Question: Please help me solve this question , I posted hundred times 12 13 Question 4 14 Lauren McMann is an advanced mountaineer and outdoor adventure

Please help me solve this question , I posted hundred times

Please help me solve this question , I posted hundred times

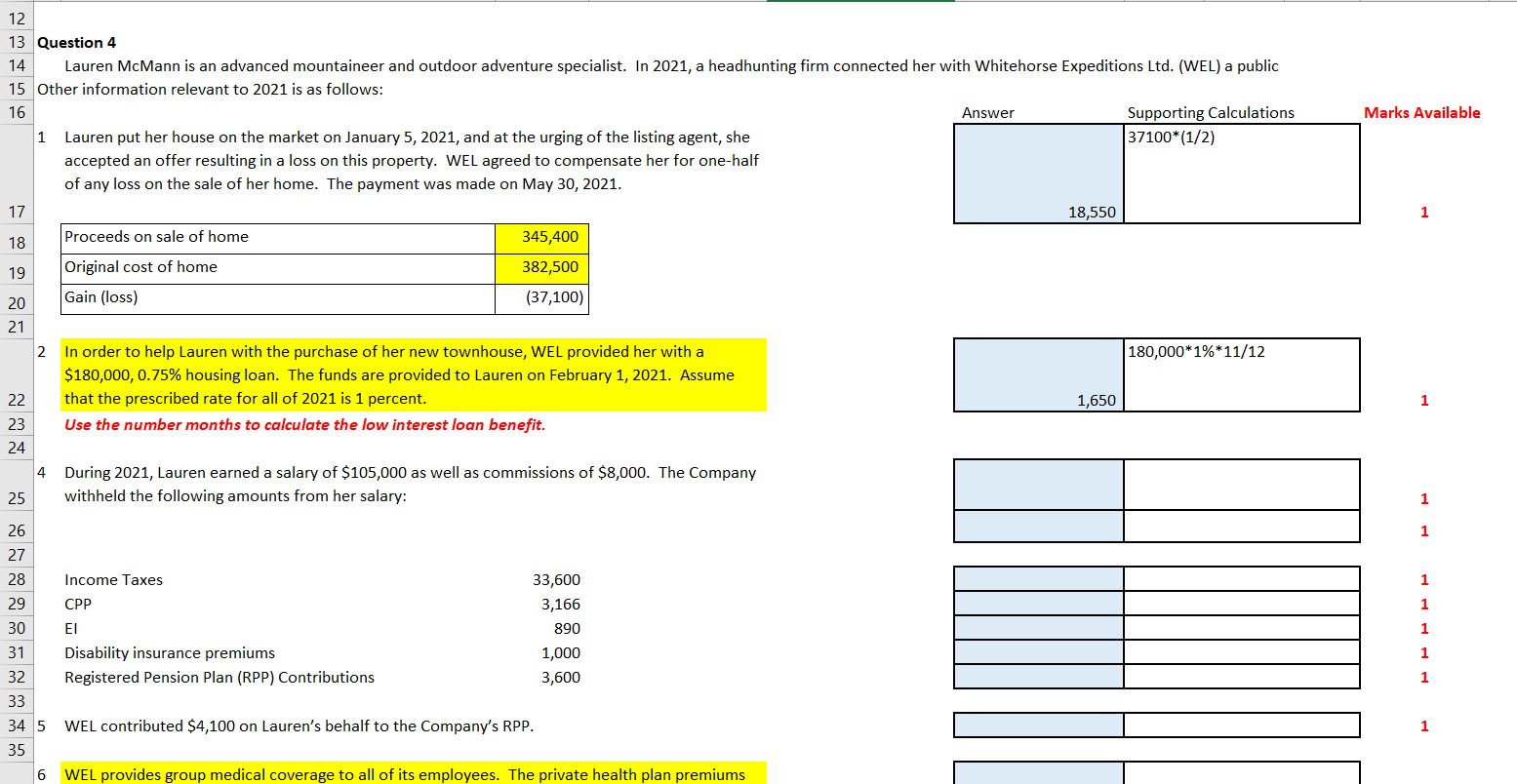

12 13 Question 4 14 Lauren McMann is an advanced mountaineer and outdoor adventure specialist. In 2021, a headhunting firm connected her with Whitehorse Expeditions Ltd. (WEL) a public Other information relevant to 2021 is as follows: 15 16 Answer Supporting Calculations 37100*(1/2) 1 Lauren put her house on the market on January 5, 2021, and at the urging of the listing agent, she accepted an offer resulting in a loss on this property. WEL agreed to compensate her for one-half of any loss on the sale of her home. The payment was made on May 30, 2021. 17 Proceeds on sale of home 18 19 Original cost of home 345,400 382,500 (37,100) Gain (loss) 20 21 2 180,000*1% *11/12 In order to help Lauren with the purchase of her new townhouse, WEL provided her with a $180,000, 0.75% housing loan. The funds are provided to Lauren on February 1, 2021. Assume that the prescribed rate for all of 2021 is 1 percent. 22 23 Use the number months to calculate the low interest loan benefit. 24 4 During 2021, Lauren earned a salary of $105,000 as well as commissions of $8,000. The Company withheld the following amounts from her salary: 25 26 27 28 Income Taxes 33,600 29 CPP 3,166 30 890 31 Disability insurance premiums 1,000 3,600 32 Registered Pension Plan (RPP) Contributions 33 34 5 WEL contributed $4,100 on Lauren's behalf to the Company's RPP. 35 6 WEL provides group medical coverage to all of its employees. The private health plan premiums 18,550 1,650 Marks Available 1 1 1 1 1 1 1 1 1 1 12 13 Question 4 14 Lauren McMann is an advanced mountaineer and outdoor adventure specialist. In 2021, a headhunting firm connected her with Whitehorse Expeditions Ltd. (WEL) a public Other information relevant to 2021 is as follows: 15 16 Answer Supporting Calculations 37100*(1/2) 1 Lauren put her house on the market on January 5, 2021, and at the urging of the listing agent, she accepted an offer resulting in a loss on this property. WEL agreed to compensate her for one-half of any loss on the sale of her home. The payment was made on May 30, 2021. 17 Proceeds on sale of home 18 19 Original cost of home 345,400 382,500 (37,100) Gain (loss) 20 21 2 180,000*1% *11/12 In order to help Lauren with the purchase of her new townhouse, WEL provided her with a $180,000, 0.75% housing loan. The funds are provided to Lauren on February 1, 2021. Assume that the prescribed rate for all of 2021 is 1 percent. 22 23 Use the number months to calculate the low interest loan benefit. 24 4 During 2021, Lauren earned a salary of $105,000 as well as commissions of $8,000. The Company withheld the following amounts from her salary: 25 26 27 28 Income Taxes 33,600 29 CPP 3,166 30 890 31 Disability insurance premiums 1,000 3,600 32 Registered Pension Plan (RPP) Contributions 33 34 5 WEL contributed $4,100 on Lauren's behalf to the Company's RPP. 35 6 WEL provides group medical coverage to all of its employees. The private health plan premiums 18,550 1,650 Marks Available 1 1 1 1 1 1 1 1 1 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts