Question: please help me solve this problem part a through c. thank you! You are CEO of a high-growth technology firm. You plan to raise $130

please help me solve this problem part a through c. thank you!

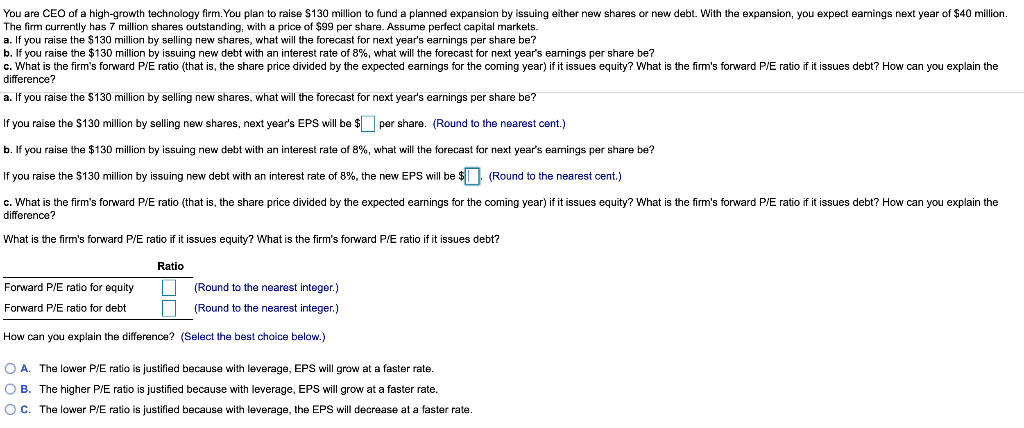

You are CEO of a high-growth technology firm. You plan to raise $130 million to fund a planned expansion by issuing either new shares or new debt. With the expansion, you expect earnings next year of $40 million. The firm currently has 7 million shares outstanding, with a price of $99 per share. Assume perfect capital markets. a. If you raise the $130 million by selling new shares, what will the forecast for next year's earnings per share be? b. If you raise the $130 million by issuing new debt with an interest rate of 8%, what will the forecast for next year's earnings per share be? c. What is the firm's forward P/E ratio (that is, the share price divided by the expected earnings for the coming year) if it issues equity? What is the firm's forward P/E ratio if it issues debt? How can you explain the difference? a. If you raise the $130 million by selling new shares, what will the forecast for next year's earnings per share be? If you raise the $130 million by selling new shares, next year's EPS will be $ per share. (Round to the nearest cent.) b. If you raise the $130 million by issuing new debt with an interest rate of 8%, what will the forecast for next year's earnings per share be? If you raise the $130 million by issuing new debt with an interest rate of 8%, the new EPS will be $1. (Round to the nearest cent.) c. What is the firm's forward P/E ratio (that is, the share price divided by the expected earnings for the coming year) if it issues equity? What is the firm's forward P/E ratio if it issues debt? How can you explain the difference? What is the firm's forward P/E ratio if it issues equity? What is the firm's forward P/E ratio if it issues debt? Ratio Forward P/E ratio for equity Forward P/E ratio for debt (Round to the nearest Integer.) (Round to the nearest integer.) How can you explain the difference? (Select the best choice below.) O A. The lower P/E ratio is justified because with leverage, EPS will grow at a faster rate. OB. The higher P/E ratio is justified because with leverage, EPS will grow at a faster rate. OC. The lower P/E ratio justified because with leverage, the EPS will decrease at a faster rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts