Question: Please help me solve this question Thank you Variable Value Variable Value $ 1.2535 SO 0.7978 8 x FO $ 1.2443 FO 0.8037 $ 1.2505

Please help me solve this question

Please help me solve this question

Thank you

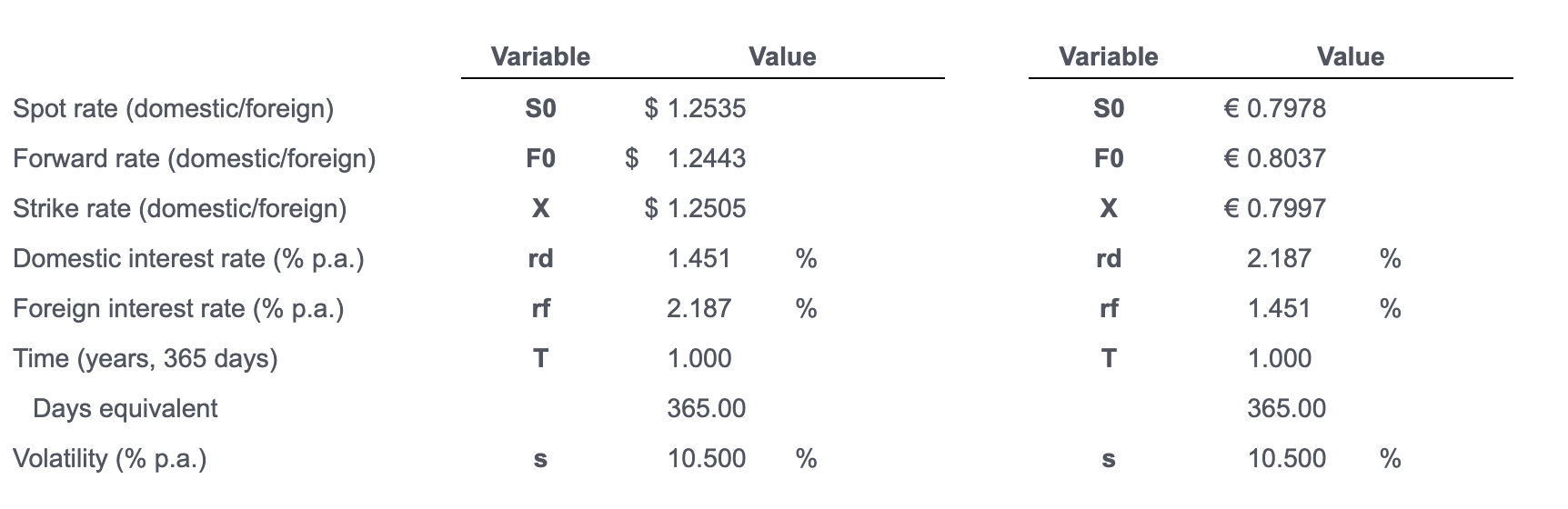

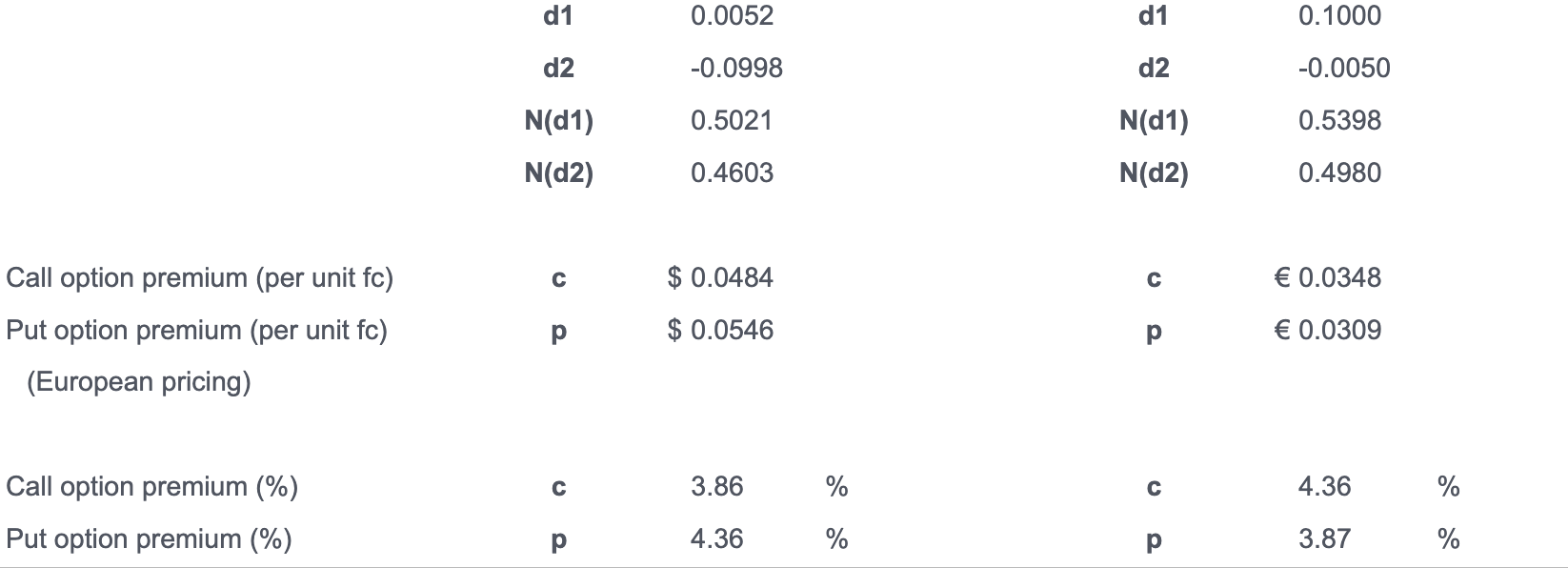

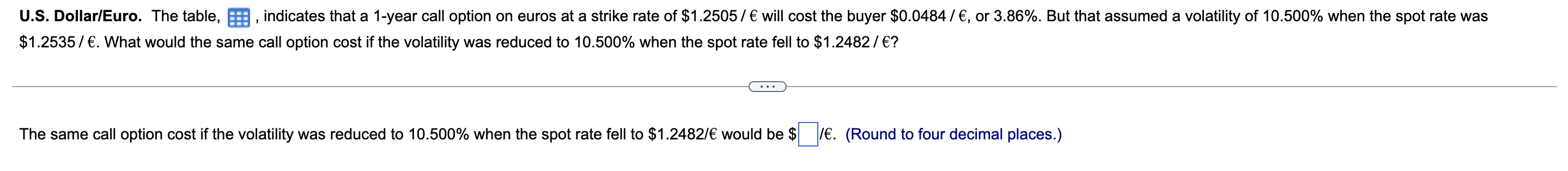

Variable Value Variable Value $ 1.2535 SO 0.7978 8 x FO $ 1.2443 FO 0.8037 $ 1.2505 X 0.7997 rd 1.451 % rd 2.187 % Spot rate (domestic/foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% p.a.) Foreign interest rate (% p.a.) Time (years, 365 days) Days equivalent Volatility (% p.a.) rf 2.187 % 1.451 % - E- 1.000 T 1.000 365.00 365.00 S 10.500 % S 10.500 % d1 0.0052 d1 0.1000 d2 -0.0998 d2 -0.0050 0.5021 0.5398 N(d1) N(02) N(D1) N(d2) 0.4603 0.4980 $ 0.0484 C 0.0348 Call option premium (per unit fc) Put option premium (per unit fc) (European pricing) p $ 0.0546 0.0309 C 3.86 % C 4.36 % Call option premium (%) Put option premium (%) p 4.36 % 3.87 % U.S. Dollar/Euro. The table, , indicates that a 1-year call option on euros at a strike rate of $1.2505/ will cost the buyer $0.0484/ , or 3.86%. But that assumed a volatility of 10.500% when the spot rate was $1.2535/ . What would the same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2482 / ? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.24827 would be $ /. (Round to four decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts