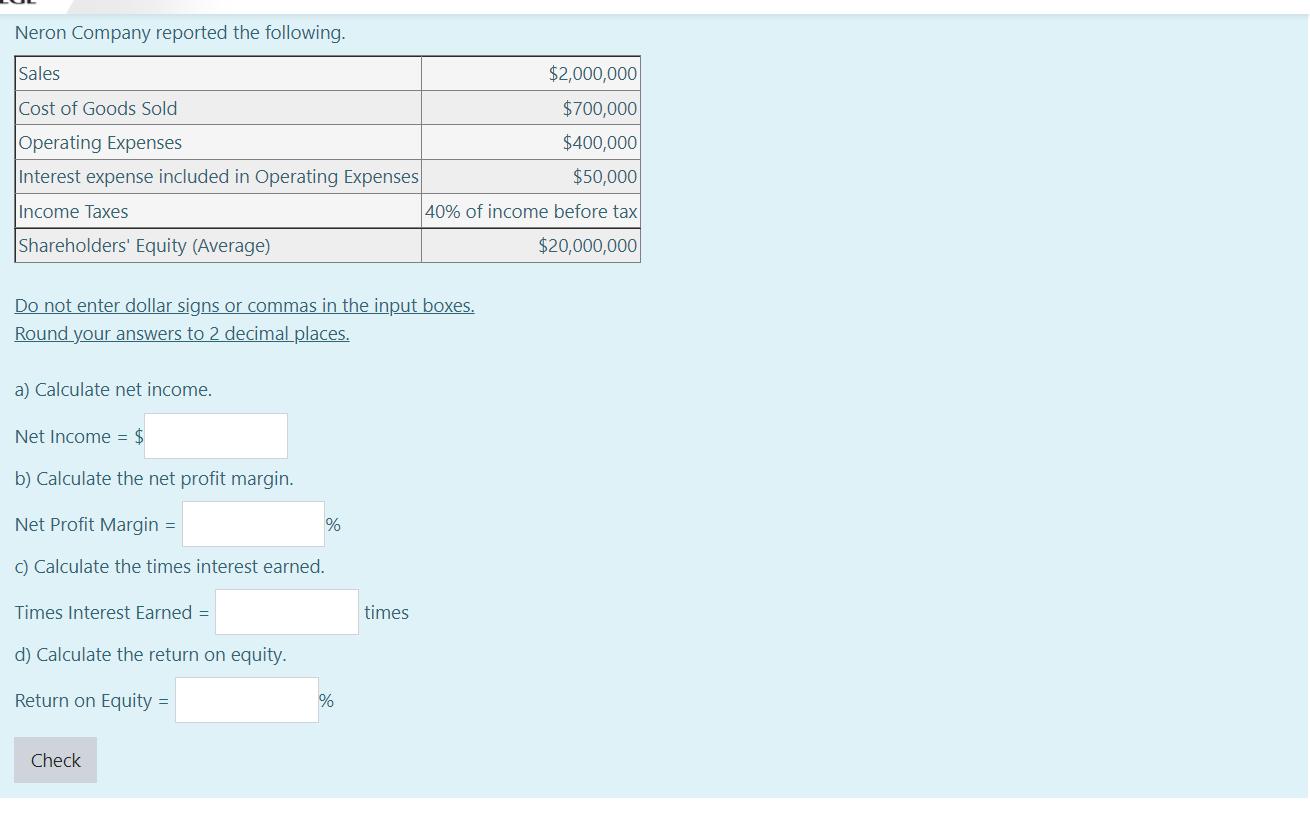

Question: Neron Company reported the following. Sales Cost of Goods Sold Operating Expenses $2,000,000 $700,000 $400,000 Interest expense included in Operating Expenses $50,000 Income Taxes

Neron Company reported the following. Sales Cost of Goods Sold Operating Expenses $2,000,000 $700,000 $400,000 Interest expense included in Operating Expenses $50,000 Income Taxes 40% of income before tax Shareholders' Equity (Average) $20,000,000 Do not enter dollar signs or commas in the input boxes. Round your answers to 2 decimal places. a) Calculate net income. Net Income = $ b) Calculate the net profit margin. Net Profit Margin = % c) Calculate the times interest earned. Times Interest Earned = d) Calculate the return on equity. Return on Equity = % Check times

Step by Step Solution

There are 3 Steps involved in it

To solve the problem lets understand the components and classify them into product costs direct cost... View full answer

Get step-by-step solutions from verified subject matter experts