Question: Please help me solve this questions? SAMPLE PROBLEM SET 1 - FUTURES AND OPTIONS FIN 436 1. You have opened a futures account with a

Please help me solve this questions?

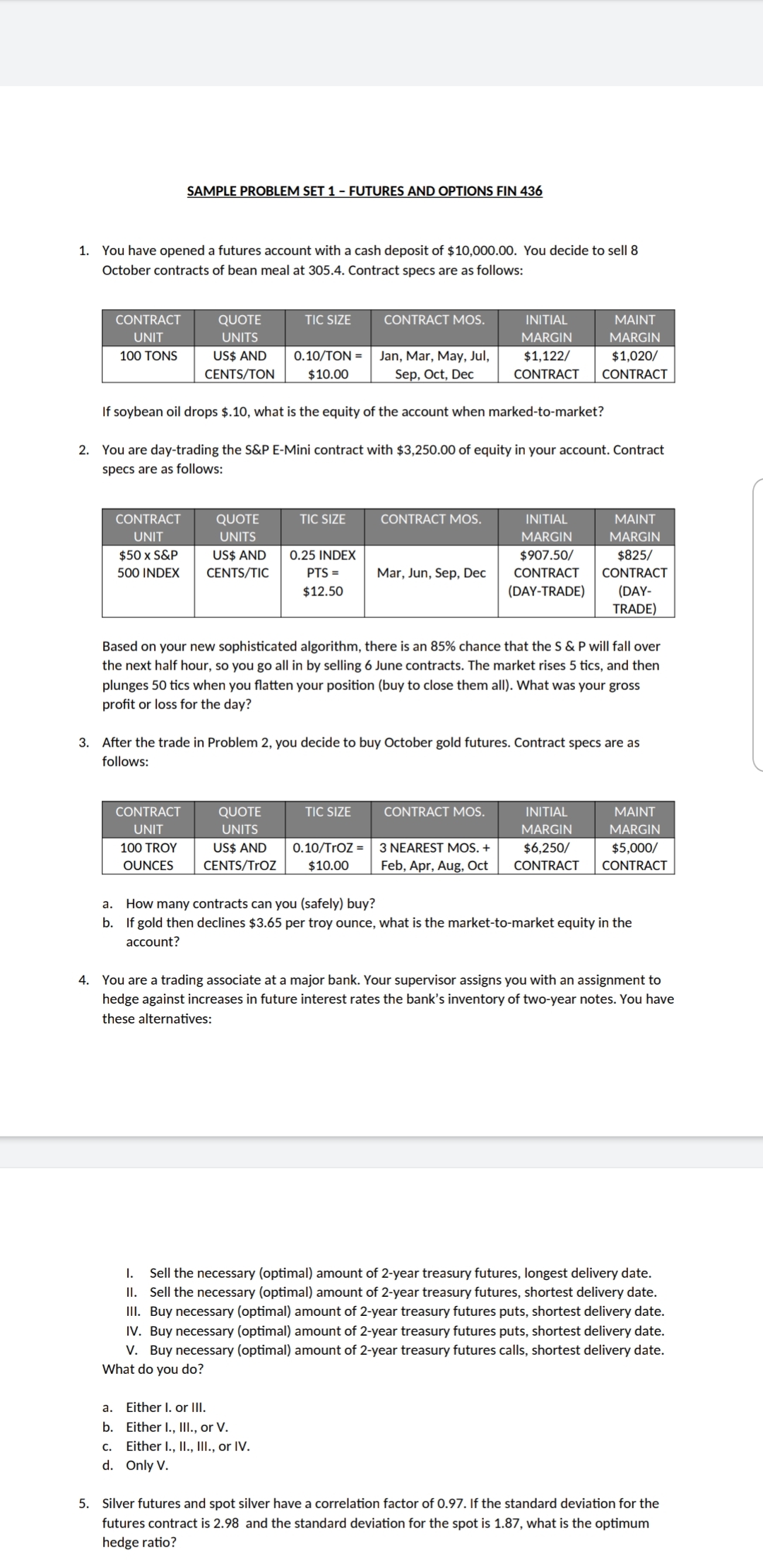

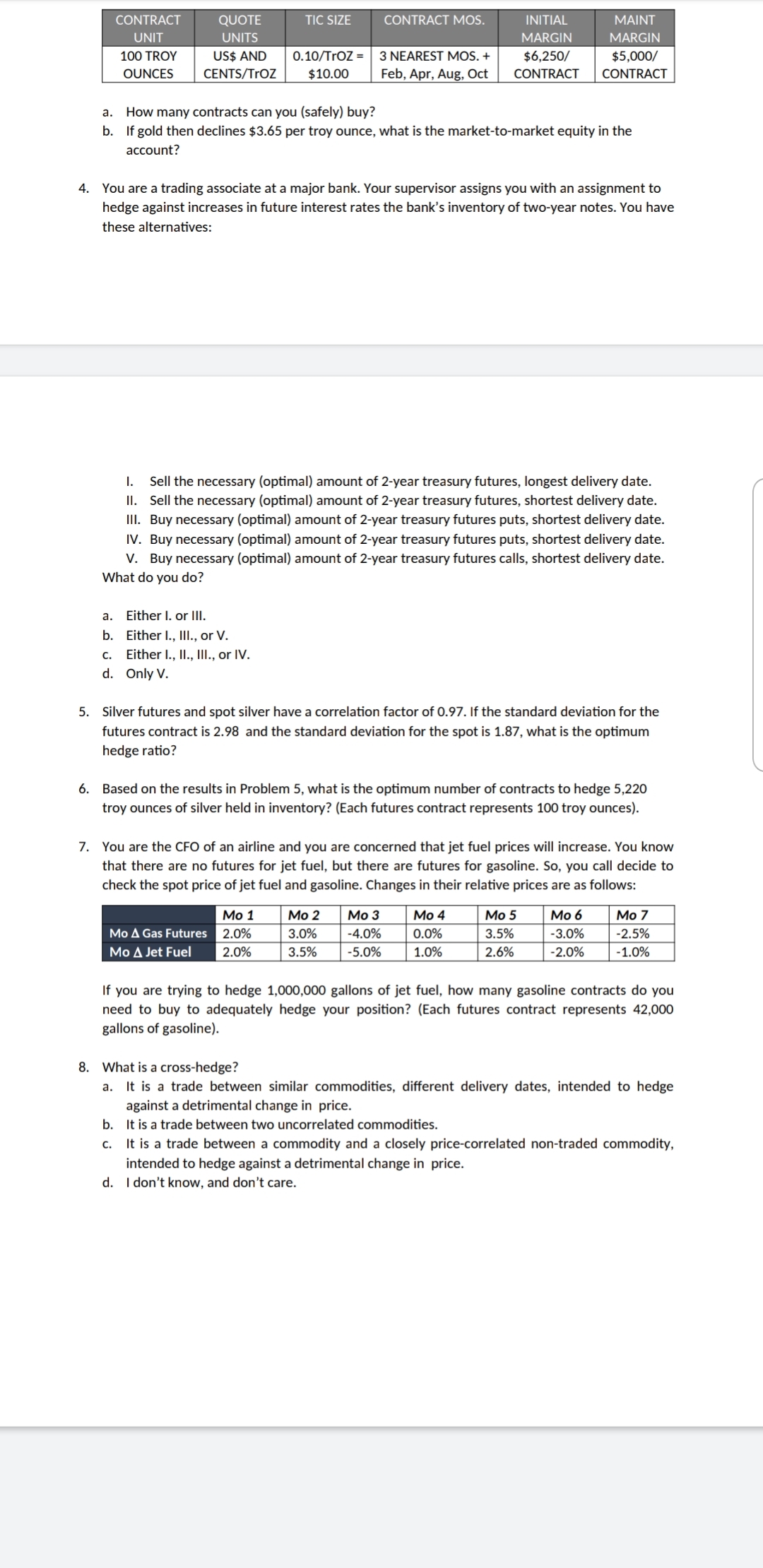

SAMPLE PROBLEM SET 1 - FUTURES AND OPTIONS FIN 436 1. You have opened a futures account with a cash deposit of $10,000.00. You decide to sell 8 October contracts of bean meal at 305.4. Contract specs are as follows: CONTRACT QUOTE TIC SIZE CONTRACT MOS. INITIAL MAINT UNIT UNITS MARGIN MARGIN 100 TONS US$ AND 0.10/TON = Jan, Mar, May, Jul, $1,122/ $1,020/ CENTS/TON $10.00 Sep, Oct, Dec CONTRACT CONTRACT If soybean oil drops $.10, what is the equity of the account when marked-to-market? 2. You are day-trading the S&P E-Mini contract with $3,250.00 of equity in your account. Contract specs are as follows: CONTRACT QUOTE TIC SIZE CONTRACT MOS. INITIAL MAINT UNIT UNITS MARGIN MARGIN $50 x S&P US$ AND 0.25 INDEX $907.50/ $825/ 500 INDEX CENTS/TIC PTS = Mar, Jun, Sep, Dec CONTRACT CONTRACT $12.50 (DAY-TRADE) DAY- TRADE) Based on your new sophisticated algorithm, there is an 85% chance that the S & P will fall over the next half hour, so you go all in by selling 6 June contracts. The market rises 5 tics, and then plunges 50 tics when you flatten your position (buy to close them all). What was your gross profit or loss for the day? 3. After the trade in Problem 2, you decide to buy October gold futures. Contract specs are as follows: CONTRACT QUOTE TIC SIZE CONTRACT MOS. INITIAL MAINT UNIT UNITS MARGIN MARGIN 100 TROY US$ AND 0.10/TrOZ = 3 NEAREST MOS. + $6,250/ $5,000/ OUNCES CENTS/TroZ $10.00 Feb, Apr, Aug, Oct CONTRACT CONTRACT a. How many contracts can you (safely) buy? b. If gold then declines $3.65 per troy ounce, what is the market-to-market equity in the account? 4. You are a trading associate at a major bank. Your supervisor assigns you with an assignment to hedge against increases in future interest rates the bank's inventory of two-year notes. You have these alternatives: I. Sell the necessary (optimal) amount of 2-year treasury futures, longest delivery date. II. Sell the necessary (optimal) amount of 2-year treasury futures, shortest delivery date. Ill. Buy necessary (optimal) amount of 2-year treasury futures puts, shortest delivery date. IV. Buy necessary (optimal) amount of 2-year treasury futures puts, shortest delivery date. V. Buy necessary (optimal) amount of 2-year treasury futures calls, shortest delivery date. What do you do? a. Either I. or III. b. Either I., Ill., or V. C. Either I., II., III., or IV. d. Only V. 5. Silver futures and spot silver have a correlation factor of 0.97. If the standard deviation for the futures contract is 2.98 and the standard deviation for the spot is 1.87, what is the optimum hedge ratio?CONTRACT QUOTE TIC SIZE CONTRACT MOS. lNlTlAL MAINT UNIT UNITS MARGIN MARGIN 100 TROY U55 AND 0.10/TrOZ = 3 NEAREST M05. + $6.250/ $5.000! OUNCES CENTS/TrOZ $10.00 Feb, Apr, Aug. Oct CONTRACT CONTRACT a. How many contracts can you (safely) buy? b. If gold then declines $3.65 per troy ounce, what is the market-tomarket equity in the account? 4. You are a trading associate at a major bank. Your supervisor assigns you with an assignment to hedge against increases in future interest rates the bank's inventory of two-year notes. You have these alternatives: I. Sell the necessary (optimal) amount of 2-year treasury futures, longest delivery date. ||. Sell the necessary (optimal) amount of 2-year treasury futuresv shortest delivery date. I\". Buy necessary (optimal) amount of 2-year treasury futures putsv shortest delivery date. IV. Buy necessary (optimal) amount of 2-year treasury futures putsv shortest delivery date. V. Buy necessary (optimal) amount of 2-year treasury futures calls, shortest delivery date. What do you do? Either I. or III. Either L. \"L, or V. Either I., IL, "L, or IV. Only V. ape-m 5. Silver futures and spot silver have a correlation factor of 0.97. If the standard deviation for the futures contract is 2.98 and the standard deviation for the spot is 1.87, what is the optimum hedge ratio? 6. Based on the results in Problem 5. what is the optimum number of contracts to hedge 5,220 troy ounces of silver held in inventory? (Each futures contract represents 100 troy ounces). 7. You are the CFO of an airline and you are concerned that jet fuel prices will increase. You know that there are no futures for jet fuel. but there are futures for gasoline. So. you call decide to check the spot price of jet fuel and gasoline. Changes in their relative prices are as follows: Mo 1 Mo 2 Me A Gas Futures 2.0% 3.0% Mo A Jet Fuel 2.0% 3.5% If you are trying to hedge 1.000.000 gallons oi jet fuel. how many gasoline contracts do you need to buy to adequately hedge your position? (Each futures contract represents 42.000 gallons of gasoline). 8. What is a cross-hedge? a. It is a trade between similar commodities. different delivery dates, intended to hedge against a detrimental change in price. It is a trade between two uncorrelated commodities. c. It is a trade between a commodity and a closely price-correlated non-traded commodity, intended to hedge against a detrimental change in price. d. I don't know. and don't care