Question: please help me solve this problem! ill be sure to thumbs up after! thanks! i have completed part a i just need part B in

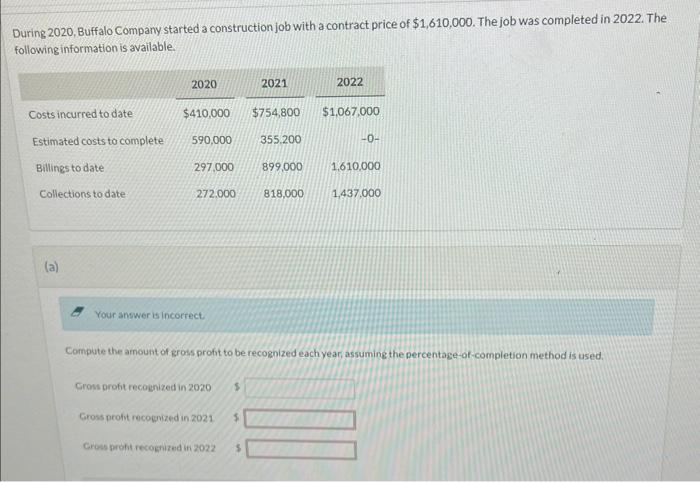

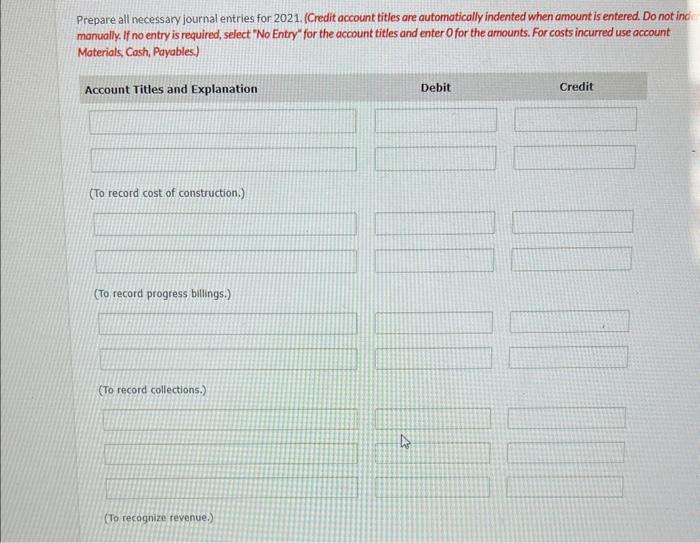

During 2020, Buffalo Company started a construction job with a contract price of $1,610,000. The job was completed in 2022 . The following information is available. (a) Your amoweris incorrect Compute the amount of gross profit to be recognized each year, assuming the percentage-of-completion method is used. Grom profit recognized in 2020 Gross profit recoenized in 20215 Cross profit recogrized in 2022 \$ Prepare all necessary journal entries for 2021. (Credit occount titles are automotically indented when amount is entered. Do not ind: manually. If no entry is required, select" No Entry" for the account titles and enter 0 for the amounts. For costs incurred use account. Mataviale Cach Denwhlec

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts