Question: Please help me solve this question step by step. U Annuity Assignment An annuity is a regular payment or deposit made at consistent intervals for

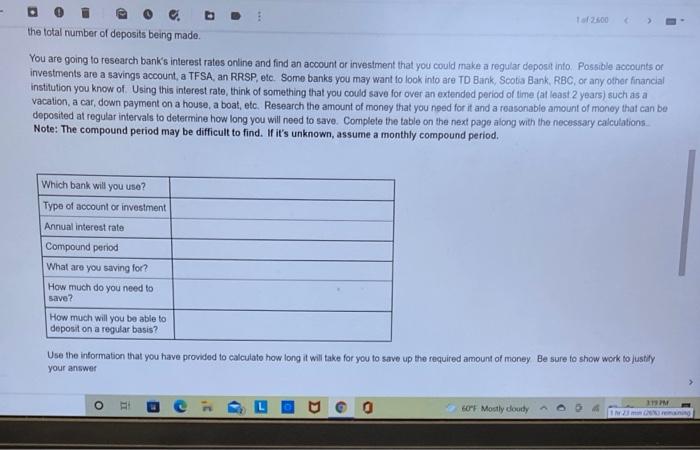

U Annuity Assignment An annuity is a regular payment or deposit made at consistent intervals for an extended period of time. For example, a deposit of $100 into a savings account every month could be treated as an annuity. For this assignment, the frequency of deposit must match the compound period of the account The future value of an annuity, A, can be calculated using the formula A= R[(1 + r)n-1 where is the amount of money deposited regularly, r is the interest rate for each compound period (not to be confused with the annual interest rato), and n is the total number of deposits being made You are going to research bank's interest ratos online and find an account or investment that you could make a rogutar deposit into. Possible accounts on investments are a savings account, a TFSA, an RRSP, etc. Somo banks you may want to look into are TD Bank, Scotia Bank RBC, or any other financial institution you know of Using this interest rate, think of something that you could save for over an extended period of time (at least 2 years) such as a vacation, a car, down payment on a house, a boat, etc. Research the amount of money that you need for it and a reasonable amount of money that can be deposited at regular intervals to determine how long you will need to save. Complete the table on the next pago along with the necessary calculations. Note: The compound period may be difficult to find. If it's unknown, assume a monthly compound period. Which tank will 19M 60 Mostly doudy 12600 the total number of deposits being made. You are going to research bank's interest rates online and find an account or investment that you could make a regular deposit into Possible accounts of investments are a savings account, a TFSA, an RRSP, etc. Some banks you may want to look into are TD Bank, Scotia Bank, RBC, or any other financial institution you know of Using this interest rate, think of something that you could save for over an extended period of time (at least 2 years) such as a vacation, a car, down payment on a house, a boat, etc. Research the amount of money that you need for it and a reasonable amount of money that can be deposited at regular intervals to determine how long you will need to save. Complete the table on the next page along with the necessary calculations Note: The compound period may be difficult to find. If it's unknown, assume a monthly compound period. Which bank will you use? Type of account or investment Annual interest rate Compound period What are you saving for? How much do you need to save? How much will you be able to deposit on a regular basis? Use the information that you have provided to calculate how long it will take for you to save up the required amount of money Be sure to show work to justify your answer 60 OF Mostly doudy PM INC U Annuity Assignment An annuity is a regular payment or deposit made at consistent intervals for an extended period of time. For example, a deposit of $100 into a savings account every month could be treated as an annuity. For this assignment, the frequency of deposit must match the compound period of the account The future value of an annuity, A, can be calculated using the formula A= R[(1 + r)n-1 where is the amount of money deposited regularly, r is the interest rate for each compound period (not to be confused with the annual interest rato), and n is the total number of deposits being made You are going to research bank's interest ratos online and find an account or investment that you could make a rogutar deposit into. Possible accounts on investments are a savings account, a TFSA, an RRSP, etc. Somo banks you may want to look into are TD Bank, Scotia Bank RBC, or any other financial institution you know of Using this interest rate, think of something that you could save for over an extended period of time (at least 2 years) such as a vacation, a car, down payment on a house, a boat, etc. Research the amount of money that you need for it and a reasonable amount of money that can be deposited at regular intervals to determine how long you will need to save. Complete the table on the next pago along with the necessary calculations. Note: The compound period may be difficult to find. If it's unknown, assume a monthly compound period. Which tank will 19M 60 Mostly doudy 12600 the total number of deposits being made. You are going to research bank's interest rates online and find an account or investment that you could make a regular deposit into Possible accounts of investments are a savings account, a TFSA, an RRSP, etc. Some banks you may want to look into are TD Bank, Scotia Bank, RBC, or any other financial institution you know of Using this interest rate, think of something that you could save for over an extended period of time (at least 2 years) such as a vacation, a car, down payment on a house, a boat, etc. Research the amount of money that you need for it and a reasonable amount of money that can be deposited at regular intervals to determine how long you will need to save. Complete the table on the next page along with the necessary calculations Note: The compound period may be difficult to find. If it's unknown, assume a monthly compound period. Which bank will you use? Type of account or investment Annual interest rate Compound period What are you saving for? How much do you need to save? How much will you be able to deposit on a regular basis? Use the information that you have provided to calculate how long it will take for you to save up the required amount of money Be sure to show work to justify your answer 60 OF Mostly doudy PM INC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts