Question: Please help me solve this problem entirely . thank you December 1 Sanyu Sony transferred $64,866 cash from a personal savings account to a ehecking

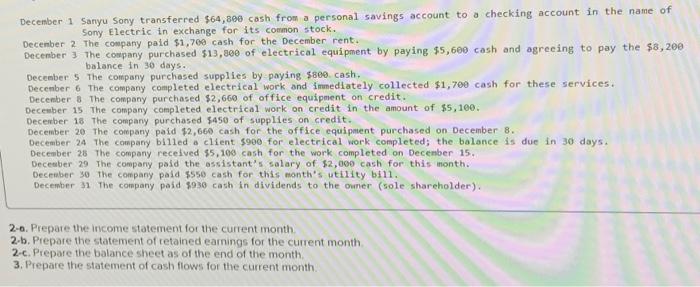

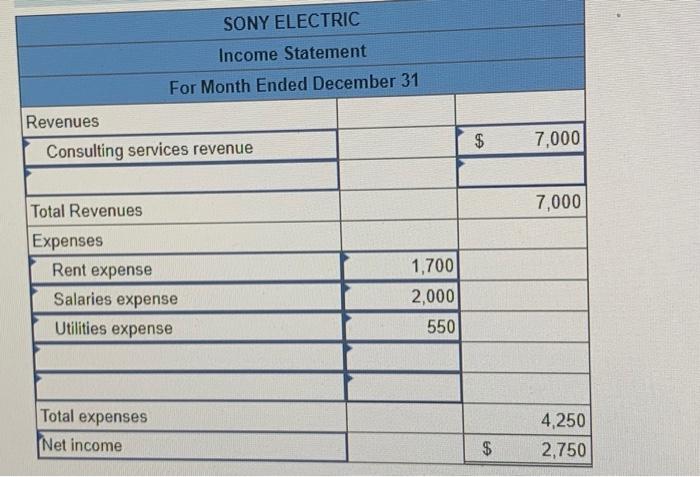

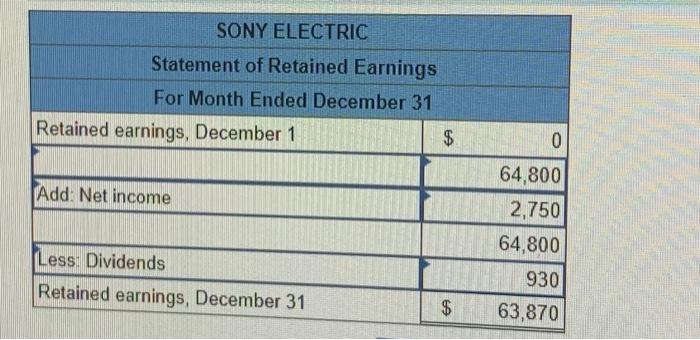

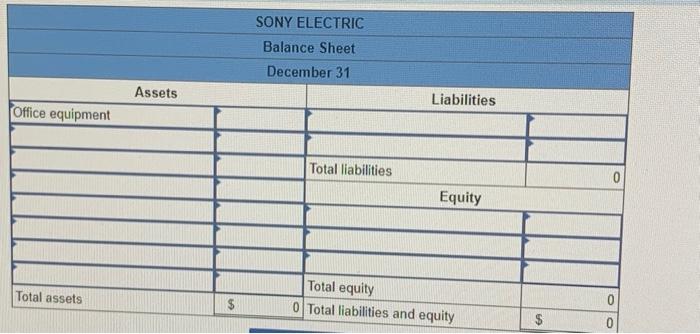

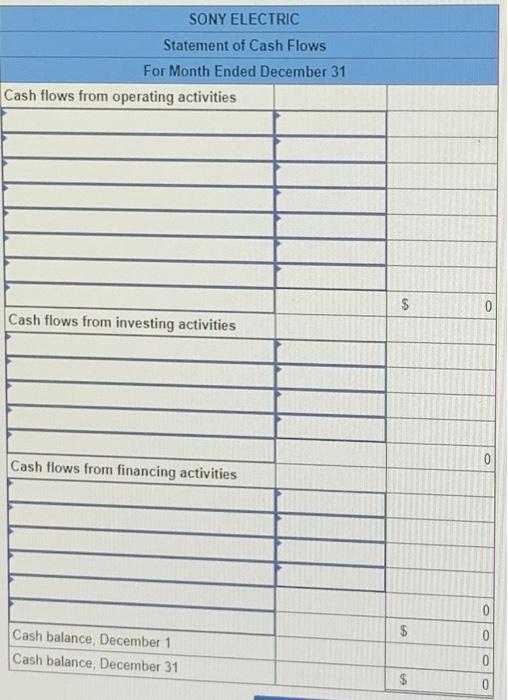

December 1 Sanyu Sony transferred $64,866 cash from a personal savings account to a ehecking account in the name of Sony Electric in exchange for its common stock. December 2. The company paid $1,700 cash for the December rent. December 3. The cospany purchased $13,800 of electrical equipment by paying $5,600 cash and agreeing to pay the $8, 20e balance in 30 days. December 5 the company purchased supplies by paying $800. cash. December 6 The company completed electrical work and immedlately collected $1,700 cash for these services. Decenber 8 the company purchased $2,660 of office equipment on credit. December 15 The company completed electrical work on credit in the amount of $5,100. Decenber 18 the company purchased $450 of supplies on credit. December 20 The company paid $2,660cash for the offlce equipment purchased on Deceinber 8. December 24 The compary billed a client 5900 for electrical work completed; the balance is due in 30 days. Decenber 28 The company received $5,109 cash for the work completed on Decenber 15. Deceaber 29 The company paid the assistant's salary of $2,000 cash for this inonth. Deceaber 30 the company pald $550 cash for this month's utility bil1. December 31 The company paid $930 cash in dividends to the ouner (sole shareholder). 2-a. Prepate the income statement for the current month. 2.b. Piepare the statement of retained eamings for the current month 2-c. Prepare the balance sheet as of the end of the month. 3. Prepare the statement of cash flows for the current month. \begin{tabular}{|l|r|r|} \hline \multicolumn{2}{|c|}{ SONY ELECTRIC } \\ \multicolumn{2}{|c|}{ Income Statement } \\ \hline \multicolumn{2}{|c|}{ For Month Ended December 31 } \\ \hline Revenues & & \\ \hline Consulting services revenue & & \\ \hline & & \\ \hline Total Revenues & & \\ \hline Expenses & 1,000 & \\ \hline Rent expense & 2,000 & \\ \hline Salaries expense & 550 & \\ \hline Utilities expense & & \\ \hline & & \\ \hline & & \\ \hline Total expenses & & $1,250 \\ \hline Net income & & 2,750 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ SONY ELECTRIC } \\ \hline \multicolumn{2}{|c|}{ Statement of Retained Earnings } \\ \hline \multicolumn{2}{|c|}{ Fonth Ended December 31} \\ \hline Retained earnings, December 1 & $ \\ \hline & 64,800 \\ \hline Add: Net income & 2,750 \\ \hline & 64,800 \\ \hline Less: Dividends & 930 \\ \hline Retained earnings, December 31 & $3,870 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts