Question: Please help me solve this question, and show all work. Thank you :) The Ruffins are negotiating with two banks for a mortgage to buy

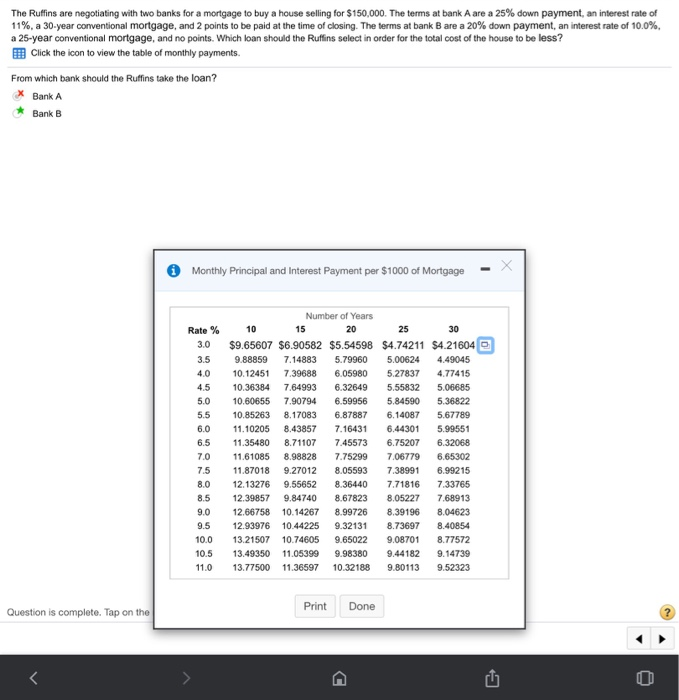

The Ruffins are negotiating with two banks for a mortgage to buy a house selling for $150,000. The terms at bank A are a 25% down payment, an interest rate of 11%, a 30-year conventional mortgage, and 2 points to be paid at the time of closing. The terms at bank Bare a 20% down payment, an interest rate of 10.0%, a 25-year conventional mortgage, and no points. Which loan should the Ruffins select in order for the total cost of the house to be less? Click the icon to view the table of monthly payments. From which bank should the Ruffins take the loan? Bank A Bank B Monthly Principal and Interest Payment per $1000 of Mortgage Rate % 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 8.5 9.0 9.5 10.0 10.5 11.0 Number of Years 10 15 20 25 30 $9.65607 $6.90582 $5.54598 $4.74211 $4.21604 9.88859 7.14883 5.79960 5.00624 4.49045 10.12451 7.39688 6.05980 5.27837 4.77415 10.36384 7.64993 6.32649 5.55832 5.06685 10.60655 7.90794 6.59956 5.84590 5.36822 10.85263 8.17083 6.87887 6.14087 5.67789 11.10205 8.43857 7.16431 6.44301 5.99551 11.35480 8.71107 7.45573 6.75207 6.32068 11.61085 8.98828 7.75299 7.06779 6.65302 11.87018 9.27012 8.05593 7.38991 6.99215 12.13276 9.55652 8.36440 7.71816 7.33765 12.39857 9.84740 8.67823 8.05227 7.68913 12.66758 10.14267 8.99726 8.39196 8.04623 12.93976 10.44225 9.32131 8.73697 8.40854 13.21507 10.74605 9.65022 9.08701 8.77572 13.49350 11.05399 9.98380 9.44182 9.14739 13.77500 11.36597 10.32188 9.80113 9.52323 Print Done Question is complete. Tap on the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts