Question: Please help me solve this problem!! Ouestion 8: Replacement Example Now you are considering replacing a machine at your company. Your current machine has $8,000

Please help me solve this problem!!

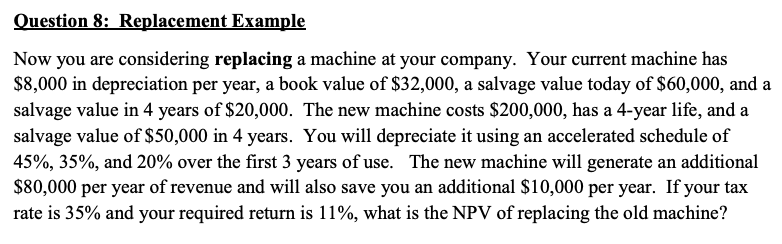

Ouestion 8: Replacement Example Now you are considering replacing a machine at your company. Your current machine has $8,000 in depreciation per year, a book value of $32,000, a salvage value today of $60,000, and a salvage value in 4 years of $20,000. The new machine costs $200,000, has a 4-year life, and a salvage value of $50,000 in 4 years. You will depreciate it using an accelerated schedule of 45%,35%, and 20% over the first 3 years of use. The new machine will generate an additional $80,000 per year of revenue and will also save you an additional $10,000 per year. If your tax rate is 35% and your required return is 11%, what is the NPV of replacing the old machine? Ouestion 8: Replacement Example Now you are considering replacing a machine at your company. Your current machine has $8,000 in depreciation per year, a book value of $32,000, a salvage value today of $60,000, and a salvage value in 4 years of $20,000. The new machine costs $200,000, has a 4-year life, and a salvage value of $50,000 in 4 years. You will depreciate it using an accelerated schedule of 45%,35%, and 20% over the first 3 years of use. The new machine will generate an additional $80,000 per year of revenue and will also save you an additional $10,000 per year. If your tax rate is 35% and your required return is 11%, what is the NPV of replacing the old machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts