Question: please help me solve this problem FastTrack Bikes, Inc, is thinking of developing a new composite road bike. Development will take sox years and the

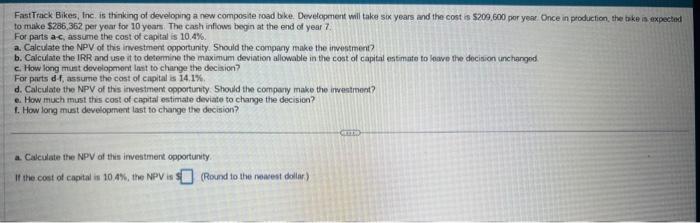

FastTrack Bikes, Inc, is thinking of developing a new composite road bike. Development will take sox years and the cost is $209,600 por year. Once in production, the bike is inpected to make $286,362 per yoar for 10 yoars. The cash inflows bogin at the end of year 7 . For parts a-c, assume the cost of capital is 10.4%. a. Calculate the NPV of this investment opportunity. Should the company make the inwostment? b. Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to loave the docision unchangod c. How long must dovelopment last to change the decision? For parts df, assume the cost of capital is 14.1%. d. Calculate the NPV of this investment opportunty. Should the company make the imestrnent? e. How much must the cost of capital estimate deviate to change the decision? f. How long must development last to change the decision? a. Cavculate the NPV af this investment opportunity. If the cost of capotal is 10 AN, the NPV is ? (Round to the neavest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts