Question: please help me solve this question. i have been struggling quite a bit 1b. ( 6 Points). This part of question #1 focuses on the

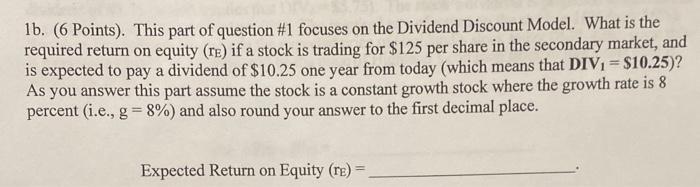

1b. ( 6 Points). This part of question \#1 focuses on the Dividend Discount Model. What is the required return on equity (rE) if a stock is trading for $125 per share in the secondary market, and is expected to pay a dividend of $10.25 one year from today (which means that DIV1=$10.25 )? As you answer this part assume the stock is a constant growth stock where the growth rate is 8 percent (i.e., g=8% ) and also round your answer to the first decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts