance at 5%, the tolerable deviation rate at 5%, and the expected deviation rate at 1%. A sample size of 100 is used. (Note that this sample size is just rounded up from the sample size of 93 that would have been obtained from the appropriate table. The results of your testing are as indicated here. Control Results 1. All sales over $10,000 must be approved by the sales manager by initialing the customer's order. 1. There were only twenty-five sales over $10,000 in the sample. So, the auditor randomly collects an additional seventy-five sales transactions that were over $10,000. All were approved by the sales manager. 2. Credit must be approved by the 2. Three sales were recorded without credit department prior to shipment and evidence of credit approval. The sales noted on the customer's order. manager said she had approved the sales. No customer order could be found for two of the other sampled items. 3. Sales are recorded only when a shipping document is forwarded to the billing department. 3. No shipping document could be found for three of the sampled items. 4. The date of recording the sale must correspond to the date on the shipping document. 4. Four sales were recorded prior to the date of shipment. Your follow-up indicates that a temporary employee worked for the last two months of the fiscal year and was unaware of this requirement. 5. All prices agreed with the appropriate price list. 5. All prices are obtained from the current price list that is periodically updated by the sales manager. 6. The shipping department is not to ship products without first receiving an approved customer's order. 6. No customer order could be found for two sample items as indicated in Step 2. 7. The billing department compares the 7. Four billed quantities were for more quantity billed with the customer's than the customer order. Three of these order. took place near year-end. In addition, there was no customer order for the two items indicated in Step 2. a. Determine the upper limit of deviation for each of the controls. b. What impact do these results have on the type of opinion to be given on the client's internal controls? c. Indicate the potential misstatements that could result from the control deviations, d. Determine what substantive audit procedures should be performed in response to each of the identified control deviations. 8-17. LO 4 Assume that you are using attributes sampling to test the controls over revenue recognition of the Packet Corporation, a public company. You will use the results as part of the evidence on which to base your opinion on internal controls and to determine what substantive auditing procedures you should performed on revenue and accounts receivable. You have decided to test the following controls and have set the risk of overreliance at 5%, the tolerable deviation rate at 5%, and the expected deviation rate at 1%. A sample size of 100 is used. (Note that this sample size is just rounded up from the sample size of 93 that would have been obtained from the appropriate table. The results of your testing are as indicated here. Control Results 1. All sales over $10,000 must be approved by the sales manager by initialing the customer's order. 1. There were only twenty-five sales over $10,000 in the sample. So, the auditor randomly collects an additional seventy-five sales transactions that were over $10,000. All were approved by the sales manager. 2. Credit must be approved by the 2. Three sales were recorded without credit department prior to shipment and evidence of credit approval. The sales noted on the customer's order. manager said she had approved the sales. No customer order could be found for two of the other sampled items. 3. Sales are recorded only when a shipping document is forwarded to the billing department. 3. No shipping document could be found for three of the sampled items. 4. The date of recording the sale must correspond to the date on the shipping document. 4. Four sales were recorded prior to the date of shipment. Your follow-up indicates that a temporary employee worked for the last two months of the fiscal year and was unaware of this requirement. 5. All prices agreed with the appropriate price list. 5. All prices are obtained from the current price list that is periodically updated by the sales manager. 6. The shipping department is not to ship products without first receiving an approved customer's order. 6. No customer order could be found for two sample items as indicated in Step 2. 7. The billing department compares the 7. Four billed quantities were for more quantity billed with the customer's than the customer order. Three of these order. took place near year-end. In addition, there was no customer order for the two items indicated in Step 2. a. Determine the upper limit of deviation for each of the controls. b. What impact do these results have on the type of opinion to be given on the client's internal controls? c. Indicate the potential misstatements that could result from the control deviations, d. Determine what substantive audit procedures should be performed in response to each of the identified control deviations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts