Question: Please help me solve this problem The Bagel LLC produces bakery. It uses accrual method in income and tax determination. Data from financial statements: 1)

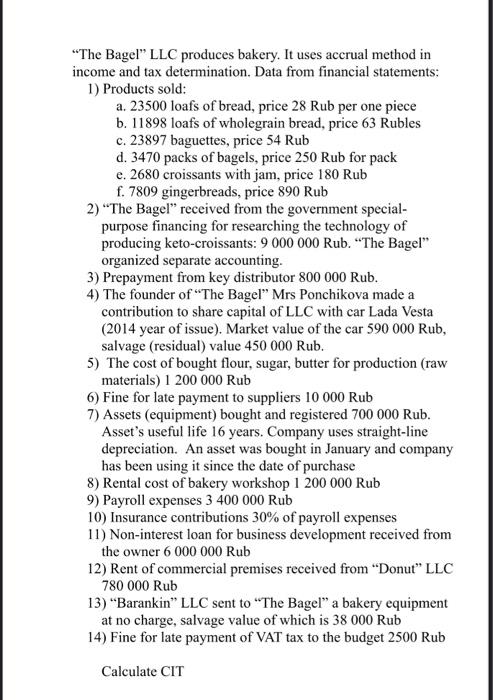

"The Bagel" LLC produces bakery. It uses accrual method in income and tax determination. Data from financial statements: 1) Products sold: a. 23500 loafs of bread, price 28 Rub per one piece b. 11898 loafs of wholegrain bread, price 63 Rubles c. 23897 baguettes, price 54 Rub d. 3470 packs of bagels, price 250 Rub for pack e. 2680 croissants with jam, price 180 Rub f. 7809 gingerbreads, price 890 Rub 2) "The Bagel" received from the government specialpurpose financing for researching the technology of producing keto-croissants: 9000000 Rub. "The Bagel" organized separate accounting. 3) Prepayment from key distributor 800000 Rub. 4) The founder of "The Bagel" Mrs Ponchikova made a contribution to share capital of LLC with car Lada Vesta (2014 year of issue). Market value of the car 590000Rub, salvage (residual) value 450000 Rub. 5) The cost of bought flour, sugar, butter for production (raw materials) 1200000Rub 6) Fine for late payment to suppliers 10000Rub 7) Assets (equipment) bought and registered 700000 Rub. Asset's useful life 16 years. Company uses straight-line depreciation. An asset was bought in January and company has been using it since the date of purchase 8) Rental cost of bakery workshop 1200000Rub 9) Payroll expenses 3400000 Rub 10) Insurance contributions 30% of payroll expenses 11) Non-interest loan for business development received from the owner 6000000Rub 12) Rent of commercial premises received from "Donut" LLC 780000Rub 13) "Barankin" LLC sent to "The Bagel" a bakery equipment at no charge, salvage value of which is 38000Rub 14) Fine for late payment of VAT tax to the budget 2500 Rub Calculate CIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts